Dear Traders,

At Dhan, we understand the needs of Traders as well as Investors. We understand that at times you want to hold a position for the shortest amount of time, and also with the minimal margin as possible - which is why we introduced MTF (Margin Trading Facility) in November 2022 or Pay Later which is what that has been referred to recently as.

As always, we have continued to improve your experience with MTF on Dhan. We introduced the same across all our platforms including Options Trader, ScanX, TradingView console by Dhan and also on our DhanHQ trading APIs. We have enhanced experience in many ways for MTF on Dhan, and recently also enabled options to convert partial quantities between Delivery / Intraday to MTF.

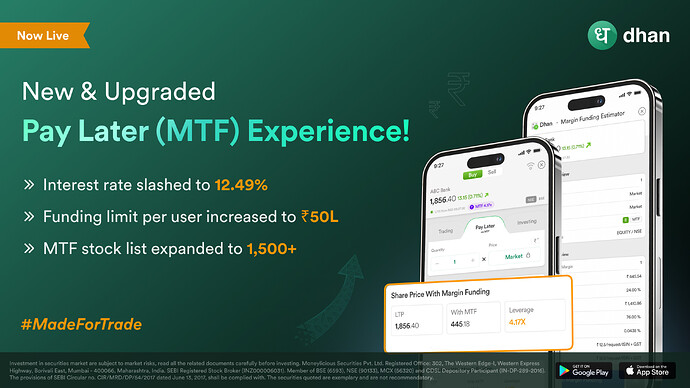

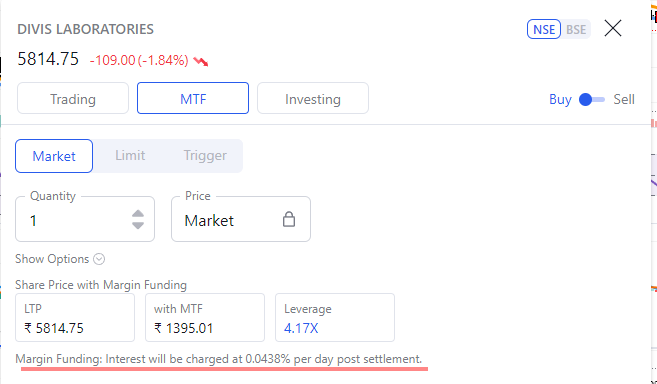

Many of our users will already know that Pay Later (with MTF) has been one of our very popular offerings - enabling traders to take leveraged positions with just a fraction of the total capital. With up to 4X leverage on 1000+ scrips, we offer leverage on one of the highest numbers of scrips in the industry!

While leverage is a powerful tool, we also understand that the cost of funding is a crucial factor in your trading decisions. One feedback we received from many of our users was to reduce the MTF rates - while we always stated that the cost of funds for Dhan is extremely higher compared to the bank-led brokers.

As Dhan gets access to better cost of capital, we have taken a gutsy move to make MTF (Margin Trading Facility) interest rates more rewarding and attractive with a major reduction in interest rates.

New MTF Interest Rates – Now as low as 12.49% without any subscription costs!

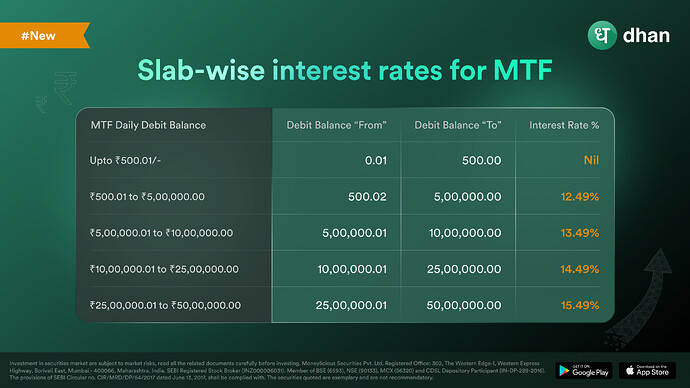

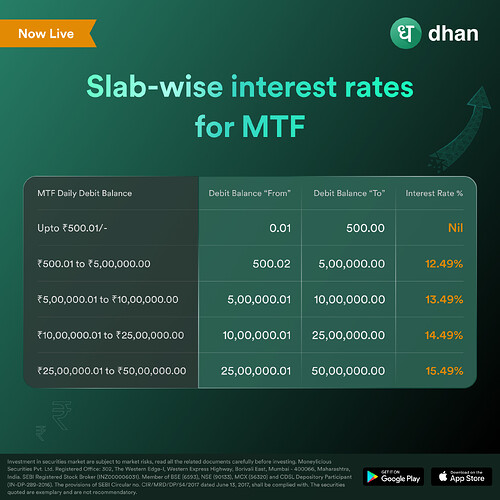

| MTF Funding Amount | Old Rate | New Interest Rate |

|---|---|---|

| Up to Rs 5 Lac | 15.99% p.a. | 12.49% p.a. |

| 5 Lac to 10 Lac | 15.99% p.a. | 13.49% p.a. |

| 10 Lac to 25 Lac | 15.99% p.a. | 14.49% p.a. |

| 25 Lac to 50 Lac | 15.99% p.a | 15.49% p.a. |

Unlike most brokering platforms that make interest rates better for clients with much higher MTF books, we have extending lower interest rates to users availing the funding value of INR 5 Lac which ensure that 90% of our MTF users will be able to avail the full benefit of this reduction in Interest Rates. As suggested, this change aims to make MTF more affordable and accessible for more traders.

But that’s not all - along with lower interest rates, we’ve introduced even more exciting updates to MTF:

-

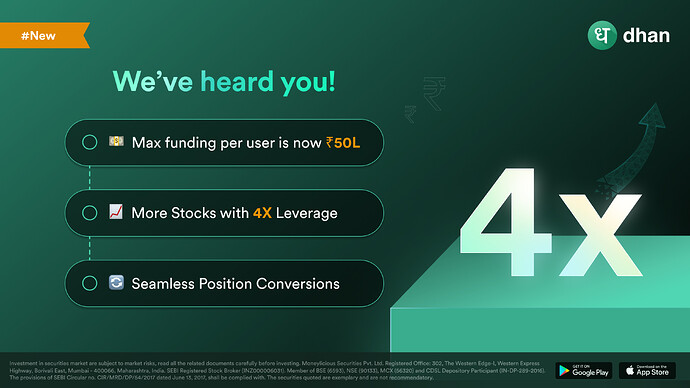

Increased Funding Limits - To support traders looking for higher leverage, we have restored the funding limit per user from ₹25 Lac to ₹50 Lac.

-

More Stocks with 4X Leverage - Now, you can trade up to 4X leverage on even more stocks, with just a 25% margin, further expanding your trading opportunities. Here’s the updated list.

-

Seamless Position Conversions - As shared previously, you can now also easily convert live MTF positions to delivery or intraday and vice versa - giving you more control over your trades based on market conditions.

When will these changes be effective?

All of the above changes will be effective 17th Feb, 25. Interest rates will automatically be calculated based on your funding amount and as usual be posted weekly in your ledger. There is no intervention required from your end to avail this facility.

We have designed these updates to make MTF more powerful, cost-effective, and flexible for every trader on Dhan.

Start using Pay Later (MTF) to avail all of these benefits today!

Thanks,

Pranita