Exchange charges the fee not the broker. If some one has to be an AP they have to pay the reg and annual exchange charges.

@t7support You’ll be surprised as to how bank brokerages always have a trick up their sleeves. ![]()

I know their tricks. I have been an ICICI customer since 2007 - bank account, Credit Card etc.

e.g see this

FYI, Phonepe, Paytm are Discount brokers like Dhan and Aditya Birla is a traditional broker. Everyone has strength and weakness. Phonepe doesn’t have AP/Franchise model as on date. Paytm offers 50% sharing for APs. And about ICICI, they’ve already shut down their B2B model. You need to prove first that Why & How your choice is better than other brokers.

No dear, it won’t be disrupted. They are already in the process of shutting down B2B model. All the employees will be mapped to their nearest ICICI Bank branches. They already knew about these things to happen. That’s why they de-listed ICICI Securities from Exchanges. And now their source of client acquisition will be through Banks only. FYI, the depository participant was ICICI Bank not ICICI Securities. ICICI Securities is still responsible for only Trading Accounts.

Here also 3 in 1 account is one reason to pull in customers. 3 in 1 will be disrupted by UPI block mechanism proposed by SEBI.

@t7support SEBI will not go through with the UPI block and even if they do, it would only be an alternative, as things stand today. Everything will be based on the adoption rate.

All these nuisances because of how Karvy messed everything.

Based on the news articles posted earlier it will be mandatory.

Ya think so

No it will not be disrupted if Bank allows to check real time account balance through brokers app. The mechanism is still into discussion panel I think. As on date UPI limit is upto Rs. 1 Lakh per day. So first all those respected authorities need to increase the limit of UPI first which is again time consuming,

I think the multiple bank addition might be disrupted. Customer has to link only one account and then through the UPI mechanism, broker will be able to debit the transaction amount from customers bank. This will be a challenge for all banks and brokers to join hands together to provide customers a 3-in-1 account facility if upcoming UPI mechanism is introduced.

Can I be a Authorised Person for enjoy back my referrals

It makes sense after all you work hard to help others introduce to the Indian stock market. Other brokers are still giving out their commissions alongside the one-time referral rewards.

No they don’t. All brokers have stopped paying commissions to referral partners. They might be paying the dues for the business generated till August 31st, but effective September 1st none of the brokers will pay commissions.

![]() You may check the article for more info.

You may check the article for more info.

@ameethwasckar @thetribaltrader @t7support On a lighter note, tighten the rules to make referral money, all the while, she earns through various other employment benefits and advisories. Don’t ask me who is she. I don’t know. ![]()

![]()

No she doesn’t have any connection to this matter. She just wanted people not to lose money. Its NSE who has stopped the referral model. Here all exchanges want people to become their Authorised Person.

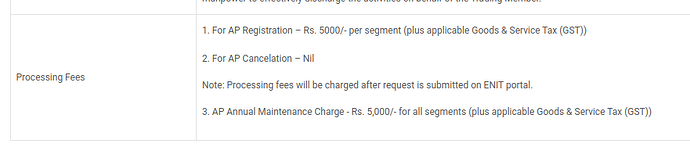

See what these exchanges did - First they increased the registation fees including cancellation fees. Second thing they want every AP to pay Annual Maintenance Charges. Here I think she should’ve intervene but don’t know whether she is aware of this or not.

Collecting AMC from each Authorised Person is like “”“Dhanda Karna Hai toh Hafta Dena Padega”“”. Why pay AMC, if broker is not giving us terminals, nor any system access to manage the portfolio. Everything related to risk management is handled by broker but Exchange want AP’s to pay AMCs.

Yes @thisisbanerjee I think she should intervene into this matter. See the outcome of this in the report which will come in January 2025. Client acquisition ratio will touch bottom point and most of the top brokers will be under pressure to generate income.

See the recent news –

Hello Dhan Team, it’s very disheartening to hear about the discontinuation of Dhan referral program.

Recently I have referred fee people and they have opened their account through my referral. It’s ok .

As you promised you will come back,

I believe you will not break our trust and come back with even more attractive referral program in the coming days

Till then best wishes to Dhan Team

With love

![]()

![]()

![]()

It’s due to exchanges, Dhan has no say in it.

NSE wants to earn money.

Hi, you can become an AP with us, more details here - https://dhan.co/authorised-partner/

Any fees?

It’s Annual Maintenance charges that Authorised Person need to pay every year. NSE charges Rs. 5000/- for all segments & BSE charges Rs. 4000/- for all segments. Apart from this MCX also charges Rs. 1000/- per year. So total you’ll be paying Rs. 10000/- plus GST every year to exchange once you register yourself as Authorised Person.

For order placement of your client on his/her behalf you need terminals for all segments. Discount Brokers like Dhan, Zerodha etc they don’t provide terminals to their sub-brokers/AP. That’s why I said that the AMC charges should be appicable only for those who take terminals, not every Authorised Person.

But here exchange has mandated every AP needs to pay AMC. This is bit strange. That’s why I said in last post “”“Dhanda Karna Hai Toh Hafta Dena Padega”“”.

Thanks. I have two questions for Team Dhan @PravinJ @Naman.

-

Will Dhan retain the same share of the brokerage (or give more) once we become Authorised Person?

-

Will the clients whom we referred to Dhan be retained along with the new ones?

Personally, i feel that this extra fees to be paid by the AP will further encourage the APs to push their clients/referees to trade more because they have to recover their investment. If the aim was to discourage traders to encourage their friends or referees to trade more, this new policy will even push them to urge their ‘clients’ to trade more.