Hi Traders,

For Traders, speed matters.

And by now, you know how much we value this. Not just the speed at which your orders are placed at the exchange, but the speed at which you make decisions, you act on them, and execute them without delay. We are proud of our core proprietary trading engine - DEXT - that keeps helping us build better and innovative trading features.

With DEXT at the core, we have built trading tools and features that make speed a reality.

Maximum orders on Dhan are processed seamlessly. Features like Iceberg Plus take it even better and faster.

And it’s not just the infra. The product flow and overall experience on Dhan products is designed to help traders take faster decisions. Features like Power Trade Mode, Reverse Order, Auto Trigger Basket, TV Webhook, Scalper, Flash Trade and more ensure that your time from decision to placing the order is almost instant.

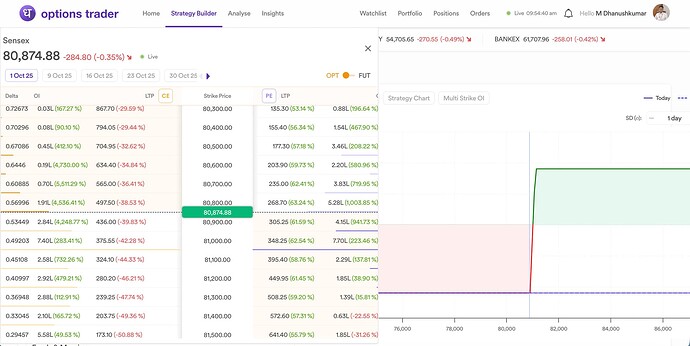

That said, we continue to believe there is always scope to improve. Even today, most traders build option strategies using the same old method. Manually picking each option contract one by one, either from the option chain or by entering it directly in the strategy builder. The process hasn’t changed much. Every leg is added manually, every time.

We asked ourselves - should a trader choose strike prices or should he pick a strategy, which in turn shows the strike price? With that, we are changing everything about building Option Trading strategies - making the experience faster, smarter and significantly better than before.

Presenting the All-New Options Trader Experience with Quant Mode!

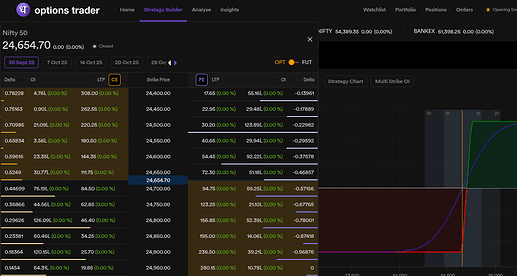

Quant Mode fundamentally transforms how you build multi-leg options strategies.

With Quant Mode, you can now define logics for each leg of the option strategy. Our platform will do the heavy lifting and instantly identify the most suitable strike based on your precise criteria. This means less time spent on tedious manual selection and more time focused on refining your overall strategy and market analysis.

Here’s how Quant Mode works. Shift toggle to “Quant” in the strategy builder. You will find the default loaded criteria for a single option leg. The criteria include:

- Transaction Type: Buy or Sell

- Condition: The core logic to identify the option strike.

- Value: Precise definition of condition.

- Option Type: Call or Put

- Expiry: The expiry date of the option contract.

- Lot: The number of lots you want to trade.

We have seamlessly integrated your favourite Fast Create Strategy feature also directly into Quant Mode. Now, when you select a strategy, you don’t just get a pre-defined template; you get a constructed strategy where each leg is already filtered and selected precisely according to your own custom preferences.

Quant Mode brings precision and speed to strategy building, helping you always be ready to act in fast-moving markets.

Quant Mode is now live and available across all F&O instruments, Nifty, Sensex, Bank Nifty, FinNifty, Commodities, and all F&O stocks, accessible seamlessly on both Options Trader App & Web.

Options trading on Dhan is now quant-powered! We are excited to see the strategies you’ll create with it.

Start experiencing Quant Mode only on the Options Trader App! Download it now!

Happy Trading,

Jai