Hi Investor ![]()

At Dhan, we’ve always believed that investors deserve transparency, lower costs, and full control over their wealth.

In July, we introduced External Mutual Funds Tracking on Dhan so you could bring all your Mutual Funds holdings into one clean dashboard. No spreadsheets. No app-hopping. Just clarity.

When thousands of you connected your portfolios, one clearly stood out. Too many were stuck in Regular Plans - without even realizing it. Often suggested by friends, family, or colleagues

What’s wrong with Regular Plans?

- Regular Plans come with a higher Total Expense Ratio (TER).

- Distributor commissions are deducted from your NAV every single day.

- The result Slower compounding over time.

Why Investors Prefer Dhan

- Only offer Direct Plans - no hidden Regular plans, ever.

- ₹0 Commission. ₹0 Platform Fee. No middlemen

- Same schemes available, with lower TER - faster compounding without extra risk.

- Full transparency - notify if any commission is being charged

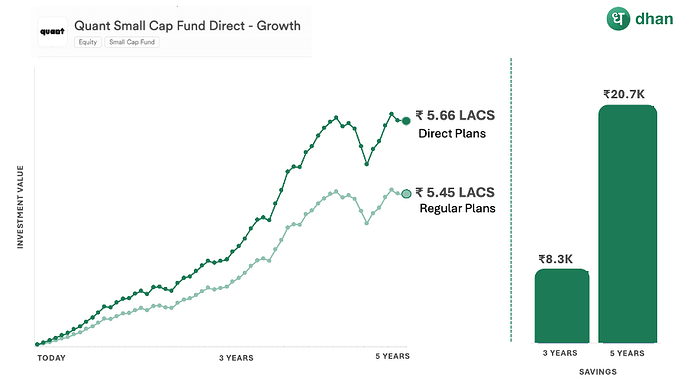

![]() The Power of Going Direct

The Power of Going Direct

Say you invest ₹5,000 every month via SIP. The cost difference between Regular and Direct could be shocking.

Note: Illustration only. Returns vary with market performance and scheme..

Fast forward a few years:

- After 3 years, the Direct investor has the power of getting 1 extra SIP installment.

- After 5 years, it’s like getting ~4 extra SIPs installment.

🚀 Say goodbye to Regular Plans. Introducing Switch to Dhan - with ₹0 Commission. ₹0 Platform Fee. No middlemen 100% transparency.

Here’s what you get

- One-tap switch: Switch all eligible schemes automatically.

- ELSS supported: partial switch when units are past 3-year lock-in.

- Exit Load & tax preview upfront

- ₹0 platform fee - Switching is completely free

- Day-1 control - start Direct SIPs (daily, weekly, monthly, top-up) right away

Getting Started is Simple

- Update your Dhan app

- Go to Mutual Fund Portfolio → External MF

- Fetch/refresh your external holdings

- Tap to “Switch” to Move to Dhan

- Review Exit Load & Capital Gains → Confirm with OTP

![]() Pro tip:

Pro tip:

- To move completely into Direct, cancel your Regular SIPs at the source and restart them on Dhan.

- Only non-demat scheme are allowed to Switch.

Cut commissions, boost compounding - Update the Dhan app and switch to Direct today.

Stay Invested with Dhan.

Saurav