Please help my code some error i not understand where is i mistake,

error below

PS D:\Dhan Practice> & C:/Users/Lenovo1/AppData/Local/Programs/Python/Python313/python.exe “d:/Dhan Practice/Dhan_KBS.py”

Codebase Version 3

Codebase Version 3

-----Logged into Dhan-----

-----Logged into Dhan-----

reading existing file all_instrument 2025-10-31.csv

reading existing file all_instrument 2025-10-31.csv

Got the instrument file

— Starting MACD Crossover Strategy —

— Performing Initial Daily Scan —

— Pre-filtering watchlist by price (₹25 - ₹5000) —

Price filter reduced watchlist from 199 to 170 stocks.

— Initial Daily Scan Complete. Starting trading loop. —

Current Day P&L: ₹0.00

Scanning for new trades at 15:04:15…

Not enough historical data for M&MFIN

BUY signal (Supertrend Confirmed) for PREMIERENE at 1098.6

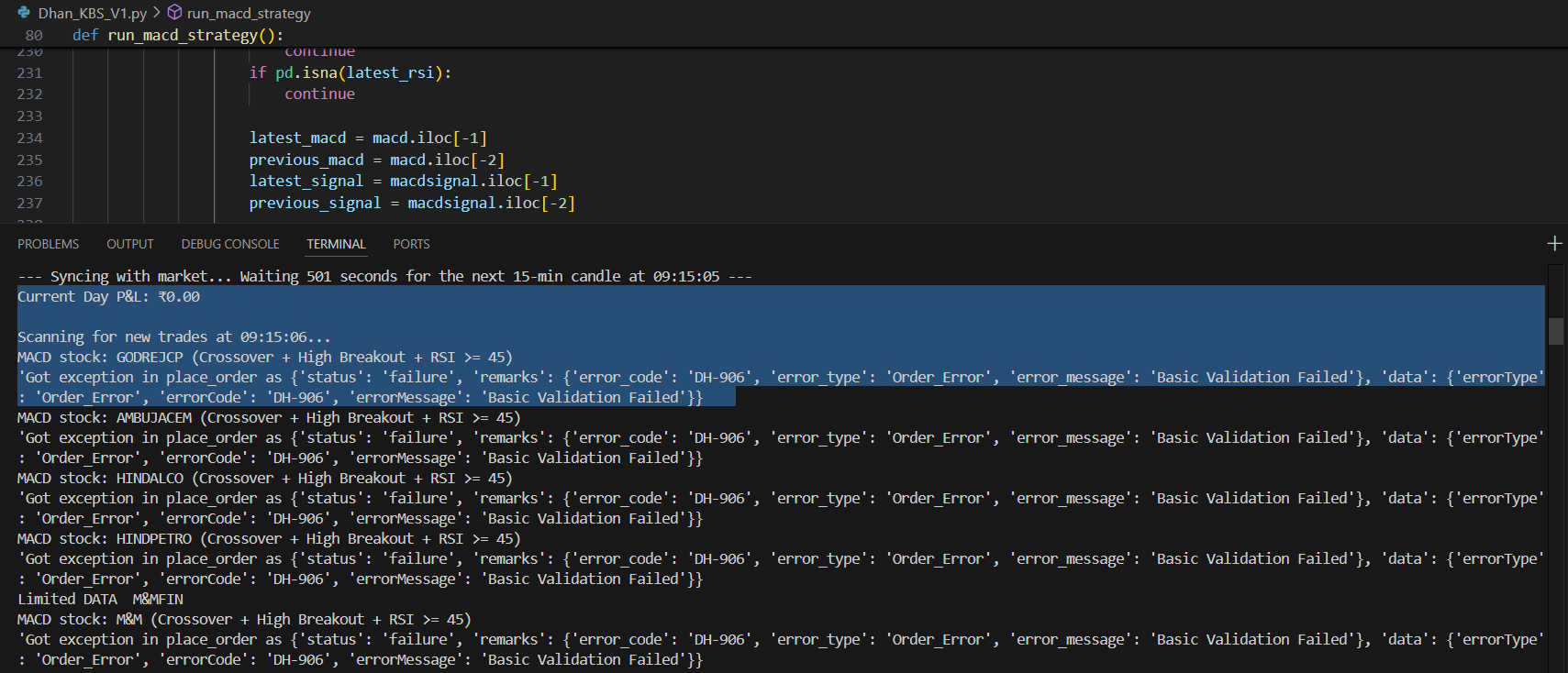

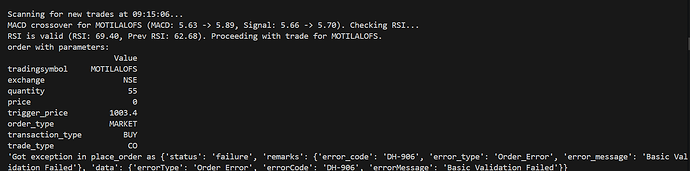

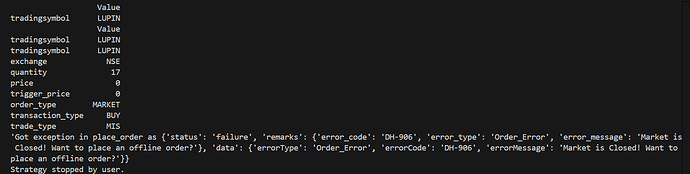

'Got exception in place_order as {‘status’: ‘failure’, ‘remarks’: {‘error_code’: ‘DH-906’, ‘error_type’: ‘Order_Error’, ‘error_message’: ‘Basic Validation Failed’}, ‘data’: {‘errorType’: ‘Order_Error’, ‘errorCode’: ‘DH-906’, ‘errorMessage’: ‘Basic Validation Failed’}}

BUY signal (Supertrend Confirmed) for SUPREMEIND at 3825.2

'Got exception in place_order as {‘status’: ‘failure’, ‘remarks’: {‘error_code’: ‘DH-906’, ‘error_type’: ‘Order_Error’, ‘error_message’: ‘Basic Validation Failed’}, ‘data’: {‘errorType’: ‘Order_Error’, ‘errorCode’: ‘DH-906’, ‘errorMessage’: ‘Basic Validation Failed’}}

Current available balance after scan: ₹5134.86

— Scan complete. Waiting for the next 15-minute candle… —

import pdb

from Dhan_Tradehull import Tradehull

import pandas as pd

import talib

import numpy as np

import pandas_ta as ta

import requests

import datetime

import time

import json

BASE_URL = "https://api.dhan.co/v2"

try:

with open('config.json', 'r') as f:

config = json.load(f)

client_id = config['client_id']

access_token = config['access_token']

except FileNotFoundError:

print("Error: config.json not found. Please create it with your client_id and access_token.")

exit()

tsl = Tradehull(client_id, access_token)

try:

with open('stocks.json', 'r') as f:

stocks_data = json.load(f)

stocks = stocks_data['stocks']

except FileNotFoundError:

print("Error: stocks.json not found. Please create it with a list of stock symbols.")

stocks = []

CAPITAL_ALLOCATION_PERCENT = 0.50

RISK_REWARD_RATIO = 2.0

ATR_PERIOD = 14

ATR_MULTIPLIER = 1.5

MAX_DAILY_LOSS = -2000

MAX_DAILY_TRADES = 6

RISK_PER_TRADE_PERCENT = 0.02

MAX_RISK_PER_TRADE_RUPEES = 500

def get_price_filtered_watchlist(full_watchlist):

print("--- Pre-filtering watchlist by price (₹25 - ₹5000) ---")

filtered_stocks = []

try:

ltp_data = tsl.get_ltp_data(full_watchlist)

if not ltp_data:

print("Could not fetch LTP data for watchlist. Using full list.")

return full_watchlist

for stock, price in ltp_data.items():

if 25 < price < 5000:

filtered_stocks.append(stock)

print(f"Price filter reduced watchlist from {len(full_watchlist)} to {len(filtered_stocks)} stocks.")

return filtered_stocks

except Exception as e:

print(f"Error during price filtering: {e}. Using full list.")

return full_watchlist

def round_to_tick(price, tick_size=0.05):

"""Rounds a price to the nearest valid tick size."""

return round(price / tick_size) * tick_size

def run_macd_strategy():

print("--- Starting MACD Crossover Strategy ---")

print("\n--- Performing Initial Daily Scan ---")

eligible_stocks = get_price_filtered_watchlist(stocks)

print("--- Initial Daily Scan Complete. Starting trading loop. ---")

if not eligible_stocks:

print("No eligible stocks found after price filtering. The script will wait for the next day.")

kill_switch_activated = False

trades_today_count = 0

current_day = datetime.date.today()

try:

positions_df = tsl.get_positions()

open_positions = {}

if positions_df is not None and not positions_df.empty:

open_positions_df = positions_df[positions_df['netQty'] != 0]

order_book_df = tsl.get_orderbook()

if order_book_df is not None and not order_book_df.empty:

co_orders = order_book_df[(order_book_df['productType'] == 'CO') & (order_book_df['orderStatus'] == 'TRADED')]

for index, row in open_positions_df.iterrows():

parent_order = co_orders[co_orders['tradingSymbol'] == row['tradingSymbol']].iloc[0] if not co_orders[co_orders['tradingSymbol'] == row['tradingSymbol']].empty else None

if parent_order is not None:

open_positions[row['tradingSymbol']] = {

'qty': row['netQty'], 'orderId': parent_order['orderId'],

'sl': parent_order['stopLoss'], 'direction': parent_order['transactionType']

}

if open_positions:

print(f"Found existing open positions: {list(open_positions.keys())}")

except Exception as e:

print(f"Warning: Could not fetch initial positions: {e}")

open_positions = {}

while True:

try:

current_time = datetime.datetime.now().time()

if current_time > datetime.time(15, 30):

print("Market is closed (after 15:30). Stopping strategy for the day.")

break

if datetime.date.today() != current_day:

print("New day detected. Resetting daily limits and kill switch.")

current_day = datetime.date.today()

kill_switch_activated = False

trades_today_count = 0

print("\n--- Performing Initial Daily Scan for new day---")

eligible_stocks = get_price_filtered_watchlist(stocks)

print("--- Initial Daily Scan Complete. Starting trading loop. ---")

if kill_switch_activated:

print(f"Kill switch is active. No new trades will be placed today. Waiting for next day.")

time.sleep(60 * 5)

continue

available_balance = tsl.get_balance()

if not available_balance or available_balance == 0:

print("Could not fetch balance or balance is zero. Waiting...")

time.sleep(60)

continue

risk_from_capital = available_balance * RISK_PER_TRADE_PERCENT

risk_amount = min(risk_from_capital, MAX_RISK_PER_TRADE_RUPEES)

live_pnl = tsl.get_live_pnl()

print(f"Current Day P&L: ₹{live_pnl:.2f}")

if live_pnl is not None and live_pnl < MAX_DAILY_LOSS:

print(f"!!! MAX DAILY LOSS of ₹{MAX_DAILY_LOSS} REACHED. ACTIVATING KILL SWITCH. !!!")

print("--- Closing all open MIS/BO positions. ---")

tsl.cancel_all_orders(trade_type='CO')

kill_switch_activated = True

continue

if open_positions:

print("--- Managing open positions ---")

for symbol, trade_info in list(open_positions.items()):

end_date = datetime.date.today()

start_date = end_date - datetime.timedelta(days=5)

hist_data_15min = tsl.get_historical_data(symbol, 'NSE', '15',

start_date=start_date.strftime('%Y-%m-%d'),

end_date=end_date.strftime('%Y-%m-%d'))

if hist_data_15min is None or len(hist_data_15min) < 30: continue

macd, macdsignal, _ = talib.MACD(hist_data_15min['close'], fastperiod=12, slowperiod=26, signalperiod=9)

previous_macd = macd.iloc[-2]

latest_macd = macd.iloc[-1]

previous_signal = macdsignal.iloc[-2]

latest_signal = macdsignal.iloc[-1]

if trade_info['direction'] == 'BUY' and previous_macd > previous_signal and latest_macd < latest_signal:

print(f"EXIT (MACD Crossover): Closing BUY on {symbol} at {hist_data_15min['close'].iloc[-1]}")

tsl.order_placement(

tradingsymbol=symbol, exchange='NSE', quantity=trade_info['qty'], price=0,

trigger_price=0, order_type='MARKET', transaction_type='SELL', trade_type='MIS'

)

del open_positions[symbol]

continue

try:

hist_data = hist_data_15min

if hist_data is None or hist_data.empty:

continue

atr = talib.ATR(hist_data['high'], hist_data['low'], hist_data['close'], timeperiod=ATR_PERIOD)

latest_close = hist_data['close'].iloc[-1]

latest_atr = atr.iloc[-1]

if pd.isna(latest_atr):

continue

current_sl = trade_info['sl']

if trade_info['direction'] == 'BUY':

new_sl = latest_close - (latest_atr * ATR_MULTIPLIER)

if new_sl > current_sl:

print(f"Trailing SL (in memory) for BUY {symbol} from {current_sl:.2f} to {new_sl:.2f}")

open_positions[symbol]['sl'] = new_sl

if latest_close < open_positions[symbol]['sl']:

print(f"EXIT (Trailing SL Hit): Closing BUY on {symbol} at {latest_close}")

tsl.order_placement(

tradingsymbol=symbol, exchange='NSE', quantity=trade_info['qty'], price=0,

trigger_price=0, order_type='MARKET', transaction_type='SELL', trade_type='MIS'

)

del open_positions[symbol]

except Exception as e:

print(f"Error trailing SL for {symbol}: {e}")

if available_balance <= 0:

print("Balance is zero or less. Skipping scan for new opportunities.")

time.sleep(15 * 60)

continue

print(f"\nScanning for new trades at {datetime.datetime.now().strftime('%H:%M:%S')}...")

for stock_symbol in eligible_stocks:

if trades_today_count >= MAX_DAILY_TRADES:

print("Max daily trades limit reached. No more new trades today.")

break

if stock_symbol in open_positions.keys():

continue

try:

end_date = datetime.date.today()

start_date = end_date - datetime.timedelta(days=5)

hist_data = tsl.get_historical_data(stock_symbol, 'NSE', '15',

start_date=start_date.strftime('%Y-%m-%d'),

end_date=end_date.strftime('%Y-%m-%d'))

if hist_data is None or len(hist_data) < 30:

print(f"Not enough historical data for {stock_symbol}")

continue

macd, macdsignal, macdhist = talib.MACD(hist_data['close'], fastperiod=12, slowperiod=26, signalperiod=9)

atr = talib.ATR(hist_data['high'], hist_data['low'], hist_data['close'], timeperiod=ATR_PERIOD)

rsi = talib.RSI(hist_data['close'], timeperiod=14)

hist_data.ta.supertrend(length=ATR_PERIOD, multiplier=3.0, append=True)

latest_close = hist_data['close'].iloc[-1]

previous_close = hist_data['close'].iloc[-2]

latest_atr = atr.iloc[-1]

latest_rsi = rsi.iloc[-1]

if pd.isna(latest_atr):

continue

if pd.isna(latest_rsi):

continue

latest_macd = macd.iloc[-1]

previous_macd = macd.iloc[-2]

latest_signal = macdsignal.iloc[-1]

previous_signal = macdsignal.iloc[-2]

st_col = f'SUPERT_{ATR_PERIOD}_3.0'

latest_supertrend = hist_data[st_col].iloc[-1]

previous_supertrend = hist_data[st_col].iloc[-2]

two_ago_supertrend = hist_data[st_col].iloc[-3]

two_ago_close = hist_data['close'].iloc[-3]

trade_placed = False

if previous_macd < previous_signal and latest_macd > latest_signal and latest_close > previous_close and (58 < latest_rsi < 70):

print(f"BUY signal (MACD) for {stock_symbol} at {latest_close}")

trade_placed = True

elif not trade_placed:

is_crossover = two_ago_close < two_ago_supertrend and previous_close > previous_supertrend

is_confirmed = latest_close > latest_supertrend

if is_crossover and is_confirmed:

print(f"BUY signal (Supertrend Confirmed) for {stock_symbol} at {latest_close}")

trade_placed = True

if trade_placed:

stop_loss_price = latest_close - (latest_atr * ATR_MULTIPLIER)

trade_placed = True

if trade_placed:

stop_loss_price = latest_close - (latest_atr * ATR_MULTIPLIER)

risk_per_share = latest_close - stop_loss_price

if risk_per_share <= 0: continue

quantity = int(risk_amount / risk_per_share)

if quantity == 0:

print(f"Skipping {stock_symbol}, not enough capital for 1 share.")

continue

order_id = tsl.order_placement(

tradingsymbol=stock_symbol, exchange='NSE', quantity=quantity, price=0,

trigger_price=round_to_tick(stop_loss_price),

order_type='MARKET', transaction_type='BUY', trade_type='CO'

)

if order_id:

print(f"Placed BUY Cover Order for {stock_symbol} | Qty: {quantity} | SL: {stop_loss_price:.2f}")

trades_today_count += 1

print(f"Trades taken today: {trades_today_count}/{MAX_DAILY_TRADES}")

open_positions[stock_symbol] = {

'qty': quantity, 'orderId': order_id,

'sl': stop_loss_price, 'direction': 'BUY'

}

except Exception as e:

print(f"Error processing {stock_symbol}: {e}")

print(f"Current available balance after scan: ₹{available_balance:.2f}")

print("--- Scan complete. Waiting for the next 15-minute candle... ---")

time.sleep(15 * 60)

except KeyboardInterrupt:

print("Strategy stopped by user.")

break

except Exception as e:

print(f"An unexpected error occurred in the main loop: {e}")

time.sleep(60)

if __name__ == "__main__":

run_macd_strategy()