Hello @Tradehull_Imran Sir,

I have downloaded from Latest codebase link - 3.1 Codebase Upgrade.zip - Google Drive

Below file I have fixed some part like

from Dhan_Tradehull import Tradehull to from Dhan_Tradehull_V2 import Tradehull

'NIFTY 19 DEC 24000 PUT' to 'NIFTY 27 FEB 23000 PUT' etc

How to use updated codebase.py ( Downloaded code below )

import pdb

import time

import datetime

import traceback

from Dhan_Tradehull import Tradehull

import pandas as pd

from pprint import pprint

import talib

client_code = "1102790337"

token_id = "eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzUxMiJ9.eyJpc3MiOiJkaGFuIiwicGFydG5lcklkIjoiIiwiZXhwIjoxNzM2ODYwMTMxLCJ0b2tlbkNvbnN1bWVyVHlwZSI6IlNFTEYiLCJ3ZWJob29rVXJsIjoiIiwiZGhhbkNsaWVudElkIjoiMTEwMjc5MDMzNyJ9.Leop6waGeVfmBOtczNEcjRWmC8pUGWQf54YPINGDi_PZjk1IvW-DDdaYXsgM_s8McOT44q4MjEQxGXU0lduK0A"

tsl = Tradehull(client_code,token_id)

all_ltp_data = tsl.get_ltp_data(names = ['NIFTY 19 DEC 24000 akshdgasjhgdhgasjgdhjagsdCALL', 'NIFTY 19 DEC 24000 PUT', "ACC", "CIPLA"])

acc_ltp = all_ltp_data['ACC']

pe_ltp = all_ltp_data['NIFTY 19 DEC 24000 PUT']

stock_name = 'NIFTY'

ltp = tsl.get_ltp_data(names = [stock_name])[stock_name]

chart = tsl.get_historical_data(tradingsymbol = 'NIFTY', exchange = 'INDEX',timeframe="DAY")

data = tsl.get_historical_data(tradingsymbol = 'NIFTY 19 DEC 24000 CALL' ,exchange = 'NFO' ,timeframe="15")

order_status = tsl.get_order_status(orderid=82241218256027)

order_price = tsl.get_executed_price(orderid=82241218256027)

order_time = tsl.get_exchange_time(orderid=82241218256027)

positions = tsl.get_positions()

orderbook = tsl.get_orderbook()

tradebook = tsl.get_trade_book()

holdings = tsl.get_holdings()

ce_name, pe_name, strike = tsl.ATM_Strike_Selection(Underlying='NIFTY', Expiry=0)

ce_name, pe_name, ce_strike, pe_strike = tsl.OTM_Strike_Selection(Underlying='NIFTY', Expiry=0, OTM_count=3)

ce_name, pe_name, ce_strike, pe_strike = tsl.ITM_Strike_Selection(Underlying='NIFTY', Expiry=0, OTM_count=5)

# Equity

entry_orderid = tsl.order_placement(tradingsymbol='ACC' ,exchange='NSE', quantity=1, price=0, trigger_price=0, order_type='MARKET', transaction_type='BUY', trade_type='MIS')

sl_orderid = tsl.order_placement(tradingsymbol='ACC' ,exchange='NSE', quantity=1, price=0, trigger_price=2200, order_type='STOPMARKET', transaction_type ='SELL', trade_type='MIS')

# Options

entry_orderid = tsl.order_placement(tradingsymbol='NIFTY 19 DEC 24400 CALL' ,exchange='NFO', quantity=50, price=0, trigger_price=0, order_type='MARKET', transaction_type='BUY', trade_type='MIS')

sl_orderid = tsl.order_placement(tradingsymbol='NIFTY 19 DEC 24400 CALL' ,exchange='NFO', quantity=25, price=29, trigger_price=30, order_type='STOPLIMIT', transaction_type='SELL', trade_type='MIS')

modified_order = tsl.modify_order(order_id=sl_orderid,order_type="STOPLIMIT",quantity=50,price=price,trigger_price=trigger_price)

order_ids = tsl.place_slice_order(tradingsymbol="NIFTY 19 DEC 24400 CALL", exchange="NFO",quantity=5000, transaction_type="BUY",order_type="LIMIT",trade_type="MIS",price=0.05)

margin = tsl.margin_calculator(tradingsymbol='ACC', exchange='NSE', transaction_type='BUY', quantity=2, trade_type='MIS', price=2180, trigger_price=0)

margin = tsl.margin_calculator(tradingsymbol='NIFTY 19 DEC 24400 CALL', exchange='NFO', transaction_type='SELL', quantity=25, trade_type='MARGIN', price=43, trigger_price=0)

margin = tsl.margin_calculator(tradingsymbol='NIFTY 19 DEC 24400 CALL', exchange='NFO', transaction_type='BUY', quantity=25, trade_type='MARGIN', price=43, trigger_price=0)

margin = tsl.margin_calculator(tradingsymbol='NIFTY DEC FUT', exchange='NFO', transaction_type='BUY', quantity=25, trade_type='MARGIN', price=24350, trigger_price=0)

exit_all = tsl.cancel_all_orders()

Updated code below

import pdb

import time

import datetime

import traceback

from Dhan_Tradehull_V2 import Tradehull

import pandas as pd

from pprint import pprint

import talib

client_code = ""

token_id = ""

tsl = Tradehull(client_code,token_id)

all_ltp_data = tsl.get_ltp_data(names = ['NIFTY 27 FEB 23000 CALL', 'NIFTY 27 FEB 23000 PUT', "ACC", "CIPLA"])

acc_ltp = all_ltp_data['ACC']

pe_ltp = all_ltp_data['NIFTY 27 FEB 23000 PUT']

stock_name = 'NIFTY'

ltp = tsl.get_ltp_data(names = [stock_name])[stock_name]

chart = tsl.get_historical_data(tradingsymbol = 'NIFTY', exchange = 'INDEX',timeframe="DAY")

data = tsl.get_historical_data(tradingsymbol = 'NIFTY 27 FEB 23000 PUT' ,exchange = 'NFO' ,timeframe="15")

order_status = tsl.get_order_status(orderid=82241218256027)

order_price = tsl.get_executed_price(orderid=82241218256027)

order_time = tsl.get_exchange_time(orderid=82241218256027)

positions = tsl.get_positions()

orderbook = tsl.get_orderbook()

tradebook = tsl.get_trade_book()

holdings = tsl.get_holdings()

ce_name, pe_name, strike = tsl.ATM_Strike_Selection(Underlying='NIFTY', Expiry=0)

ce_name, pe_name, ce_strike, pe_strike = tsl.OTM_Strike_Selection(Underlying='NIFTY', Expiry=0, OTM_count=3)

ce_name, pe_name, ce_strike, pe_strike = tsl.ITM_Strike_Selection(Underlying='NIFTY', Expiry=0, OTM_count=5)

# Equity

entry_orderid = tsl.order_placement(tradingsymbol='ACC' ,exchange='NSE', quantity=1, price=0, trigger_price=0, order_type='MARKET', transaction_type='BUY', trade_type='MIS')

sl_orderid = tsl.order_placement(tradingsymbol='ACC' ,exchange='NSE', quantity=1, price=0, trigger_price=2200, order_type='STOPMARKET', transaction_type ='SELL', trade_type='MIS')

# Options

entry_orderid = tsl.order_placement(tradingsymbol='NIFTY 27 FEB 23000 CALL' ,exchange='NFO', quantity=50, price=0, trigger_price=0, order_type='MARKET', transaction_type='BUY', trade_type='MIS')

sl_orderid = tsl.order_placement(tradingsymbol='NIFTY 27 FEB 23000 CALL' ,exchange='NFO', quantity=25, price=29, trigger_price=30, order_type='STOPLIMIT', transaction_type='SELL', trade_type='MIS')

modified_order = tsl.modify_order(order_id=sl_orderid,order_type="STOPLIMIT",quantity=50,price=price,trigger_price=trigger_price)

order_ids = tsl.place_slice_order(tradingsymbol="NIFTY 27 FEB 23000 CALL", exchange="NFO",quantity=5000, transaction_type="BUY",order_type="LIMIT",trade_type="MIS",price=0.05)

margin = tsl.margin_calculator(tradingsymbol='ACC', exchange='NSE', transaction_type='BUY', quantity=2, trade_type='MIS', price=2180, trigger_price=0)

margin = tsl.margin_calculator(tradingsymbol='NIFTY 27 FEB 23000 CALL', exchange='NFO', transaction_type='SELL', quantity=25, trade_type='MARGIN', price=43, trigger_price=0)

margin = tsl.margin_calculator(tradingsymbol='NIFTY 27 FEB 23000 CALL', exchange='NFO', transaction_type='BUY', quantity=25, trade_type='MARGIN', price=43, trigger_price=0)

margin = tsl.margin_calculator(tradingsymbol='NIFT FEB PUT', exchange='NFO', transaction_type='BUY', quantity=25, trade_type='MARGIN', price=24350, trigger_price=0)

exit_all = tsl.cancel_all_orders()

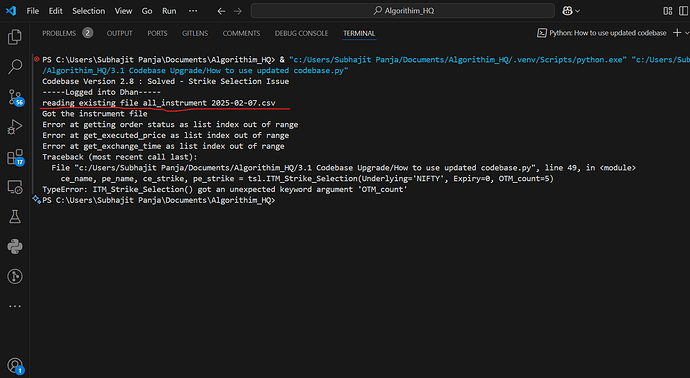

Output

PS C:\Users\Subhajit Panja\Documents\Algorithim_HQ> & "c:/Users/Subhajit Panja/Documents/Algorithim_HQ/.venv/Scripts/python.exe" "c:/Users/Subhajit Panja/Documents/Algorithim_HQ/3.1 Codebase Upgrade/How to use updated codebase.py"

Codebase Version 2.8 : Solved - Strike Selection Issue

-----Logged into Dhan-----

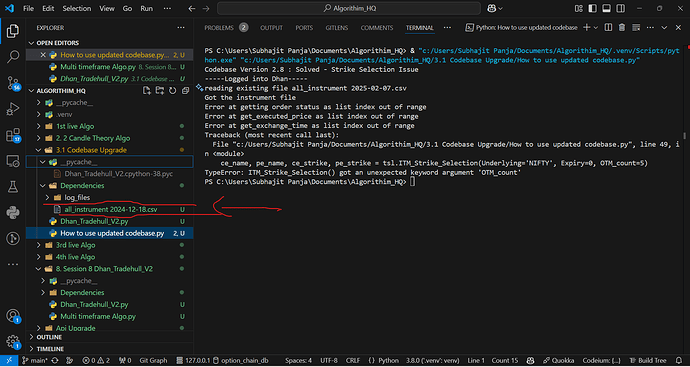

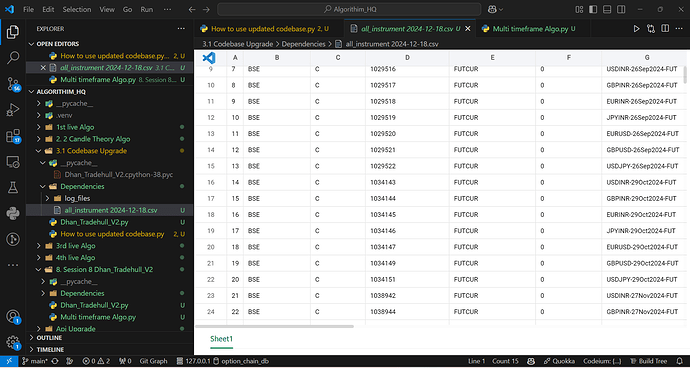

reading existing file all_instrument 2025-02-07.csv

Got the instrument file

Error at getting order status as list index out of range

Error at get_executed_price as list index out of range

Error at get_exchange_time as list index out of range

Traceback (most recent call last):

File "c:/Users/Subhajit Panja/Documents/Algorithim_HQ/3.1 Codebase Upgrade/How to use updated codebase.py", line 49, in <module>

ce_name, pe_name, ce_strike, pe_strike = tsl.ITM_Strike_Selection(Underlying='NIFTY', Expiry=0, OTM_count=5)

TypeError: ITM_Strike_Selection() got an unexpected keyword argument 'OTM_count'

PS C:\Users\Subhajit Panja\Documents\Algorithim_HQ>

How it is still getting

reading existing file

all_instrument 2025-02-07.csv