Hi Sir, @Tradehull_Imran

Now the Algo is working with the following Erros, but the order has been placed.

Microsoft Windows [Version 10.0.22631.4391]

(c) Microsoft Corporation. All rights reserved.

C:\Users\Rejith Koroth\Desktop\REJITH KOROTH\DHAN_APP\DHAN ALGO\8.Session8\8. Session8- 2nd Live Algo_2\2nd live Algo>py “Multi timeframe Algo.py”

-----Logged into Dhan-----

reading existing file all_instrument 2024-11-12.csv

Got the instrument file

Traceback (most recent call last):

File “C:\Users\Rejith Koroth\Desktop\REJITH KOROTH\DHAN_APP\DHAN ALGO\8.Session8\8. Session8- 2nd Live Algo_2\2nd live Algo\Dhan_Tradehull_V2.py”, line 178, in get_live_pnl

closePrice = ltp_data[underlying]

KeyError: ‘NIFTY 14 NOV 24050 CALL’

MOTHERSON

OFSS

OFSS is in downtrend, Sell this script

MANAPPURAM

MANAPPURAM is in downtrend, Sell this script

BSOFT

CHAMBLFERT

DIXON

NATIONALUM

DLF

IDEA

ADANIPORTS

ADANIPORTS is in downtrend, Sell this script

SAIL

HINDCOPPER

HINDCOPPER is in downtrend, Sell this script

INDIGO

RECLTD

PNB

HINDALCO

RBLBANK

GNFC

ALKEM

CONCOR

PFC

GODREJPROP

MARUTI

ADANIENT

ONGC

CANBK

OBEROIRLTY

BANDHANBNK

SBIN

HINDPETRO

CANFINHOME

TATAMOTORS

LALPATHLAB

MCX

TATACHEM

BHARTIARTL

INDIAMART

LUPIN

INDUSTOWER

VEDL

SHRIRAMFIN

POLYCAB

WIPRO

UBL

SRF

BHARATFORG

GRASIM

IEX

BATAINDIA

AARTIIND

TATASTEEL

UPL

HDFCBANK

LTF

TVSMOTOR

GMRINFRA

IOC

ABCAPITAL

ACC

IDFCFIRSTB

ABFRL

ZYDUSLIFE

GLENMARK

TATAPOWER

PEL

IDFC

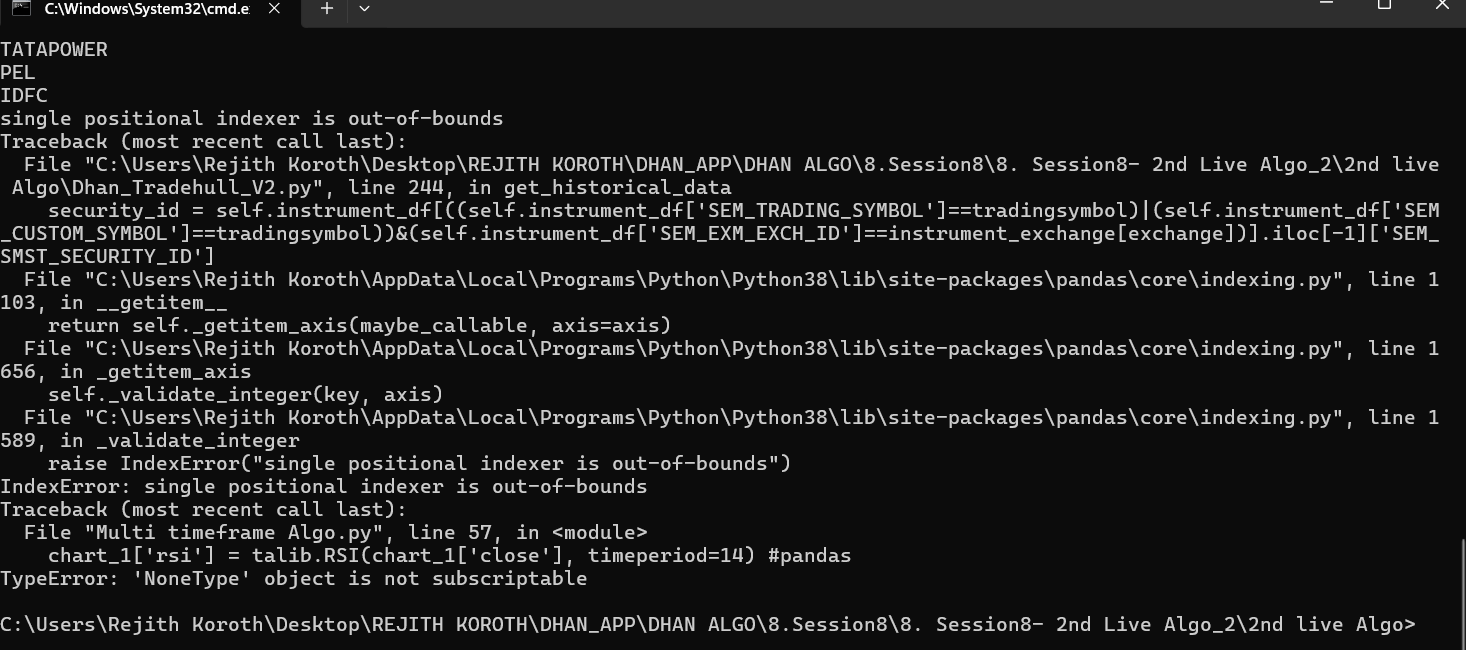

single positional indexer is out-of-bounds

Traceback (most recent call last):

File “C:\Users\Rejith Koroth\Desktop\REJITH KOROTH\DHAN_APP\DHAN ALGO\8.Session8\8. Session8- 2nd Live Algo_2\2nd live Algo\Dhan_Tradehull_V2.py”, line 244, in get_historical_data

security_id = self.instrument_df[((self.instrument_df[‘SEM_TRADING_SYMBOL’]==tradingsymbol)|(self.instrument_df[‘SEM_CUSTOM_SYMBOL’]==tradingsymbol))&(self.instrument_df[‘SEM_EXM_EXCH_ID’]==instrument_exchange[exchange])].iloc[-1][‘SEM_SMST_SECURITY_ID’]

File “C:\Users\Rejith Koroth\AppData\Local\Programs\Python\Python38\lib\site-packages\pandas\core\indexing.py”, line 1103, in getitem

return self._getitem_axis(maybe_callable, axis=axis)

File “C:\Users\Rejith Koroth\AppData\Local\Programs\Python\Python38\lib\site-packages\pandas\core\indexing.py”, line 1656, in _getitem_axis

self._validate_integer(key, axis)

File “C:\Users\Rejith Koroth\AppData\Local\Programs\Python\Python38\lib\site-packages\pandas\core\indexing.py”, line 1589, in _validate_integer

raise IndexError(“single positional indexer is out-of-bounds”)

IndexError: single positional indexer is out-of-bounds

Traceback (most recent call last):

File “Multi timeframe Algo.py”, line 57, in

chart_1[‘rsi’] = talib.RSI(chart_1[‘close’], timeperiod=14) #pandas

TypeError: ‘NoneType’ object is not subscriptable

C:\Users\Rejith Koroth\Desktop\REJITH KOROTH\DHAN_APP\DHAN ALGO\8.Session8\8. Session8- 2nd Live Algo_2\2nd live Algo>

C:\Users\Rejith Koroth\Desktop\REJITH KOROTH\DHAN_APP\DHAN ALGO\8.Session8\8. Session8- 2nd Live Algo_2\2nd live Algo>

<`# TA-Lib

Notion – The all-in-one workspace for your notes, tasks, wikis, and databases.

import pdb

from Dhan_Tradehull_V2 import Tradehull

import pandas as pd

import talib

import time

import datetime

client_code = “1104068813”

token_id = “eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzUxMiJ9.eyJpc3MiOiJkaGFuIiwicGFydG5lcklkIjoiIiwiZXhwIjoxNzMzODkxMTg1LCJ0b2tlbkNvbnN1bWVyVHlwZSI6IlNFTEYiLCJ3ZWJob29rVXJsIjoiIiwiZGhhbkNsaWVudElkIjoiMTEwNDA2ODgxMyJ9.ng5EkX1O_ZLx1CMvMyvUCpA6PFos9jKb90Nd8ZK99_YBhOCk2gnJn18CcLh8FoIswozr5K9oE2uSOoFMRr”

tsl = Tradehull(client_code,token_id)

available_balance = tsl.get_balance()

leveraged_margin = available_balance5

max_trades = 3

per_trade_margin = (leveraged_margin/max_trades)

max_loss = (available_balance1)/100*-1

watchlist = [‘MOTHERSON’, ‘OFSS’, ‘MANAPPURAM’, ‘BSOFT’, ‘CHAMBLFERT’, ‘DIXON’, ‘NATIONALUM’, ‘DLF’, ‘IDEA’, ‘ADANIPORTS’, ‘SAIL’, ‘HINDCOPPER’, ‘INDIGO’, ‘RECLTD’, ‘PNB’, ‘HINDALCO’, ‘RBLBANK’, ‘GNFC’, ‘ALKEM’, ‘CONCOR’, ‘PFC’, ‘GODREJPROP’, ‘MARUTI’, ‘ADANIENT’, ‘ONGC’, ‘CANBK’, ‘OBEROIRLTY’, ‘BANDHANBNK’, ‘SBIN’, ‘HINDPETRO’, ‘CANFINHOME’, ‘TATAMOTORS’, ‘LALPATHLAB’, ‘MCX’, ‘TATACHEM’, ‘BHARTIARTL’, ‘INDIAMART’, ‘LUPIN’, ‘INDUSTOWER’, ‘VEDL’, ‘SHRIRAMFIN’, ‘POLYCAB’, ‘WIPRO’, ‘UBL’, ‘SRF’, ‘BHARATFORG’, ‘GRASIM’, ‘IEX’, ‘BATAINDIA’, ‘AARTIIND’, ‘TATASTEEL’, ‘UPL’, ‘HDFCBANK’, ‘LTF’, ‘TVSMOTOR’, ‘GMRINFRA’, ‘IOC’, ‘ABCAPITAL’, ‘ACC’, ‘IDFCFIRSTB’, ‘ABFRL’, ‘ZYDUSLIFE’, ‘GLENMARK’, ‘TATAPOWER’, ‘PEL’, ‘IDFC’, ‘LAURUSLABS’, ‘BANKBARODA’, ‘KOTAKBANK’, ‘CUB’, ‘GAIL’, ‘DABUR’, ‘TECHM’, ‘CHOLAFIN’, ‘BEL’, ‘SYNGENE’, ‘FEDERALBNK’, ‘NAVINFLUOR’, ‘AXISBANK’, ‘LT’, ‘ICICIGI’, ‘EXIDEIND’, ‘TATACOMM’, ‘RELIANCE’, ‘ICICIPRULI’, ‘IPCALAB’, ‘AUBANK’, ‘INDIACEM’, ‘GRANULES’, ‘HDFCAMC’, ‘COFORGE’, ‘LICHSGFIN’, ‘BAJAJFINSV’, ‘INFY’, ‘BRITANNIA’, ‘M&MFIN’, ‘BAJFINANCE’, ‘PIIND’, ‘DEEPAKNTR’, ‘SHREECEM’, ‘INDUSINDBK’, ‘DRREDDY’, ‘TCS’, ‘BPCL’, ‘PETRONET’, ‘NAUKRI’, ‘JSWSTEEL’, ‘MUTHOOTFIN’, ‘CUMMINSIND’, ‘CROMPTON’, ‘M&M’, ‘GODREJCP’, ‘IGL’, ‘BAJAJ-AUTO’, ‘HEROMOTOCO’, ‘AMBUJACEM’, ‘BIOCON’, ‘ULTRACEMCO’, ‘VOLTAS’, ‘BALRAMCHIN’, ‘SUNPHARMA’, ‘ASIANPAINT’, ‘COALINDIA’, ‘SUNTV’, ‘EICHERMOT’, ‘ESCORTS’, ‘HAL’, ‘ASTRAL’, ‘NMDC’, ‘ICICIBANK’, ‘TORNTPHARM’, ‘JUBLFOOD’, ‘METROPOLIS’, ‘RAMCOCEM’, ‘INDHOTEL’, ‘HINDUNILVR’, ‘TRENT’, ‘TITAN’, ‘JKCEMENT’, ‘ASHOKLEY’, ‘SBICARD’, ‘BERGEPAINT’, ‘JINDALSTEL’, ‘MFSL’, ‘BHEL’, ‘NESTLEIND’, ‘HDFCLIFE’, ‘COROMANDEL’, ‘DIVISLAB’, ‘ITC’, ‘TATACONSUM’, ‘APOLLOTYRE’, ‘AUROPHARMA’, ‘HCLTECH’, ‘LTTS’, ‘BALKRISIND’, ‘DALBHARAT’, ‘APOLLOHOSP’, ‘ABBOTINDIA’, ‘ATUL’, ‘UNITDSPR’, ‘PVRINOX’, ‘SIEMENS’, ‘SBILIFE’, ‘IRCTC’, ‘GUJGASLTD’, ‘BOSCHLTD’, ‘NTPC’, ‘POWERGRID’, ‘MARICO’, ‘HAVELLS’, ‘MPHASIS’, ‘COLPAL’, ‘CIPLA’, ‘MGL’, ‘ABB’, ‘PIDILITIND’, ‘MRF’, ‘LTIM’, ‘PAGEIND’, ‘PERSISTENT’]

traded_wathclist =

while True:

live_pnl = tsl.get_live_pnl()

current_time = datetime.datetime.now().time()

if current_time < datetime.time(9, 30):

print("wait for market to start", current_time)

continue

if (current_time > datetime.time(15, 15)) or (live_pnl < max_loss):

I_want_to_trade_no_more = tsl.kill_switch('ON')

order_details = tsl.cancel_all_orders()

print("Market is over, Bye Bye see you tomorrow", current_time)

break

for stock_name in watchlist:

time.sleep(0.7)

print(stock_name)

# Conditions that are on 1 minute timeframe

# chart_1 = tsl.get_intraday_data(stock_name, 'NSE', 1) # 1 minute chart # this call has been updated to get_historical_data call,

chart_1 = tsl.get_historical_data(tradingsymbol = stock_name,exchange = 'NSE',timeframe="1")

chart_1['rsi'] = talib.RSI(chart_1['close'], timeperiod=14) #pandas

cc_1 = chart_1.iloc[-2] #pandas completed candle of 1 min timeframe

uptrend = cc_1['rsi'] > 50

downtrend = cc_1['rsi'] < 49

# Conditions that are on 5 minute timeframe

# chart_5 = tsl.get_intraday_data(stock_name, 'NSE', 5) # 5 minute chart

chart_5 = tsl.get_historical_data(tradingsymbol = stock_name,exchange = 'NSE',timeframe="5") # this call has been updated to get_historical_data call,

chart_5['upperband'], chart_5['middleband'], chart_5['lowerband'] = talib.BBANDS(chart_5['close'], timeperiod=5, nbdevup=2, nbdevdn=2, matype=0)

cc_5 = chart_5.iloc[-1] # pandas

ub_breakout = cc_5['high'] > cc_5['upperband']

lb_breakout = cc_5['low'] < cc_5['lowerband']

no_repeat_order = stock_name not in traded_wathclist

max_order_limit = len(traded_wathclist) <= max_trades

if uptrend and ub_breakout and no_repeat_order and max_order_limit:

print(stock_name, "is in uptrend, Buy this script")

sl_price = round((cc_1['close']*0.98),1)

qty = int(per_trade_margin/cc_1['close'])

buy_entry_orderid = tsl.order_placement(stock_name,'NSE', 1, 0, 0, 'MARKET', 'BUY', 'MIS')

sl_orderid = tsl.order_placement(stock_name,'NSE', 1, 0, sl_price, 'STOPMARKET', 'SELL', 'MIS')

traded_wathclist.append(stock_name)

if downtrend and lb_breakout and no_repeat_order and max_order_limit:

print(stock_name, "is in downtrend, Sell this script")

sl_price = round((cc_1['close']*1.02),1)

qty = int(per_trade_margin/cc_1['close'])

buy_entry_orderid = tsl.order_placement(stock_name,'NSE', 1, 0, 0, 'MARKET', 'SELL', 'MIS')

sl_orderid = tsl.order_placement(stock_name,'NSE', 1, 0, sl_price, 'STOPMARKET', 'BUY', 'MIS')

traded_wathclist.append(stock_name)

`