Hi @Tradehull_Imran ,

I’ve been trying to get the historical last one year data points at 5 min and 15 min time frame and despite multiple attempts only getting for last few days. is this the limitation at API side or I’m missing something in code. due to lack of historical data all other calculations are going for toss . please advise.

import pdb

import time

import datetime

import traceback

from Dhan_Tradehull_V2 import Tradehull

import pandas as pd

from pprint import pprint

import talib

import plotly.graph_objects as go

from datetime import datetime, timedelta

import numpy as np

from plotly.subplots import make_subplots

import pytz

def plot_candlestick_chart(df, title, timeframe="5min"):

"""

Create an interactive candlestick chart with volume and remove gaps

"""

fig = go.Figure()

# Add candlestick

fig.add_trace(go.Candlestick(

x=df.index,

open=df['open'],

high=df['high'],

low=df['low'],

close=df['close'],

name='Price'

))

# Add volume bars

fig.add_trace(go.Bar(

x=df.index,

y=df['volume'],

name='Volume',

yaxis='y2',

opacity=0.3

))

# Update layout with rangebreaks to remove non-trading hours and weekends

fig.update_layout(

title=title,

yaxis_title='Price',

yaxis2=dict(

title='Volume',

overlaying='y',

side='right'

),

xaxis_title='Date',

template='plotly_dark'

)

# Add range breaks to remove non-trading periods

fig.update_xaxes(

rangebreaks=[

dict(bounds=["sat", "mon"]), # Remove weekends

dict(bounds=[16, 9], pattern="hour"), # Remove non-trading hours

],

rangeslider_visible=True,

)

fig.show()

def fetch_historical_data(tsl, symbol, exchange='INDEX', timeframe="15", lookback_days=365):

"""

Fetch historical data with proper timezone handling and chunked requests

"""

try:

print(f"Fetching {timeframe}-minute data for {symbol}...")

# Calculate date ranges for chunked requests

end_date = datetime.now()

start_date = end_date - timedelta(days=lookback_days)

# Initialize empty DataFrame for storing all data

all_data = pd.DataFrame()

# Fetch data in 30-day chunks to handle API limitations

current_start = start_date

while current_start < end_date:

current_end = min(current_start + timedelta(days=30), end_date)

print(f"Fetching chunk from {current_start.date()} to {current_end.date()}")

# Get historical data for current chunk

chunk_data = tsl.get_historical_data(

tradingsymbol=symbol,

exchange=exchange,

timeframe=timeframe

)

if chunk_data is not None and not chunk_data.empty:

# Convert to dataframe

df_chunk = chunk_data.copy()

# Handle timestamp conversion

df_chunk['timestamp'] = pd.to_datetime(df_chunk['timestamp'])

# Filter for the current chunk's date range

df_chunk = df_chunk[

(df_chunk['timestamp'].dt.date >= current_start.date()) &

(df_chunk['timestamp'].dt.date <= current_end.date())

]

# Append to main DataFrame

all_data = pd.concat([all_data, df_chunk], axis=0)

# Move to next chunk

current_start = current_end

time.sleep(1) # Add delay between requests to avoid rate limiting

if not all_data.empty:

# Process the combined data

all_data = all_data.drop_duplicates()

all_data = all_data.sort_values('timestamp')

# Set timestamp as index

all_data = all_data.set_index('timestamp')

# Convert timezone if needed

if all_data.index.tz is None:

ist = pytz.timezone('Asia/Kolkata')

all_data.index = all_data.index.tz_localize('UTC').tz_convert(ist)

elif all_data.index.tz.zone != 'Asia/Kolkata':

all_data.index = all_data.index.tz_convert('Asia/Kolkata')

# Filter for trading hours (9:15 AM to 3:30 PM IST)

all_data = all_data.between_time('09:15', '15:30')

# Remove weekends

all_data = all_data[all_data.index.dayofweek < 5]

print(f"\nData Statistics:")

print(f"Total Days: {len(all_data.index.date.unique())}")

print(f"Total Candles: {len(all_data)}")

print(f"Date Range: {all_data.index.min().date()} to {all_data.index.max().date()}")

return all_data

else:

print("No data received")

return None

except Exception as e:

print(f"Error fetching data: {str(e)}")

traceback.print_exc() # Print full traceback for debugging

return None

def calculate_cvd(df):

"""

Calculate Cumulative Volume Delta

"""

# Calculate buy/sell volume based on close position relative to high/low

df['buy_volume'] = df['volume'] * (df['close'] - df['low']) / (df['high'] - df['low'])

df['sell_volume'] = df['volume'] - df['buy_volume']

# Calculate CVD

df['cvd'] = (df['buy_volume'] - df['sell_volume']).cumsum()

return df

def plot_data(df, symbol):

"""

Create a plot similar to TradingView with candlesticks, EMAs, and CVD

"""

# Calculate EMAs using pandas

df['ema9'] = df['close'].ewm(span=9, adjust=False).mean()

df['ema12'] = df['close'].ewm(span=12, adjust=False).mean()

# Create the figure with secondary y-axis

fig = make_subplots(rows=2, cols=1,

shared_xaxes=True,

vertical_spacing=0.03,

row_heights=[0.7, 0.3])

# Add candlestick

fig.add_trace(go.Candlestick(

x=df.index,

open=df['open'],

high=df['high'],

low=df['low'],

close=df['close'],

name='Price'

), row=1, col=1)

# Add EMAs

fig.add_trace(go.Scatter(

x=df.index,

y=df['ema9'],

name='EMA 9',

line=dict(color='blue', width=1)

), row=1, col=1)

fig.add_trace(go.Scatter(

x=df.index,

y=df['ema12'],

name='EMA 12',

line=dict(color='red', width=1)

), row=1, col=1)

# Add CVD

fig.add_trace(go.Scatter(

x=df.index,

y=df['cvd'],

name='CVD',

line=dict(color='purple', width=1.5)

), row=2, col=1)

# Add volume bars to CVD subplot

colors = ['red' if close < open else 'green'

for open, close in zip(df['open'], df['close'])]

fig.add_trace(go.Bar(

x=df.index,

y=df['volume'],

name='Volume',

marker_color=colors,

opacity=0.3

), row=2, col=1)

# Update layout

fig.update_layout(

title=f'{symbol} Price with CVD',

yaxis_title='Price',

yaxis2_title='CVD',

xaxis_title='Date',

template='plotly_dark',

xaxis_rangeslider_visible=False,

height=800 # Make the chart taller

)

# Remove non-trading periods

fig.update_xaxes(

rangebreaks=[

dict(bounds=["sat", "mon"]), # Remove weekends

dict(bounds=[15.5, 9.25], pattern="hour"), # Remove non-trading hours

]

)

fig.show()

def main():

# Initialize client

client_code = ""

token_id = ""

tsl = Tradehull(client_code, token_id)

# Fetch data for NIFTY

symbol = 'NIFTY'

df = fetch_historical_data(tsl, symbol)

if df is not None:

# Calculate CVD

df = calculate_cvd(df)

# Plot the data

plot_data(df, symbol)

# Print some statistics

print("\nData Statistics:")

print(f"Total Days: {len(df.index.date.unique())}")

print(f"Total Candles: {len(df)}")

print(f"Date Range: {df.index.min().date()} to {df.index.max().date()}")

if __name__ == "__main__":

main()

# Initialize Dhan client

client_code = "1"

token_id = "ey"

tsl = Tradehull(client_code, token_id)

# List of instruments to track

instruments = [

'NIFTY',

'BANKNIFTY',

'FINNIFTY',

'RELIANCE',

'TCS',

'HDFC',

'INFY',

'ICICIBANK'

]

# Get LTP for all instruments

print("\nFetching Last Traded Prices...")

print("-" * 50)

all_ltp_data = tsl.get_ltp_data(names=instruments)

for instrument in instruments:

if instrument in all_ltp_data:

print(f"{instrument:<15}: ₹{all_ltp_data[instrument]:,.2f}")

# Get and plot intraday data for indices

indices = ['NIFTY', 'BANKNIFTY', 'FINNIFTY']

print("\nFetching and plotting 5-minute intraday data...")

for index in indices:

print(f"\nGetting data for {index}...")

# Get 5-minute intraday data

hist_data = tsl.get_historical_data(

tradingsymbol=index,

exchange='INDEX',

timeframe="5" # Changed to 5-minute timeframe

)

if hist_data is not None and not hist_data.empty:

# Process the data

hist_data = hist_data.set_index(pd.to_datetime(hist_data['timestamp']))

hist_data = hist_data.sort_index()

# Calculate some basic statistics

current_price = hist_data['close'].iloc[-1]

high_price = hist_data['high'].max()

low_price = hist_data['low'].min()

total_return = ((hist_data['close'].iloc[-1] - hist_data['close'].iloc[0]) / hist_data['close'].iloc[0]) * 100

print(f"\n{index} Statistics:")

print(f"Current Price: ₹{current_price:,.2f}")

print(f"Period High: ₹{high_price:,.2f}")

print(f"Period Low: ₹{low_price:,.2f}")

print(f"Period Return: {total_return:.2f}%")

# Plot the candlestick chart

plot_candlestick_chart(hist_data, f"{index} 5-Minute Intraday Chart")

else:

print(f"No data available for {index}")

# Get NIFTY Options Data

print("\nFetching NIFTY Options Data...")

print("-" * 50)

# Get ATM Strikes

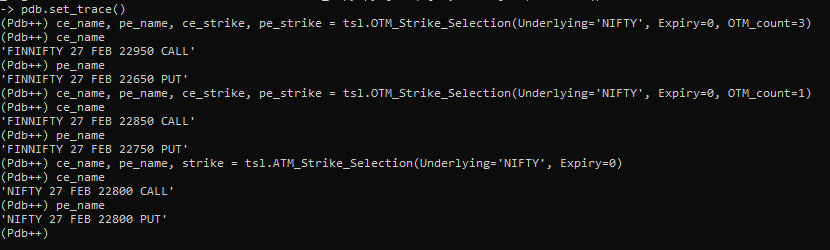

print("\nATM Strike Selection:")

ce_name, pe_name, strike = tsl.ATM_Strike_Selection(Underlying='NIFTY', Expiry=0)

print(f"Call Option: {ce_name}")

print(f"Put Option: {pe_name}")

print(f"Strike Price: {strike}")

# Get OTM Strikes

print("\nOTM Strike Selection (3 strikes):")

ce_name, pe_name, ce_strike, pe_strike = tsl.OTM_Strike_Selection(Underlying='NIFTY', Expiry=0, OTM_count=3)

print(f"Call Options: {ce_name}")

print(f"Put Options: {pe_name}")

print(f"Call Strikes: {ce_strike}")

print(f"Put Strikes: {pe_strike}")

# Get ITM Strikes

print("\nITM Strike Selection (5 strikes):")

ce_name, pe_name, ce_strike, pe_strike = tsl.ITM_Strike_Selection(Underlying='NIFTY', Expiry=0, ITM_count=5)

print(f"Call Options: {ce_name}")

print(f"Put Options: {pe_name}")

print(f"Call Strikes: {ce_strike}")

print(f"Put Strikes: {pe_strike}")

# Get current positions and holdings

print("\nCurrent Positions:")

positions = tsl.get_positions()

pprint(positions)

print("\nCurrent Holdings:")

holdings = tsl.get_holdings()

pprint(holdings)

Error code-

venvINR-HQ-2609:PythonProjects radharaman.jha$ /Users/radharaman.jha/Documents/PythonProjects/venv/bin/python "/Users/radharaman.jha/Documents/PythonProjects/How to use updated codebase.py"

Codebase Version 2.8 : Solved - Strike Selection Issue

-----Logged into Dhan-----

This BOT Is Picking New File From Dhan

Got the instrument file

Fetching 15-minute data for NIFTY...

Fetching chunk from 2024-02-24 to 2024-03-25

Fetching chunk from 2024-03-25 to 2024-04-24

Fetching chunk from 2024-04-24 to 2024-05-24

Fetching chunk from 2024-05-24 to 2024-06-23

Fetching chunk from 2024-06-23 to 2024-07-23

Fetching chunk from 2024-07-23 to 2024-08-22

Fetching chunk from 2024-08-22 to 2024-09-21

Fetching chunk from 2024-09-21 to 2024-10-21

Fetching chunk from 2024-10-21 to 2024-11-20

Fetching chunk from 2024-11-20 to 2024-12-20

Fetching chunk from 2024-12-20 to 2025-01-19

Fetching chunk from 2025-01-19 to 2025-02-18

Fetching chunk from 2025-02-18 to 2025-02-23

Error fetching data: 'datetime.timezone' object has no attribute 'zone'

Traceback (most recent call last):

File "/Users/radharaman.jha/Documents/PythonProjects/How to use updated codebase.py", line 124, in fetch_historical_data

elif all_data.index.tz.zone != 'Asia/Kolkata':

^^^^^^^^^^^^^^^^^^^^^^

AttributeError: 'datetime.timezone' object has no attribute 'zone'

-----Logged into Dhan-----

This BOT Is Picking New File From Dhan

Got the instrument file

Fetching Last Traded Prices...

--------------------------------------------------

Exception for instrument name HDFC as Check the Tradingsymbol

NIFTY : ₹22,795.90

BANKNIFTY : ₹48,981.20

FINNIFTY : ₹23,174.35

RELIANCE : ₹1,228.15

TCS : ₹3,786.00

INFY : ₹1,815.00

ICICIBANK : ₹1,232.95

Fetching and plotting 5-minute intraday data...

Getting data for NIFTY...

NIFTY Statistics:

Current Price: ₹22,764.35

Period High: ₹22,923.85

Period Low: ₹22,720.30

Period Return: -0.41%

Getting data for BANKNIFTY...

BANKNIFTY Statistics:

Current Price: ₹48,908.50

Period High: ₹49,455.80

Period Low: ₹48,764.00

Period Return: -0.93%

Getting data for FINNIFTY...

FINNIFTY Statistics:

Current Price: ₹23,135.20

Period High: ₹23,396.05

Period Low: ₹23,030.90

Period Return: -0.95%

Fetching NIFTY Options Data...

--------------------------------------------------

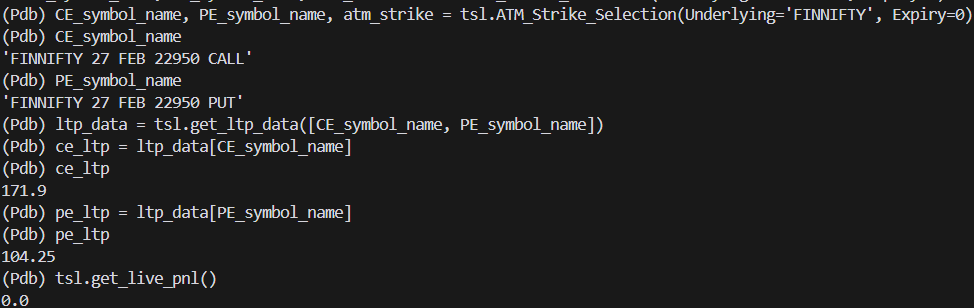

ATM Strike Selection:

Call Option: NIFTY 27 FEB 22800 CALL

Put Option: NIFTY 27 FEB 22800 PUT

Strike Price: 22800

OTM Strike Selection (3 strikes):

Call Options: FINNIFTY 27 FEB 22950 CALL

Put Options: FINNIFTY 27 FEB 22650 PUT

Call Strikes: 22950

Put Strikes: 22650

ITM Strike Selection (5 strikes):

Call Options: FINNIFTY 27 FEB 22550 CALL

Put Options: FINNIFTY 27 FEB 23050 PUT

Call Strikes: 22550

Put Strikes: 23050

Current Positions:

Empty DataFrame

Columns: []

Index: []

Current Holdings:

exchange tradingSymbol securityId isin totalQty dpQty t1Qty availableQty collateralQty avgCostPrice lastTradedPrice

0 ALL TATASTEEL 3499 INE081A01020 3 3 0 3 3 112.10 140.76

1 NSE AXISNIFTY 21252 INF846K01W98 3 3 0 3 3 199.89 247.98type or paste code here