Eid Mubarak @Tradehull_Imran Sir.

Hello @Tradehull_Imran ,

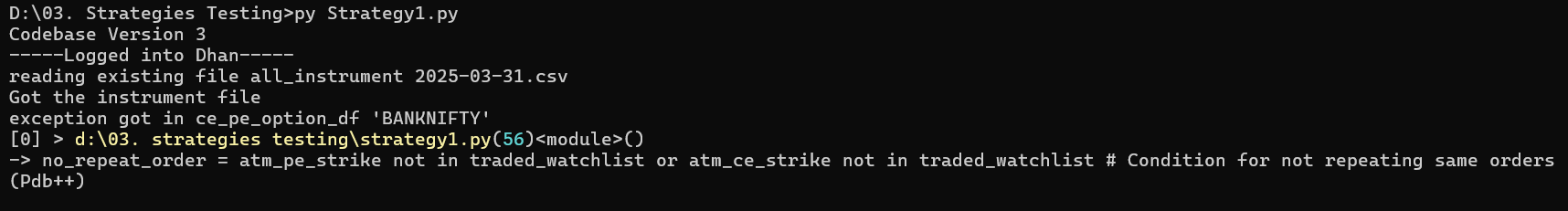

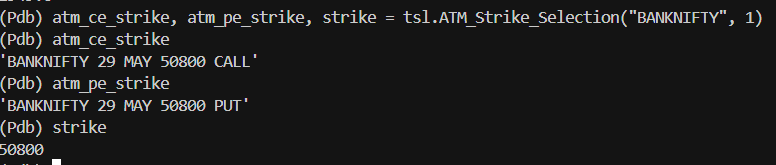

I am using Codebase Version 3 and I am getting this error while using ATM_Strike_Selection function.

Code:

atm_ce_strike, atm_pe_strike, strike = tsl.ATM_Strike_Selection("BANKNIFTY", 1)

Error:

Please support to resolve this error.

Dear Imran Ali Sir, Wish you and your family a very happy Ramzan, with blessed life of hundred years, with all happiness, good health, peace, prosperity fulfilling all your endeavors.

VBR Prasad

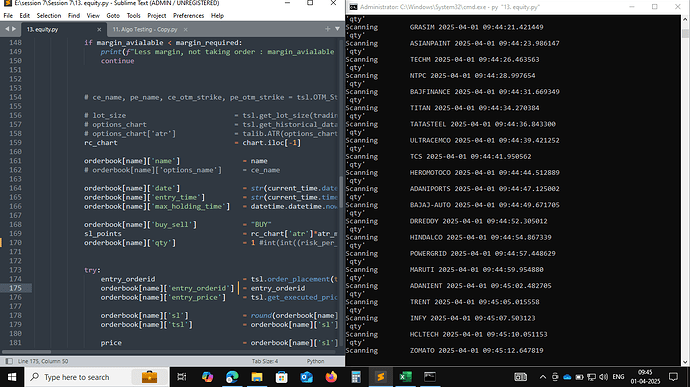

@Tradehull_Imran I was edited this code for equity

but iam getting only qty ??? my code is correct or not please help me

import pdb

import time

import datetime

import traceback

from Dhan_Tradehull import Tradehull

import pandas as pd

from pprint import pprint

import talib

import pandas_ta as ta

import xlwings as xw

import winsound

import sqn_lib

client_code = “1000728206”

token_id = “eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzUxMiJ9.eyJpc3MiOiJkaGFuIiwicGFydG5lcklkIjoiIiwiZXhwIjoxNzQ1Mzg1MjQyLCJ0b2tlbkNvbnN1bWVyVHlwZSI6IlNFTEYiLCJ3ZWJob29rVXJsIjoiIiwiZGhhbkNsaWVudElkIjoiMTAwMDcyODIwNiJ9.e10wS0hlk9DwEFw-MHH_FxFhmO_I7C05RDxhXgGcEpN2a8OpwyUGWcSZxmi3Q-CxTUOscaBTaPkQNfxzlxtwEA”

tsl = Tradehull(client_code,token_id)

opening_balance = tsl.get_balance()

base_capital = 1205.02

market_money = opening_balance - base_capital

beacuse I am loosing money, so I have 0 market money, and I can take risk on the current opening balance and not on the base capital

if (market_money < 0):

market_money = 0

base_capital = opening_balance

market_money_risk = (market_money1)/100

base_capital_risk = (base_capital0.5)/100

max_risk_for_today = base_capital_risk + market_money_risk

max_order_for_today = 2

risk_per_trade = (max_risk_for_today/max_order_for_today)

atr_multipler = 3

risk_reward = 3

watchlist = [‘TATACONSUM’,‘KOTAKBANK’,‘APOLLOHOSP’,‘ONGC’,‘ICICIBANK’,‘TATAMOTORS’,‘HINDUNILVR’,‘JIOFIN’,‘SBILIFE’,‘HDFCLIFE’,‘AXISBANK’,‘BEL’,‘NESTLEIND’,‘ITC’,‘BHARTIARTL’,‘SUNPHARMA’,‘COALINDIA’,‘JSWSTEEL’,‘HDFCBANK’,‘EICHERMOT’,‘SBIN’,‘BAJAJFINSV’,‘RELIANCE’,‘LT’,‘GRASIM’,‘ASIANPAINT’,‘TECHM’,‘NTPC’,‘BAJFINANCE’,‘TITAN’,‘TATASTEEL’,‘ULTRACEMCO’,‘TCS’,‘HEROMOTOCO’,‘ADANIPORTS’,‘BAJAJ-AUTO’,‘DRREDDY’,‘HINDALCO’,‘POWERGRID’,‘MARUTI’,‘ADANIENT’,‘TRENT’,‘INFY’,‘HCLTECH’,‘ZOMATO’,‘M&M’,‘CIPLA’,‘SHRIRAMFIN’,‘WIPRO’,‘INDUSINDBK’]

single_order = {‘name’:None, ‘date’:None , ‘entry_time’: None, ‘entry_price’: None, ‘buy_sell’: None, ‘qty’: None, ‘sl’: None, ‘exit_time’: None, ‘exit_price’: None, ‘pnl’: None, ‘remark’: None, ‘traded’:None}

orderbook = {}

wb = xw.Book(‘Live Trade Data.xlsx’)

live_Trading = wb.sheets[‘Live_Trading’]

completed_orders_sheet = wb.sheets[‘completed_orders’]

reentry = “yes” #“yes/no”

completed_orders =

bot_token = “7746461948:AAHR7MQSe40UA9jMZuw7-u2XhvBpwwR1ozQ”

receiver_chat_id = “1570007384”

live_Trading.range(“A2:Z100”).value = None

completed_orders_sheet.range(“A2:Z100”).value = None

for name in watchlist:

orderbook[name] = single_order.copy()

while True:

print("starting while Loop \n\n")

current_time = datetime.datetime.now().time()

if current_time < datetime.time(9, 15):

print(f"Wait for market to start", current_time)

time.sleep(1)

continue

live_pnl = tsl.get_live_pnl()

max_loss_hit = live_pnl < (max_risk_for_today*-1)

market_over = current_time > datetime.time(15, 15)

if max_loss_hit or market_over:

order_details = tsl.cancel_all_orders()

print(f"Market over Closing all trades !! Bye Bye See you Tomorrow", current_time)

pdb.set_trace()

break

all_ltp = tsl.get_ltp_data(names = watchlist)

for name in watchlist:

orderbook_df = pd.DataFrame(orderbook).T

live_Trading.range('A1').value = orderbook_df

completed_orders_df = pd.DataFrame(completed_orders)

completed_orders_sheet.range('A1').value = completed_orders_df

current_time = datetime.datetime.now()

print(f"Scanning {name} {current_time}")

try:

chart = tsl.get_historical_data(tradingsymbol = name,exchange = 'NSE',timeframe="5")

chart['rsi'] = talib.RSI(chart['close'], timeperiod=14)

indi = ta.supertrend(chart['high'], chart['low'], chart['close'], 7, 3)

chart = pd.concat([chart, indi], axis=1, join='inner')

sqn_lib.sqn(df=chart, period=21)

chart['market_type'] = chart['sqn'].apply(sqn_lib.market_type)

chart['atr'] = talib.ATR(chart['high'], chart['low'], chart['close'], timeperiod=14)

cc = chart.iloc[-2]

no_of_orders_placed = orderbook_df[orderbook_df['qty'] > 0].shape[0] + completed_orders_df[completed_orders_df['qty'] > 0].shape[0]

# buy entry conditions

bc1 = cc['rsi'] > 1

bc2 = cc['SUPERTd_7_3.0'] == 1

bc3 = cc['market_type'] != "neutral"

bc4 = no_of_orders_placed < 5

bc5 = orderbook[name]['traded'] is None

except Exception as e:

print(e)

continue

if bc1 and bc2 and bc3 and bc4 and bc5:

print("buy ", name, "\t")

margin_avialable = tsl.get_balance()

margin_required = cc['close']/4.5

if margin_avialable < margin_required:

print(f"Less margin, not taking order : margin_avialable is {margin_avialable} and margin_required is {margin_required} for {name}")

continue

# ce_name, pe_name, ce_otm_strike, pe_otm_strike = tsl.OTM_Strike_Selection(Underlying='NIFTY', Expiry=0, OTM_count=2)

# lot_size = tsl.get_lot_size(tradingsymbol = ce_name)

# options_chart = tsl.get_historical_data(tradingsymbol = ce_name,exchange = 'NFO',timeframe="5")

# options_chart['atr'] = talib.ATR(options_chart['high'], options_chart['low'], options_chart['close'], timeperiod=14)

rc_chart = chart.iloc[-1]

orderbook[name]['name'] = name

# orderbook[name]['options_name'] = ce_name

orderbook[name]['date'] = str(current_time.date())

orderbook[name]['entry_time'] = str(current_time.time())[:8]

orderbook[name]['max_holding_time'] = datetime.datetime.now() + datetime.timedelta(hours=2)

orderbook[name]['buy_sell'] = "BUY"

sl_points = rc_chart['atr']*atr_multipler

orderbook[name]['qty'] = 1 #int(int((risk_per_trade*0.7)/sl_points))

try:

entry_orderid = tsl.order_placement(tradingsymbol=name ,exchange='NSE', quantity=orderbook[name]['qty'], price=0, trigger_price=0, order_type='MARKET', transaction_type='BUY', trade_type='MIS')

orderbook[name]['entry_orderid'] = entry_orderid

orderbook[name]['entry_price'] = tsl.get_executed_price(orderid=orderbook[name]['entry_orderid'])

orderbook[name]['sl'] = round(orderbook[name]['entry_price'] - sl_points, 1) # 99

orderbook[name]['tsl'] = orderbook[name]['sl']

price = orderbook[name]['sl'] - 0.05

sl_orderid = tsl.order_placement(tradingsymbol=name ,exchange='NSE', quantity=orderbook[name]['qty'], price=0, trigger_price=orderbook[name]['sl'], order_type='STOPMARKET', transaction_type ='SELL', trade_type='MIS')

orderbook[name]['sl_orderid'] = sl_orderid

orderbook[name]['traded'] = "yes"

message = "\n".join(f"'{key}': {repr(value)}" for key, value in orderbook[name].items())

message = f"Entry_done {name} \n\n {message}"

tsl.send_telegram_alert(message=message,receiver_chat_id=receiver_chat_id,bot_token=bot_token)

except Exception as e:

print(e)

pdb.set_trace(header= "error in entry order")

if orderbook[name]['traded'] == "yes":

bought = orderbook[name]['buy_sell'] == "BUY"

if bought:

try:

ltp = all_ltp[name]

sl_hit = tsl.get_order_status(orderid=orderbook[name]['sl_orderid']) == "TRADED"

holding_time_exceeded = datetime.datetime.now() > orderbook[name]['max_holding_time']

current_pnl = round((ltp - orderbook[name]['entry_price'])*orderbook[name]['qty'],1)

except Exception as e:

print(e)

pdb.set_trace(header = "error in sl order cheking")

if sl_hit:

try:

orderbook[name]['exit_time'] = str(current_time.time())[:8]

orderbook[name]['exit_price'] = tsl.get_executed_price(orderid=orderbook[name]['sl_orderid'])

orderbook[name]['pnl'] = round((orderbook[name]['exit_price'] - orderbook[name]['entry_price'])*orderbook[name]['qty'],1)

orderbook[name]['remark'] = "Bought_SL_hit"

message = "\n".join(f"'{key}': {repr(value)}" for key, value in orderbook[name].items())

message = f"SL_HIT {name} \n\n {message}"

tsl.send_telegram_alert(message=message,receiver_chat_id=receiver_chat_id,bot_token=bot_token)

if reentry == "yes":

completed_orders.append(orderbook[name])

orderbook[name] = None

except Exception as e:

print(e)

pdb.set_trace(header = "error in sl_hit")

if holding_time_exceeded and (current_pnl < 0):

try:

tsl.cancel_order(OrderID=orderbook[name]['sl_orderid'])

time.sleep(2)

square_off_buy_order = tsl.order_placement(tradingsymbol=orderbook[name]['name'] ,exchange='NSE', quantity=orderbook[name]['qty'], price=0, trigger_price=0, order_type='MARKET', transaction_type='SELL', trade_type='MIS')

orderbook[name]['exit_time'] = str(current_time.time())[:8]

orderbook[name]['exit_price'] = tsl.get_executed_price(orderid=square_off_buy_order)

orderbook[name]['pnl'] = (orderbook[name]['exit_price'] - orderbook[name]['entry_price'])*orderbook[name]['qty']

orderbook[name]['remark'] = "holding_time_exceeded_and_I_am_still_facing_loss"

message = "\n".join(f"'{key}': {repr(value)}" for key, value in orderbook[name].items())

message = f"holding_time_exceeded_and_I_am_still_facing_loss {name} \n\n {message}"

tsl.send_telegram_alert(message=message,receiver_chat_id=receiver_chat_id,bot_token=bot_token)

if reentry == "yes":

completed_orders.append(orderbook[name])

orderbook[name] = None

winsound.Beep(1500, 10000)

except Exception as e:

print(e)

pdb.set_trace(header = "error in tg_hit") # Testing changes. sadhasd ajsdas dbna sdb abs da sd asd abs d asd

chart_name = orderbook[name]['name']

chart = tsl.get_historical_data(tradingsymbol = chart_name,exchange = 'NSE',timeframe="5")

chart['atr'] = talib.ATR(chart_name['high'], chart_name['low'], chart_name['close'], timeperiod=14)

rc_chart = chart.iloc[-1]

sl_points = rc_chart['atr']*atr_multipler

chart_ltp = tsl.get_ltp_data(names = chart_name)[chart_name]

tsl_level = chart_ltp - sl_points

if tsl_level > orderbook[name]['tsl']:

trigger_price = round(tsl_level, 1)

price = trigger_price - 0.05

tsl.modify_order(order_id=orderbook[name]['sl_orderid'],order_type="STOPLIMIT",quantity=25,price=price,trigger_price=trigger_price)

orderbook[name]['tsl'] = tsl_level

# order_ids = tsl.place_slice_order(tradingsymbol=“NIFTY 19 DEC 24400 CALL”, exchange=“NFO”,quantity=10000, transaction_type=“BUY”,order_type=“LIMIT”,trade_type=“MIS”,price=0.05)

@Tradehull_Imran

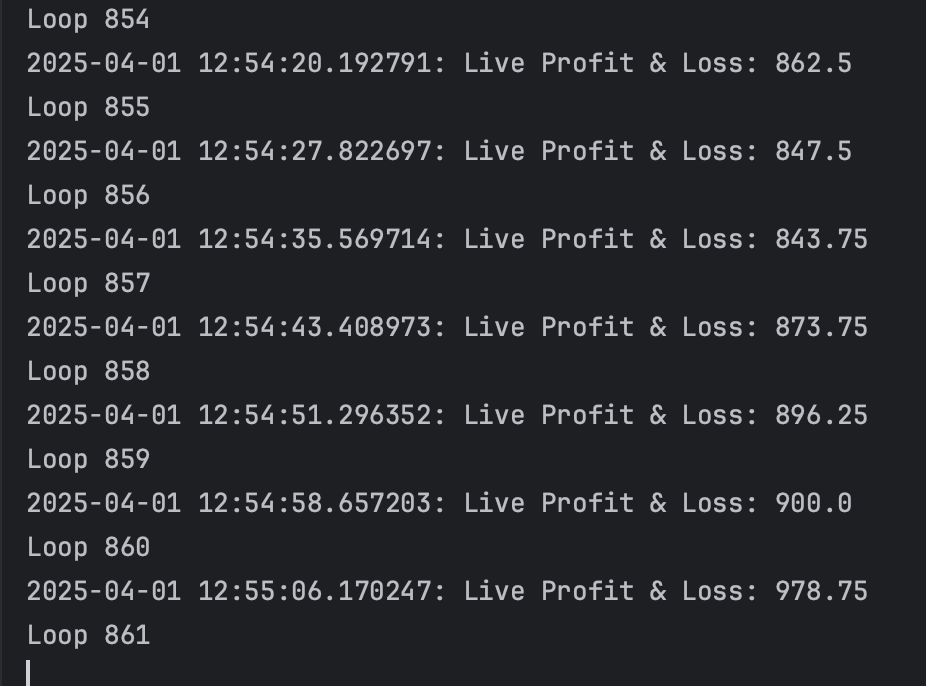

My first algo is live today. Thank you for your support and teaching us about Algo Trading.

You explained most of the concepts very well.

@Dhan - Thank you for organising such wonderful youtube series.

Here is glimpse of my live Algo:

Thanks!

Hi @Tradehull_Imran and @Dhan ,

I want to calculate margin utilised in my Delta Neutral Option Selling Strategy.

margin = tsl.margin_calculator(tradingsymbol=scrip_name, exchange=“NFO”, quantity=quantity, price=price, transaction_type=transaction_type, trade_type=“MARGIN”, trigger_price=0)[“totalMargin”]

For sold legs it showing margin requirement much higher according to naked option selling.

When we execute strategies buy OTM legs first and then sell ATM legs in this case margin requirement is much lesser. How can I get these margin values using programming.

I need this info to calculate overall margin required for strategy and then decide number of lots accordingly.

Please assist me on this.

Thanks!

No change is required in the ALGO, the codebase is just upgraded.

Refer the below link for more details:

Dhan-Tradehull · PyPI

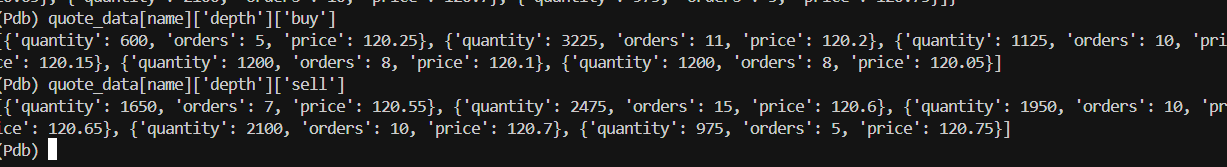

Hi @Qaisar ,

Make sure Dhan-TradeHull file is not present in the same folder. Else not it will use the previous version.

Just FYI… NIFTY got executed w/o any issue today also. I think it’s not related to version.

Hi @Akshay_Bawane ,

You can use the below code :

name = 'NIFTY 03 APR 23200 CALL'

quote_data = tsl.get_quote_data(name)

quote_data[name]['depth']['buy']

quote_data[name]['depth']['sell']

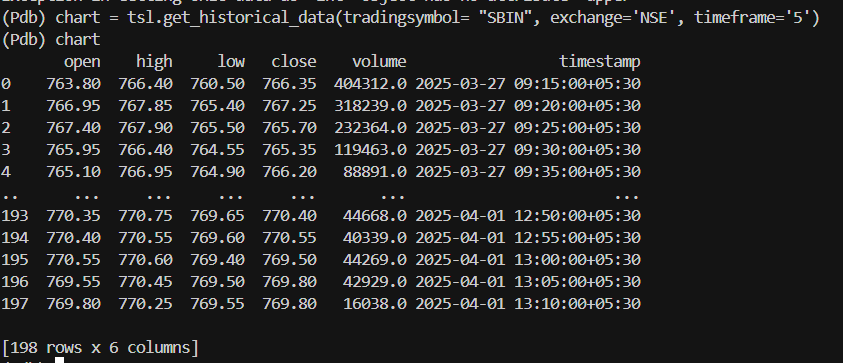

Hi @rohit2312 ,

The code seems to be working fine:

Make sure you have subscribed to Data API, and verify if you are able to fetch the historical data.

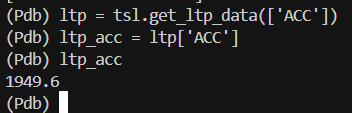

Hi @Lekhini ,

Here’s how you can fetch LTP for a stock,

ltp = tsl.get_ltp_data(['ACC'])

ltp_acc = ltp['ACC']

Make sure you have subscribed to Data API.

Hi @Jagrut_Nemade ,

The code seems to be working fine …

Kindly use the upgraded codebase version 3.0.6,

- Open Command Prompt: Press Win, type cmd, and press Enter.

- Install Dhan-Tradehull: Run

pip install Dhan-Tradehull - Confirm the installation by running

pip show Dhan-Tradehull

Guide to use the updated codebase:

Refer the below pypi link for more details:

https://pypi.org/project/Dhan-Tradehull/

Hi @Manish1 ,

Currently Dhan supports only 5 days historical data for 1 hour timeframe. You can use ‘DAY’ timeframe to get more data.

Hi @Rajeev_Kallur ,

Consider the below scenario:

entry_price = 100 # Sold at ₹100

trailing_sl = 120 # Initial stop-loss

trail_step = 5 # Move SL by ₹5 as price drops

min_trail_gap = 10 # Trail only after ₹10 profit

while True:

ltp = get_live_option_price(symbol)

profit = entry_price - ltp

# Trailing logic

if profit >= min_trail_gap:

new_sl = ltp + trail_step

if new_sl < trailing_sl:

trailing_sl = new_sl

print(f"Trailed SL to ₹{trailing_sl}")

Hi @Aijaz_Ahmad ,

We will check on this.

@Tradehull_Imran Where can I find the Dhan_Tradehull_V3 script?

Hi @Siddhesh_Amrute,

Wonderful… best luck, coloring the console output, would have an extra effect… ![]()

Hi @Siddhesh_Amrute ,

Congratulations… you started.

I am still version 2 & 3. as it does not have any reference doc.

Can u share your contact number or call me @7042367771 wanted to seek some help.

Regards

Thank you @Tradehull_Imran