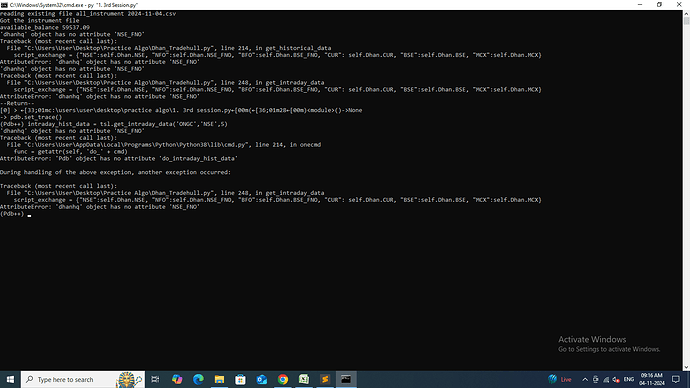

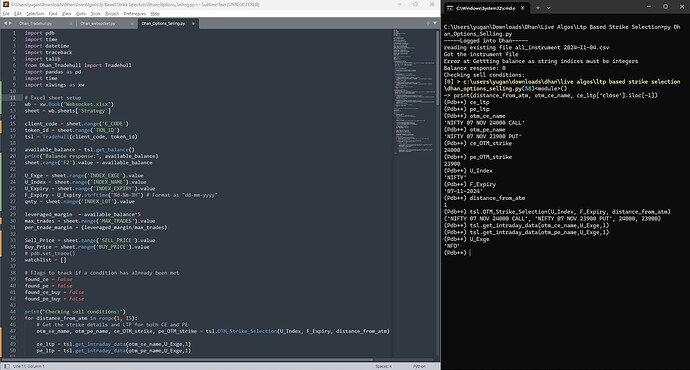

import pdb

from Dhan_Tradehull import Tradehull

import pandas as pd

import talib

Trading API client setup

client_code = “********”

token_id = “token_id_used”

tsl = Tradehull(client_code, token_id)

Intraday strategy parameters

available_balance = tsl.get_balance()

leveraged_margin = available_balance * 5

max_trades = 3

per_trade_margin = leveraged_margin / max_trades

Watchlist

watchlist = [

‘MOTHERSON’, ‘OFSS’, ‘MANAPPURAM’, ‘BSOFT’, ‘CHAMBLFERT’, ‘DIXON’, ‘NATIONALUM’,

‘DLF’, ‘IDEA’, ‘ADANIPORTS’, ‘SAIL’, ‘HINDCOPPER’, ‘INDIGO’, ‘RECLTD’, ‘PNB’,

‘HINDUNILVR’, ‘TATAPOWER’, ‘BPCL’, ‘HCLTECH’, ‘WIPRO’

]

traded_watchlist =

Main loop

while True:

for stock_name in watchlist:

print(f"Processing {stock_name}…")

# Fetch intraday data

chart = tsl.get_intraday_data(stock_name, 'NSE', 1)

if chart is None or chart.empty:

print(f"No data retrieved for {stock_name}. Skipping...")

continue

# Calculate RSI

try:

chart['rsi'] = talib.RSI(chart['close'], timeperiod=14)

except TypeError:

print(f"Data is missing or incorrect for {stock_name}. Skipping...")

continue

# Ensure sufficient data for analysis

if len(chart) < 4:

print(f"Not enough data for {stock_name}. Skipping...")

continue

# Define candles for analysis

bc = chart.iloc[-2] # Breakout candle

ic = chart.iloc[-3] # Inside candle

ba_c = chart.iloc[-4] # Base candle

# Determine trend and conditions

uptrend = bc['rsi'] > 50

downtrend = bc['rsi'] < 49

inside_candle_formed = (ba_c['high'] > ic['high']) and (ba_c['low'] < ic['low'])

upper_side_breakout = bc['high'] > ba_c['high']

down_side_breakout = bc['low'] < ba_c['low']

# Print values for debugging

print(f"{stock_name} - RSI: {bc['rsi']}, uptrend: {uptrend}, downtrend: {downtrend}")

print(f"Inside candle formed: {inside_candle_formed}, Upper breakout: {upper_side_breakout}")

no_repeat_order = stock_name not in traded_watchlist

max_order_limit = len(traded_watchlist) < max_trades # Changed <= to < for limit enforcement

# Execute buy order

if uptrend and inside_candle_formed and upper_side_breakout and no_repeat_order and max_order_limit:

print(f"{stock_name} is in uptrend. Attempting to place a buy order.")

qty = int(per_trade_margin / bc['close'])

try:

buy_entry_orderid = tsl.order_placement(stock_name, 'NSE', qty, 1, 0, 0, 'MARKET', 'BUY', 'MIS')

traded_watchlist.append(stock_name)

print(f"Buy order placed for {stock_name}, order ID: {buy_entry_orderid}")

except Exception as e:

print(f"Error placing buy order for {stock_name}: {e}")

# Execute sell order

elif downtrend and inside_candle_formed and down_side_breakout and no_repeat_order and max_order_limit:

print(f"{stock_name} is in downtrend. Attempting to place a sell order.")

qty = int(per_trade_margin / bc['close'])

try:

sell_entry_orderid = tsl.order_placement(stock_name, 'NSE', qty, 1, 0, 0, 'MARKET', 'SELL', 'MIS')

traded_watchlist.append(stock_name)

print(f"Sell order placed for {stock_name}, order ID: {sell_entry_orderid}")

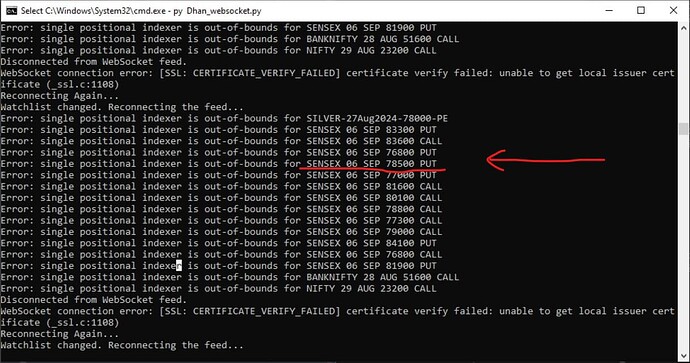

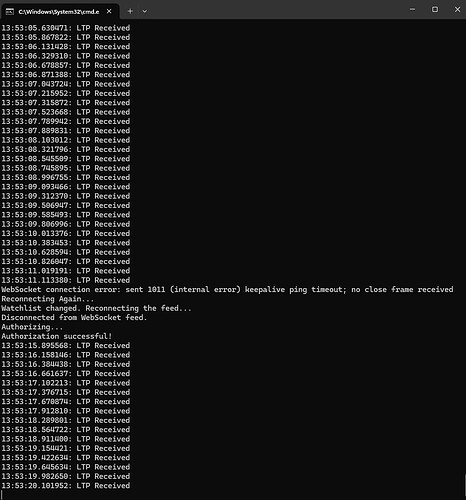

use this code ,make sure above stock price updated in your webshockt list.