Hi @Kalpeshh_Patel

Also for the pseudocode, do carefully fill in any gaps, fix any errors, and implement it into a working program.

Also same changes needs to be made PE side as well.

import pdb

import traceback

import time

import datetime

from Dhan_Tradehull_V2 import Tradehull

import pandas as pd

from pprint import pprint

import pandas_ta as pta

import talib

import pandas_ta as ta

import warnings

warnings.filterwarnings("ignore")

# ---------------for dhan login ----------------

client_code = "xxxxxxxxx"

token_id = "xxxxxxxx"

tsl = Tradehull(client_code,token_id)

available_balance = tsl.get_balance()

print("available_balance", available_balance)

index_name = 'BANKNIFTY NOV FUT'

traded = "no"

trade_info = {"options_name":None, "qty":None, "sl":None, "CE_PE":None, "entry_price":None , "Trailed":None, "entry_orderid":None}

while True:

current_time = datetime.datetime.now().time()

if current_time < datetime.time(9,20):

print("wait for market to start", current_time)

continue

if (current_time > datetime.time(23, 25)):

print("Market is over, Bye Bye see you tomorrow", current_time)

break

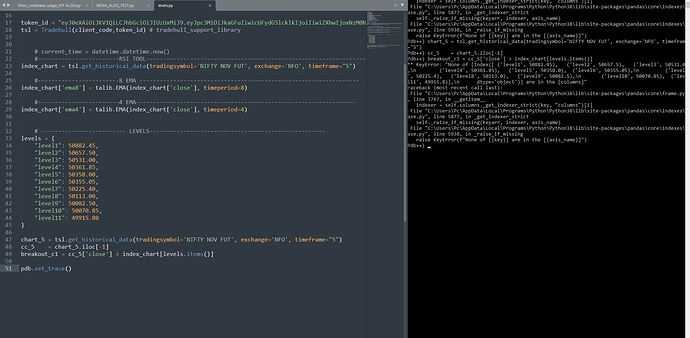

index_chart = tsl.get_historical_data(tradingsymbol=index_name, exchange='NFO', timeframe="15")

time.sleep(3)

index_chart_5 = tsl.get_historical_data(tradingsymbol = index_name,exchange = 'NFO',timeframe="5")

index_ltp = tsl.get_ltp_data(names = ['NIFTY NOV FUT','BANKNIFTY NOV FUT'])

if index_chart.empty or index_chart_5.empty:

time.sleep(60)

continue

index_chart['rsi'] = talib.RSI(index_chart['close'], timeperiod=14) #pandas

supertrend = ta.supertrend(index_chart_5['high'], index_chart_5['low'], index_chart_5['close'], 10, 3)

index_chart_5 = pd.concat([index_chart_5, supertrend], axis=1, join='inner')

pdb.set_trace()

# time.sleep(60)

# continue

# print(index_chart,'scanning',)

cc_1 = index_chart.iloc[-1] #pandas completed candle of 15 min timeframe

cc_2 = index_chart.iloc[-2]

cc_3 = index_chart.iloc[-3]

cc5_2 = index_chart_5.iloc[-2]

# ---------------------------- BUY ENTRY CONDITIONS ----------------------------

up1 = cc_2['rsi'] > 60

up2 = cc_3['rsi'] < 60

up3 = cc_2['high'] < cc_1['close']

print(f"BUY\t {current_time} \t {up1} \t {up2} \t {up3} \t cc_1 {str(cc_1['timestamp'].time())}")

# pdb.set_trace()

# ---------------------------- SELL ENTRY CONDITIONS ----------------------------

dt1 = cc_2['rsi'] < 90 # This is for tral basis

dt2 = cc_3['rsi'] > 90 # This is for tral basis

dt3 = cc_2['low'] > cc_1['close']

print(f"SELL\t {current_time} \t {dt1} \t {dt2} \t {dt3} \t cc_1 {str(cc_1['timestamp'].time())} \n")

if up1 and up2 and up3:

print(index_name, "Buy CALL")

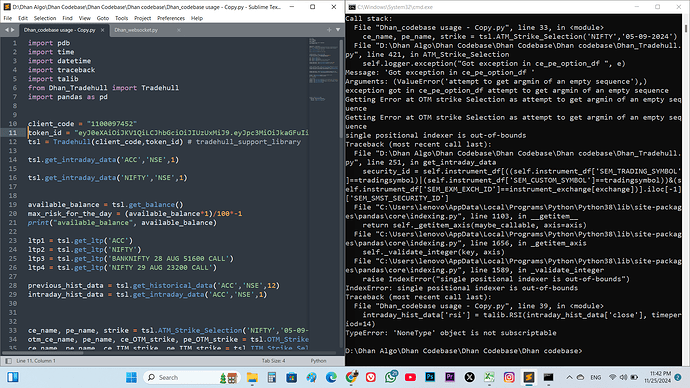

ce_name, pe_name, strike = tsl.ATM_Strike_Selection(Underlying ='NIFTY',Expiry ='28-11-2024')

lot_size = tsl.get_lot_size(ce_name)*1

entry_orderid = tsl.order_placement(ce_name,'NFO', lot_size, 0, 0, 'MARKET', 'BUY', 'MIS')

traded = "yes"

trade_info['options_name'] = ce_name

trade_info['qty'] = lot_size

trade_info['sl'] = cc_2['low']

trade_info['CE_PE'] = "CE"

trade_info['entry_orderid']= entry_orderid

time.sleep(1)

trade_info['entry_price'] = tsl.get_executed_price(orderid=trade_info['entry_orderid'])

if dt1 and dt2 and dt3:

print(index_name, "Buy PUT")

ce_name, pe_name, strike = tsl.ATM_Strike_Selection(Underlying ='NIFTY',Expiry ='28-11-2024')

lot_size = tsl.get_lot_size(pe_name)*1

entry_orderid = tsl.order_placement(pe_name,'NFO', lot_size, 0, 0, 'MARKET', 'BUY', 'MIS')

traded = "yes"

trade_info['options_name'] = pe_name

trade_info['qty'] = lot_size

trade_info['sl'] = cc_2['high']

trade_info['CE_PE'] = "PE"

# ---------------------------- check for exit SL/TG

if traded == "yes":

long_position = trade_info['CE_PE'] == "CE"

short_position = trade_info['CE_PE'] == "PE"

if long_position:

price_has_moved_20_pct = index_ltp > (trade_info['entry_price'])*1.2

position_has_not_been_trailed = trade_info['Trailed'] is None

if price_has_moved_20_pct and position_has_not_been_trailed:

trade_info['sl'] = trade_info['entry_price']

trade_info['Trailed'] = "yes_I_have_trailed"

sl_hit = index_ltp < trade_info['sl']

tg_hit = index_ltp < cc5_2['SUPERT_10_3.0']

if sl_hit or tg_hit:

print("Order Exited", trade_info)

exit_orderid = tsl.order_placement(trade_info['options_name'],'NFO', trade_info['qty'], 0, 0, 'MARKET', 'SELL', 'MIS')

# pdb.set_trace()

if short_position:

price_has_moved_20_pct = index_ltp > (trade_info['entry_price'])*1.2

position_has_not_been_trailed = trade_info['Trailed'] is None

if price_has_moved_20_pct and position_has_not_been_trailed:

trade_info['sl'] = trade_info['entry_price']

trade_info['Trailed'] = "yes_I_have_trailed"

sl_hit = index_ltp < trade_info['sl']

tg_hit = index_ltp < cc5_2['SUPERT_10_3.0']

if sl_hit or tg_hit:

print("Order Exited", trade_info)

exit_orderid = tsl.order_placement(trade_info['options_name'],'NFO', trade_info['qty'], 0, 0, 'MARKET', 'SELL', 'MIS')

# pdb.set_trace()