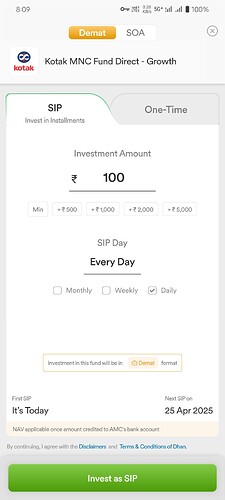

@Pranita Don’t you think 5000 is on too much higher side?? If instalment frequency is more minimum amount should be less but @Dhan has done reverse.

@Pranita today I checked, many fund allowed 100 Rs as minimum amount for Daily and weekly SIP, then why few fund demand 5000 on Dhan only? See attachment. Please rectify this difference.

@PravinJ @Saurav.P

Hi,

I have transferred my Demat mutual fund units to Dhan from other broker.

Units are credited to my Dhan account but it is not showing in my Dhan App.

Please check and do the needful.

Hi @Cool2050 The SIP management for Demat / SOA format is managed at Dhan for Daily & Weekly SIPs, for monthly it is based on Mutual Funds.

At present there is no standardisation for daily / weekly SIPs across the industry for multiple AMCs. With this - we are able to offer daily or weekly SIPs for all mutual fund schemes in all formats.

Hi @Cool2050 For account specific queries, please connect with our Customer Care on help@dhan.co

@PravinJ My simple input is keep minimum SIP amount as per AMC’s requirement for that particular scheme only. If AMC want minimum SIP as 100 then don’t make it 1000 at Dhan end.

already done before writing here.

Hi @Cool2050,

As discussed, I hope our call helped clear things up!

yes, things cleared now.

I fail to understand why this feature was the most sought-after. Pledging Giltbees, in my opinion, is much better too. What is the added benefit of pledging MFs?

It would only be useful if we can pledge non-gilt (non-liquid) funds too like equity, gold, or bond based funds.

We have ETFs for equity, gold and bonds too. To be clear, I am not questioning the reason behind providing this feature. I am just trying to understand why it was requested so much.

Hey @GOPAL_MAKWANA ,

Do you have any purchases in Demat MF ? Have you activated Demat MF yet ? Your regular MF holdings will display as usual in MF portfolio tab .

Thanks,

Pranita

CURRENT MF IN SOA is it available for pledging…??

If not then what is solution for it…??

Gives more options across smallcap, midcap and large cap. Plus Liquid Funds offer better returns than LiquidBees or LiquidCase.

Hi @GOPAL_MAKWANA,

No, Mutual Funds held in SOA (Statement of Account) mode cannot be pledged.

This is because SOA units are held directly with the Fund House or their RTA (like CAMS or KFintech) and not in your Demat account. Since pledging requires a Demat setup to mark a lien through depositories like CDSL or NSDL, SOA holdings fall outside this system and aren’t eligible for margin use.

If you’re looking to unlock margin benefits, the best way forward is to enable Demat Mode on Dhan. Once activated, any new Mutual Fund investments you make will be held in your Demat account and become eligible for pledging.

Hi @VijayNair

Let’s wait for the official announcement. The full list of schemes available for margin benefit will be published soon.

One option is there. If you have another demat other than Dhan with same mode of holding in Demat and Mutual fund, then apply for Demat conversion to that broker, after conversion transfer all units to Dhan and then enjoy pledging.