//@version=5

strategy(“XXXX Strategy with Dhan Integration”, overlay=true)

//Webhook Settings

groupWebhook = “Webhook Settings”

secretCode = input.string(defval=“”, title=“Secret Code”, group=groupWebhook)

symbol = input.string(defval=“NIFTY”, title=“Symbol”, options=[“NIFTY”, “FINNIFTY”, “BANKNIFTY”, “MIDCPNIFTY”, “BANKEX”, “SENSEX”], group=groupWebhook)

quantity = input.int(defval=1, title=“Lots”, minval=1, group=groupWebhook)

expiryDate = input.string(defval=“2024-10-17”, title=“Expiry Date”, group=groupWebhook)

//Auto Strike Selection Settings

opt_level = input.int(1, title=“Option Depth Level”, minval=1)

// Define the strike price step based on the selected symbol

var float strikeStep = na

if (symbol == “BANKNIFTY” or symbol == “SENSEX” or symbol == “BANKEX”)

strikeStep := 100

else if (symbol == “NIFTY” or symbol == “FINNIFTY”)

strikeStep := 50

else if (symbol == “MIDCPNIFTY”)

strikeStep := 25

upBound_buy = ta.highest(high, 20)

upBound_sell = ta.highest(high, 20)

downBound_short = ta.lowest(low, 20)

downBound_cover = ta.lowest(low, 20)

callbuytext = math.floor(upBound_buy / strikeStep) * strikeStep - opt_level * strikeStep

callselltext = math.floor(upBound_sell / strikeStep) * strikeStep - opt_level * strikeStep

putbuytext = math.ceil(downBound_short / strikeStep) * strikeStep + opt_level * strikeStep

putselltext = math.ceil(downBound_cover / strikeStep) * strikeStep + opt_level * strikeStep

// Risk Management Settings

groupRisk = “Risk Management”

inpTakeProfit = input.int(defval=15000, title=“Take Profit”, minval=0, group=groupRisk)

inpStopLoss = input.int(defval=3000, title=“Stop Loss”, minval=0, group=groupRisk)

inpTrailStop = input.int(defval=100, title=“Trailing Stop Loss”, minval=0, group=groupRisk)

inpTrailOffset = input.int(defval=1, title=“Trailing Stop Loss Offset”, minval=0, group=groupRisk)

// Logic Settings

XXXXXXXXXXX

//Risk Management Values

XXXXXXXXXXX

//Buy and Sell Strategy Conditions

XXXXXXXXXXXX

size = math.abs(strategy.position_size) // Find absolute value of position size to exit position properly

// Determine the exchange based on the selected symbol

var string exchange = “”

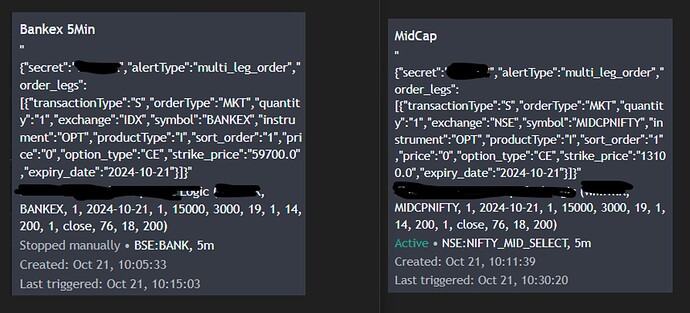

if (symbol == “NIFTY” or symbol == “BANKNIFTY” or symbol == “FINNIFTY” or symbol == “MIDCPNIFTY”)

exchange := “NSE”

else if (symbol == “BANKEX” or symbol == “SENSEX”)

exchange := “IDX”

//Dhan Webhook Messages - Dynamic Construct

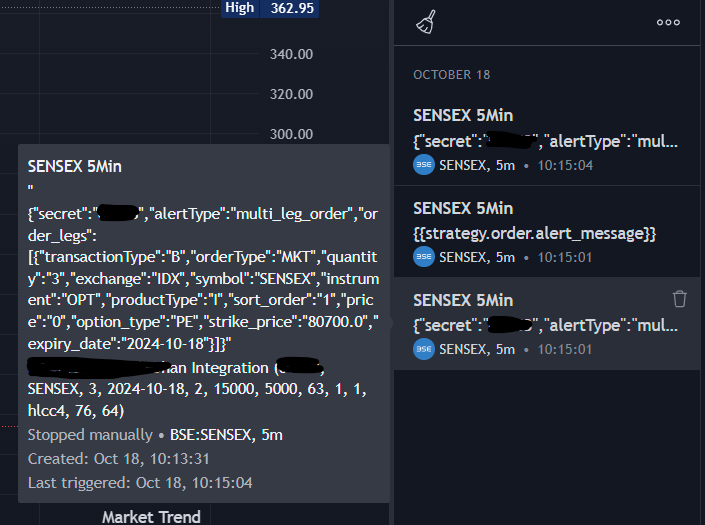

long_msg = ‘{“secret”:"’ + secretCode + ‘“,“alertType”:“multi_leg_order”,“order_legs”:[{“transactionType”:“B”,“orderType”:“MKT”,“quantity”:”’ + str.tostring(quantity) + ‘“,“exchange”:”’ + exchange + ‘“,“symbol”:”’ + symbol + ‘“,“instrument”:“OPT”,“productType”:“I”,“sort_order”:“1”,“price”:“0”,“option_type”:“CE”,“strike_price”:”’ + str.tostring(callbuytext) + ‘.0",“expiry_date”:"’ + expiryDate + ‘"}]}’

short_msg = ‘{“secret”:"’ + secretCode + ‘“,“alertType”:“multi_leg_order”,“order_legs”:[{“transactionType”:“B”,“orderType”:“MKT”,“quantity”:”’ + str.tostring(quantity) + ‘“,“exchange”:”’ + exchange + ‘“,“symbol”:”’ + symbol + ‘“,“instrument”:“OPT”,“productType”:“I”,“sort_order”:“1”,“price”:“0”,“option_type”:“PE”,“strike_price”:”’ + str.tostring(putbuytext) + ‘.0",“expiry_date”:"’ + expiryDate + ‘"}]}’

long_exit_msg = ‘{“secret”:"’ + secretCode + ‘“,“alertType”:“multi_leg_order”,“order_legs”:[{“transactionType”:“S”,“orderType”:“MKT”,“quantity”:”’ + str.tostring(quantity) + ‘“,“exchange”:”’ + exchange + ‘“,“symbol”:”’ + symbol + ‘“,“instrument”:“OPT”,“productType”:“I”,“sort_order”:“1”,“price”:“0”,“option_type”:“CE”,“strike_price”:”’ + str.tostring(callselltext) + ‘.0",“expiry_date”:"’ + expiryDate + ‘"}]}’

short_exit_msg = ‘{“secret”:"’ + secretCode + ‘“,“alertType”:“multi_leg_order”,“order_legs”:[{“transactionType”:“S”,“orderType”:“MKT”,“quantity”:”’ + str.tostring(quantity) + ‘“,“exchange”:”’ + exchange + ‘“,“symbol”:”’ + symbol + ‘“,“instrument”:“OPT”,“productType”:“I”,“sort_order”:“1”,“price”:“0”,“option_type”:“PE”,“strike_price”:”’ + str.tostring(putselltext) + ‘.0",“expiry_date”:"’ + expiryDate + ‘"}]}’

//Date Range Settings

groupDateRange = “Date Range for Backtesting”

startDate = input.time(timestamp(“2023-01-01 00:00”), title=“Start Date”, group=groupDateRange)

endDate = input.time(timestamp(“2024-12-31 23:59”), title=“End Date”, group=groupDateRange)

// Only run the strategy if the current time is within the date range

inDateRange = (time >= startDate and time <= endDate)

//Submit Orders Based on Signals

if (inDateRange and strategy.position_size == 0) // No active position

if (longEntryCondition)

strategy.order(“Long”, strategy.long)

alert(long_msg, freq=alert.freq_all) // Trigger alert for long entry

if (shortEntryCondition)

strategy.order(“Short”, strategy.short)

alert(short_msg, freq=alert.freq_all) // Trigger alert for short entry

if (inDateRange and strategy.position_size > 0) // Long position active

if (shortEntryCondition)

strategy.order(“Short”, strategy.short, qty=size)

alert(short_msg, freq=alert.freq_all) // Trigger alert for short entry

else

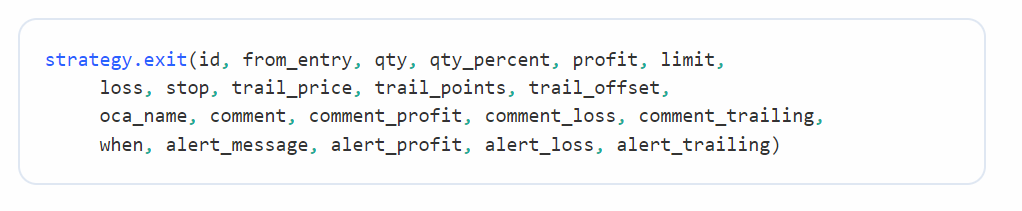

strategy.exit(“Long Exit”, from_entry=“Long”, qty=size, stop=useStopLoss, limit=useTakeProfit, alert_message=long_exit_msg) // Trigger alert for long exit

if (inDateRange and strategy.position_size < 0) // Short position active

if (longEntryCondition)

strategy.order(“Long”, strategy.long, qty=size)

alert(long_msg, freq=alert.freq_all) // Trigger alert for long entry

else

strategy.exit(“Short Exit”, from_entry=“Short”, qty=size, stop=useStopLoss, limit=useTakeProfit, alert_message=short_exit_msg) // Trigger alert for short exit

//Risk Management Exits (Outside Alerts)

if (inDateRange)

strategy.exit(“Exit Long”, from_entry=“Long”, profit=useTakeProfit, loss=useStopLoss, trail_points=useTrailStop, trail_offset=useTrailOffset, alert_message=long_exit_msg)

strategy.exit(“Exit Short”, from_entry=“Short”, profit=useTakeProfit, loss=useStopLoss, trail_points=useTrailStop, trail_offset=useTrailOffset, alert_message=short_exit_msg)

// Alert message - {{strategy.order.alert_message}}

I have checked for extra quotes in the webhook construct, but i couldn’t find the issue, It would be so helpful if you could point it out

And I hope other traders find this structure helpful, all they need to do is to enter there core logic in.

Thank You!!