Hi All

We have recently introduced one minor adjustment to our Risk Management Policy and this update involves the implementation of our internal Limit Price Protection, in adherence to the NSE circular NSE/FAOP/54242.

New Update: 25 Oct 2023

We have increased the limits from 10% to 20% between Trigger Price and Limit Price.

The Exchange had introduced Limit Price Protection (LPP) in the derivatives market in October 2022. For more detailed information, you can refer to the post available here.![]()

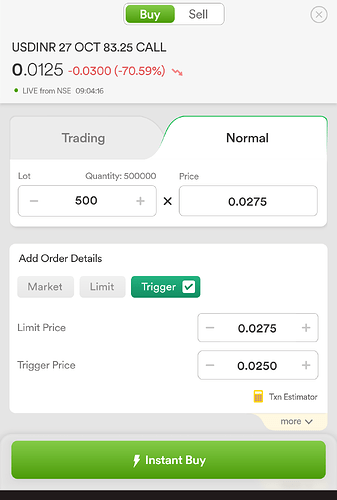

The internal Limit Price Protection is specifically applied to Stop-Loss Limit orders. It places restrictions on the difference between the Trigger Price and Limit Price, as outlined in the table below.

Example to understand this:

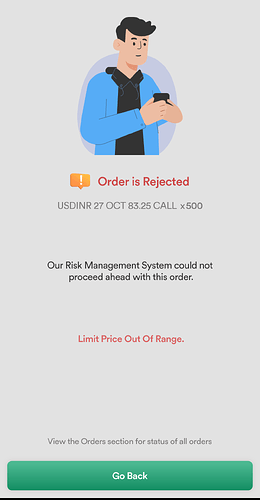

For instance, if you intend to execute a sell Stop-Loss Limit order in the Options Market with a Trigger Price set at 100, your Limit Price must fall below 100 but above 90. In the event that you place this order with a Limit Price below 90, it will initially be accepted; however, if the Stop-Loss is subsequently triggered, the order will be rejected.

Similarly, if you intend to place a buy Stop-Loss Limit order in the Options Market with 100 as Trigger Price, the Limit Price range will be more than 100 & less than 110.

This policy has been established to ensure a fair price discovery process in the market and to safeguard users from undue risks through pre-trade risk controls.

Best Regards,

Kuldeep Mathur