Hello everyone!

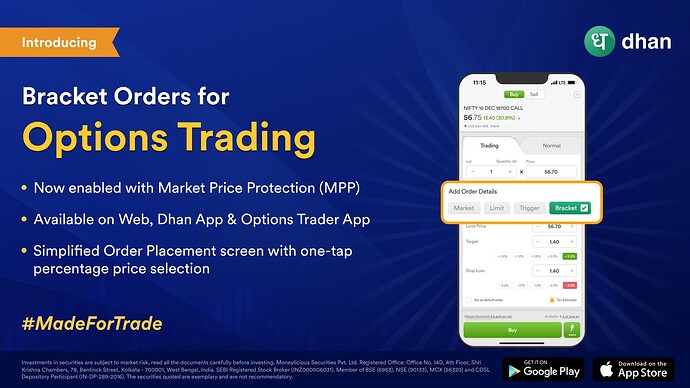

We are introducing Bracket Orders(BO) for Options Trading on Dhan!

Yes, you heard it right. Earlier, we revoked Bracket Orders as order type for options to comply with exchange guidelines, post that we have made required changes in our order management & risk management systems to offer Bracket Orders orders for all our Option Traders on Dhan across our platforms.

We mentioned reintroducing Bracket Orders back in September - here, it took us some time, and finally we are elated to announce that now you can seamlessly place Bracket Orders in Options starting today on Web, Dhan App & Options Trader app.

So, what’s new with Bracket Orders this time?

To explain this, let’s start with Bracket Orders first. Essentially, there are three legs in a Bracket Order that you need to add:

- Entry Leg - Limit order at which you enter the position

- Target Leg - Absolute value difference between desired Target trigger price and entry leg

- Stop Loss Leg - Absolute value difference between desired Stop Loss trigger price and entry leg

Note: Stop Loss range will be 80% of the Entry leg price

For the new Bracket Orders, we have made changes only for the Stop Loss leg. Currently, Stop Loss (as Market Order) is not allowed at exchange level. Hence, we have implemented a Market Price Protection (MPP) which would essentially convert Stop Loss trigger to SL-Limit order.

Let’s review with an Example…

Suppose that an index option is trading at ₹500. Assuming that you want to execute a Bracket Order at this price, you place a Bracket Order on Dhan with the following three values:

- Limit Price = ₹500

- Target = ₹100 (Target Price will be ₹600)

- Stop Loss = ₹50 (Stop Loss Price will be ₹450)

Over here, once your entry leg has been executed, our system will create the Target Leg and Stop Loss Leg. In case of Stop Loss leg, since Stop Loss Market order is not allowed at the exchange as a product type, we instead create a Stop Loss Limit order with ₹450 as trigger price and ₹405 as limit price (90% of Stop Loss trigger price).

Now, if your Stop loss leg gets triggered, we would essentially place a limit order at 90% of trigger price which would execute at the best available price in the market at that instance.

If you wish to edit the SL leg order, you will find two values in the order edit screen which is Trigger Price and Limit Price. We recommend you to keep sufficient difference between the two values in order to ensure your order is executed when triggered.

Moreover, whenever you are exiting a Bracket Order, make sure to reconfirm the status of both the pending order legs at your end.

Currently we have allowed Bracket Orders in Liquid Index Options for the current month only - which is NIFTY50, BANKNIFTY & FINNIFTY.

Note: In case your Entry Leg is executed in multiple trades, subsequent orders will be created for Target and Stop Loss leg, which may result in brokerage being charged on multiple orders for executed leg.

Hope the introduction of Bracket Order now makes it further easier for our Options Traders on Dhan to trade across our platforms.

As always, we are building at Dhan for our users.

Happy Trading

– Hardik

Product