![]() What is the 200 DMA?

What is the 200 DMA?

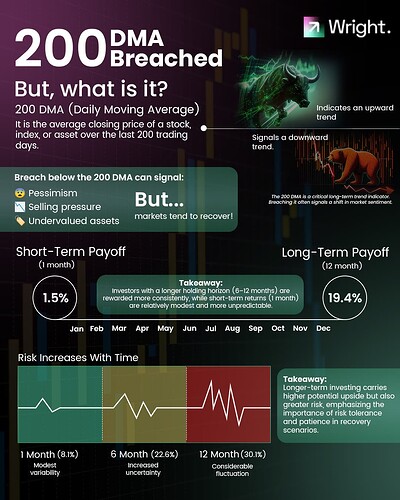

200 DMA (Daily Moving Average) is the average closing price of a stock, index, or asset over the last 200 trading days.

Above 200 DMA = Bullish trend ![]()

Below 200 DMA = Bearish trend ![]()

![]() Why is the 200 DMA Breach Important?

Why is the 200 DMA Breach Important?

A break below 200 DMA often signals market pessimism, leading to potential undervaluation.

Recovery aligns with mean-reversion, where markets return to long-term growth trends.

![]() Short-Term vs. Long-Term Payoff

Short-Term vs. Long-Term Payoff

Short-term (1 Month): Returns = 1.5% (modest, unpredictable).

Long-term (12 Months): Returns = 19.4% (more consistent recovery).

![]() Takeaway: Longer holding periods (6-12 months) reward patient investors.

Takeaway: Longer holding periods (6-12 months) reward patient investors.

![]() Risk vs. Reward

Risk vs. Reward

Risk grows with time, but so do potential returns:

1 Month: Max return = 35.4% ![]()

12 Months: Max return = 104.4% ![]()

Takeaway: Be ready for volatility but trust long-term growth.

![]() High Probability of Positive Returns

High Probability of Positive Returns

Positive return probability rises from 60.4% (1 Month) to 70.2% (12 Months).

![]() History favors patience: Nearly 3 in 4 chances of earning positive returns over a year!

History favors patience: Nearly 3 in 4 chances of earning positive returns over a year!

After a 200 DMA breach, holding for 6–12 months historically pays off. Prepare for volatility, but let time and patience work in your favor.