Sir,

tsl = Tradehull(client_code,token_id) # tradehull_support_library

available_balance = tsl.get_balance()

leveraged_margin = available_balance2

max_trades = 3

per_trade_margin = (leveraged_margin/max_trades)

max_loss = (available_balance1)/100*-1

waitchlist = [“RBLBANK”, “BIOCON”, “INDIGO”, “TATACHEM”, “UBL”, “HINDCOPPER”, “HINDPETRO”, “BATAINDIA”, “GAIL”, “BHARATFORG”, “GRANULES”, “ICICIPRULI”, “SONACOMS”, “TATAMOTORS”, “MGL”, “POONAWALLA”, “IGL”, “PAYTM”, “TVSMOTOR”, “JUBLFOOD”, “AARTIIND”, “ADANIENT”, “OIL”, “HFCL”, “KPITTECH”, “LTF”, “NAVINFLUOR”, “ANGELONE”, “CHOLAFIN”, “GUJGASLTD”, “CROMPTON”, “BSOFT”, “IDFCFIRSTB”, “AUBANK”, “EICHERMOT”, “BANDHANBNK”, “OBEROIRLTY”, “UNITDSPR”, “ATUL”, “NESTLEIND”, “BPCL”, “SYNGENE”, “ITC”, “PVRINOX”, “NYKAA”, “DRREDDY”, “TRENT”, “PIDILITIND”, “MANAPPURAM”, “NTPC”, “BRITANNIA”, “COALINDIA”, “AUROPHARMA”, “TCS”, “SBICARD”, “HAVELLS”, “CYIENT”, “MOTHERSON”, “APOLLOTYRE”, “EXIDEIND”, “CAMS”, “ESCORTS”, “BAJAJ-AUTO”, “PAGEIND”, “LUPIN”, “GODREJCP”, “INDHOTEL”, “CUMMINSIND”, “ICICIGI”, “KOTAKBANK”, “JSL”, “INDIANB”, “AXISBANK”, “M&M”, “TATACONSUM”, “ASIANPAINT”, “ASHOKLEY”, “JINDALSTEL”, “PNB”, “FEDERALBNK”, “OFSS”, “ZOMATO”, “IRCTC”, “ICICIBANK”, “IOC”, “RELIANCE”, “IRFC”, “SUNPHARMA”, “VBL”, “JIOFIN”, “DEEPAKNTR”, “BERGEPAINT”, “BAJAJFINSV”, “CANFINHOME”, “SJVN”, “IDEA”, “ABFRL”, “DABUR”, “PETRONET”, “PEL”, “CUB”, “LICHSGFIN”, “GNFC”, “NHPC”, “CIPLA”, “COLPAL”, “HDFCBANK”, “LTIM”, “HDFCLIFE”, “SHRIRAMFIN”, “ATGL”, “CONCOR”, “TATAPOWER”, “BANKINDIA”, “IPCALAB”, “TATACOMM”, “NAUKRI”, “TECHM”, “ABBOTINDIA”, “DMART”, “LAURUSLABS”, “LT”, “ABCAPITAL”, “SUPREMEIND”, “BOSCHLTD”, “HINDUNILVR”, “BHARTIARTL”, “MFSL”, “NCC”, “MRF”, “PIIND”, “CANBK”, “INDIAMART”, “MAXHEALTH”, “GMRAIRPORT”, “IEX”, “CDSL”, “DLF”, “HEROMOTOCO”, “INDUSTOWER”, “HAL”, “M&MFIN”, “KEI”, “MCX”, “ADANIGREEN”, “KALYANKJIL”, “COFORGE”, “LTTS”, “CESC”, “UNIONBANK”, “TATASTEEL”, “BANKBARODA”, “HCLTECH”, “POLYCAB”, “BEL”, “TORNTPHARM”, “TATAELXSI”, “SRF”, “YESBANK”]

traded_watchlist = # Stocks that have already been traded

Main live trading loop

while True:

live_pnl = tsl.get_live_pnl()

# current_time =datetime.datetime.now() # time and date

current_time_t = datetime.datetime.now().time() #time only

print(current_time_t)

if current_time_t < datetime.time(9, 21, 30):

print (“Wait market to open”, current_time_t)

continue

if current_time_t > datetime.time(15, 15, 30) or(live_pnl <max_loss):

i_want_to_trade_no_more = tsl.kill_switch('ON')

order_details = tsl.cancel_all_orders()

print ("Market is over or MAX LOSS, Bye for Now", current_time_t)

break

print("Algo is working", current_time_t)

# Loop over each stock in the watchlist

for nifty_FnO_stocks in waitchlist:

# print(nifty_FnO_stocks)

# Fetch intraday data for each stock condition for 10min

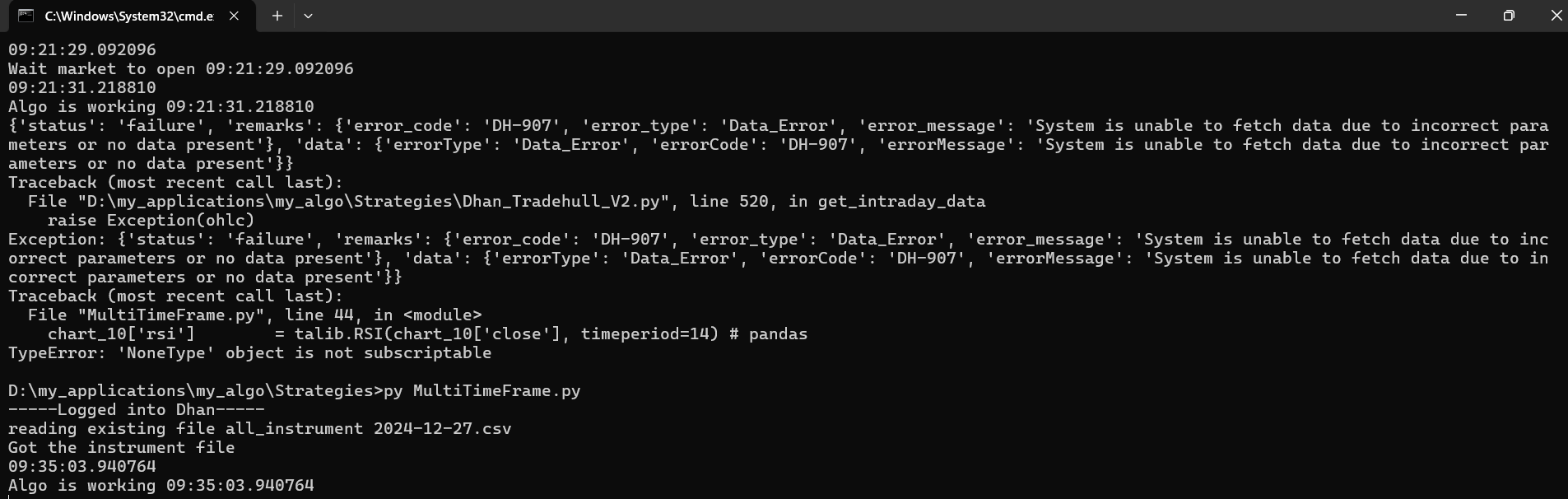

chart_10 = tsl.get_intraday_data(nifty_FnO_stocks, 'NSE', 10) # Intraday data for 10min

# Calculate the RSI indicator (Relative Strength Index) using talib

chart_10['rsi'] = talib.RSI(chart_10['close'], timeperiod=14) # pandas

# Extract relevant candles for breakout analysis

cc_10 = chart_10.iloc[-1] # Breakout candle (most recent)

# Conditions for uptrend and downtrend based on RSI

uptrend = cc_10['rsi'] > 60

downtrend = cc_10['rsi'] < 40

# Fetch intraday data for each stock condition for 15min

chart_15 = tsl.get_intraday_data(nifty_FnO_stocks, 'NSE', 15) # Intraday data for 10min

# Calculate the BB indicator (BB band) using talib

# chart_15['rsi'] = talib.RSI(chart_15['close'], timeperiod=14) # pandas

chart_15['upperband'], chart_15['middleband'], chart_15['lowerband'] = talib.BBANDS(chart_15['close'], timeperiod=15, nbdevup=2, nbdevdn=2, matype=0)

# Extract relevant candles for breakout analysis

cc_15 = chart_15.iloc[-1] # Breakout candle (most recent)

ub_breakout = cc_15['close'] > cc_15['upperband']

# Prevent repeating orders

no_repeat_order = nifty_FnO_stocks not in traded_watchlist

# Ensure maximum order limit is respected

max_order_limit = len(traded_watchlist) <= max_trades

# Order Execution Section---------------------------------------------

# Condition to place a buy order

if uptrend and ub_breakout and no_repeat_order and max_order_limit:

print(f"{nifty_FnO_stocks} upper bb breakout, Buy the Stock")

sl_price = round((cc_10['close']*0.30),1)

qty = int(per_trade_margin / cc_10['close']) # Calculate quantity based on margin and price

buy_entry_orderid = tsl.order_placement(

nifty_FnO_stocks, 'NSE', 1, 0, 0, 'MARKET', 'BUY', 'MIS'

)

sl_orderid = tsl.order_placement(nifty_FnO_stocks, 'NSE',1,0,sl_price,'STOPMARKET', 'SELL', 'MIS')

traded_watchlist.append(nifty_FnO_stocks) # Add to traded list

# # Condition to place a sell order

# if downtrend and inside_candle_formed and down_side_breakout and no_repeat_order and max_order_limit:

# print(f"{nifty_FnO_stocks} is in downtrend, Sell the Stock")

# qty = int(per_trade_margin / bc['close']) # Calculate quantity based on margin and price

# sell_entry_orderid = tsl.order_placement(

# nifty_FnO_stocks, 'NSE', 1, 0, 0, 'MARKET', 'SELL', 'MIS'

# )

# traded_watchlist.append(nifty_FnO_stocks) # Add to traded list

# Sleep for a few seconds before fetching the next data point (to avoid API throttling)

time.sleep(5) # Check every 5 second (adjust as needed)

Please find the above code, I’m running it in live market