Hi @Tradehull_Imran sir need your help

The algo is working fine, but whenever a position exits, the algo is buying the same position again if the conditions are met. I want it to only buy the position the second time if it is 50+ on the CE/PE side. Can you please help me with the code?

could you please provide me code if possible .

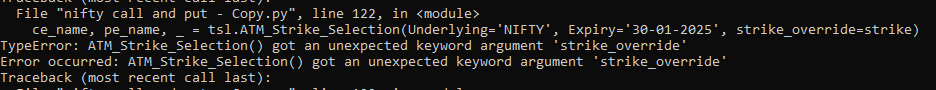

this is the error what i am getting it.

traded = “no”

trade_info = {“options_name”: None, “qty”: None, “sl”: None, “CE_PE”: None, “entry_price”: None}

used_strikes = set() # Set to track used strikes for CE and PE

Flag to track if algo has been logged in for the day

algo_logged_in_today = False

Define a cache for LTP and a timestamp to store the last time it was updated

ltp_cache = {}

ltp_timestamp = {}

def fetch_ltp_with_rate_limit(symbol):

global ltp_cache, ltp_timestamp

current_time = time.time()

# Check if LTP is already cached and if it's recent (cache for 30 seconds)

if symbol in ltp_cache and (current_time - ltp_timestamp[symbol]) < 30:

return ltp_cache[symbol]

try:

# Fetch LTP from the API

ltp_data = tsl.get_ltp_data(names=[symbol])

if ltp_data and symbol in ltp_data:

ltp_value = ltp_data[symbol]

# Cache the LTP and timestamp it

ltp_cache[symbol] = ltp_value

ltp_timestamp[symbol] = current_time

return ltp_value

else:

print("Failed to fetch LTP for symbol:", symbol)

return None

except Exception as e:

print(f"Error fetching LTP for {symbol}: {e}")

return None

while True:

time.sleep(2)

try:

current_time = datetime.datetime.now()

current_time_str = current_time.strftime(“%H:%M”)

# Check if the algorithm is logged in before 9:15 AM

if current_time_str < "09:15" and not algo_logged_in_today:

print("Algo logged in before 9:15 AM. It will automatically activate at 9:15 AM.")

continue

# Market opening condition at 9:15 AM

if current_time_str == "09:15" and not algo_logged_in_today:

print("Algo is now active. Starting trading at 9:15 AM.")

algo_logged_in_today = True

# Stop trading at 3:20 PM and exit the algorithm at 3:30 PM

if current_time_str == "15:20":

print("Market closing. Selling all positions...")

if traded == "yes":

tsl.order_placement(

trade_info['options_name'], 'NFO', trade_info['qty'], 0, 0, 'MARKET', 'SELL', 'MIS'

)

traded = "no"

continue

elif current_time_str == "15:30":

print("Market is closed. Algorithm stopping.")

break

# Fetch index chart data

index_chart = tsl.get_historical_data(tradingsymbol="NIFTY JAN FUT", exchange="NFO", timeframe="5")

if index_chart.empty:

print("No data retrieved from API. Retrying...")

continue

# Apply indicators

index_chart['SMA'] = talib.SMA(index_chart['close'], timeperiod=5)

index_chart['RSI'] = talib.RSI(index_chart['close'], timeperiod=14)

supertrend = ta.supertrend(index_chart['high'], index_chart['low'], index_chart['close'], length=10, multiplier=2)

index_chart = pd.concat([index_chart, supertrend], axis=1, join="inner")

# Extract candles

first_candle = index_chart.iloc[-3]

second_candle = index_chart.iloc[-2]

running_candle = index_chart.iloc[-1]

# Define conditions for PE buying

pe_conditions = (

running_candle['RSI'] < 80,

running_candle['close'] < running_candle['SMA'],

running_candle['volume'] > second_candle['volume'],

running_candle['close'] < running_candle['SUPERT_10_2.0'],

running_candle['volume'] > 50000

)

# Define conditions for CE buying

ce_conditions = (

running_candle['RSI'] > 20,

running_candle['close'] > running_candle['SMA'],

running_candle['volume'] > second_candle['volume'],

running_candle['close'] > running_candle['SUPERT_10_2.0'],

running_candle['volume'] > 50000

)

# Place PE order

if all(pe_conditions) and traded == "no":

ce_name, pe_name, strike = tsl.ATM_Strike_Selection(Underlying='NIFTY', Expiry='30-01-2025')

while pe_name in used_strikes:

strike -= 50

ce_name, pe_name, _ = tsl.ATM_Strike_Selection(Underlying='NIFTY', Expiry='30-01-2025', strike_override=strike)

print(f"Placing PE order for {pe_name}.")

# Order placement logic here

used_strikes.add(pe_name)

# Place CE order

if all(ce_conditions) and traded == "no":

ce_name, pe_name, strike = tsl.ATM_Strike_Selection(Underlying='NIFTY', Expiry='30-01-2025')

while ce_name in used_strikes:

strike += 50

ce_name, pe_name, _ = tsl.ATM_Strike_Selection(Underlying='NIFTY', Expiry='30-01-2025', strike_override=strike)

print(f"Placing CE order for {ce_name}.")

# Order placement logic here

used_strikes.add(ce_name)

except Exception as e:

print(f"Error occurred: {e}")

traceback.print_exc()