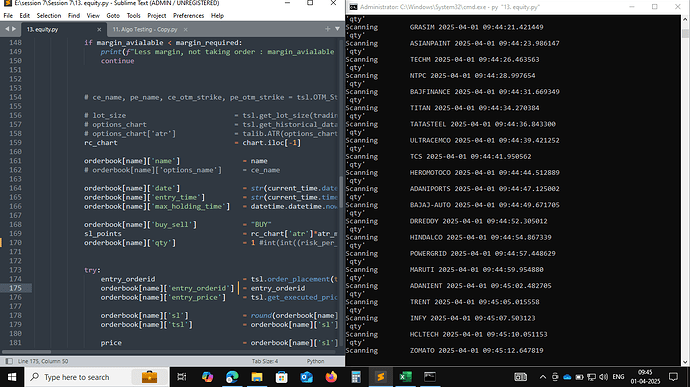

i was changed code for equity buying kindly check for me once correct or not please

import pdb

import time

import datetime

import traceback

from Dhan_Tradehull import Tradehull

import pandas as pd

from pprint import pprint

import talib

import pandas_ta as ta

import xlwings as xw

import winsound

import sqn_lib

client_code = “1000728206”

token_id = “eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzUxMiJ9.eyJpc3MiOiJkaGFuIiwicGFydG5lcklkIjoiIiwiZXhwIjoxNzQ1Mzg1MjQyLCJ0b2tlbkNvbnN1bWVyVHlwZSI6IlNFTEYiLCJ3ZWJob29rVXJsIjoiIiwiZGhhbkNsaWVudElkIjoiMTAwMDcyODIwNiJ9.e10wS0hlk9DwEFw-MHH_FxFhmO_I7C05RDxhXgGcEpN2a8OpwyUGWcSZxmi3Q-CxTUOscaBTaPkQNfxzlxtwEA”

tsl = Tradehull(client_code,token_id)

opening_balance = tsl.get_balance()

base_capital = 1579.74

market_money = opening_balance - base_capital

beacuse I am loosing money, so I have 0 market money, and I can take risk on the current opening balance and not on the base capital

if (market_money < 0):

market_money = 0

base_capital = opening_balance

market_money_risk = (market_money1)/100

base_capital_risk = (base_capital0.5)/100

max_risk_for_today = base_capital_risk + market_money_risk

max_order_for_today = 2

risk_per_trade = (max_risk_for_today/max_order_for_today)

atr_multipler = 3

risk_reward = 3

watchlist = [‘TATACONSUM’,‘KOTAKBANK’,‘APOLLOHOSP’,‘ONGC’,‘ICICIBANK’,‘TATAMOTORS’,‘HINDUNILVR’,‘JIOFIN’,‘SBILIFE’,‘HDFCLIFE’,‘AXISBANK’,‘BEL’,‘NESTLEIND’,‘ITC’,‘BHARTIARTL’,‘SUNPHARMA’,‘COALINDIA’,‘JSWSTEEL’,‘HDFCBANK’,‘EICHERMOT’,‘SBIN’,‘BAJAJFINSV’,‘RELIANCE’,‘LT’,‘GRASIM’,‘ASIANPAINT’,‘TECHM’,‘NTPC’,‘BAJFINANCE’,‘TITAN’,‘TATASTEEL’,‘ULTRACEMCO’,‘TCS’,‘HEROMOTOCO’,‘ADANIPORTS’,‘BAJAJ-AUTO’,‘DRREDDY’,‘HINDALCO’,‘POWERGRID’,‘MARUTI’,‘ADANIENT’,‘TRENT’,‘INFY’,‘HCLTECH’,‘ZOMATO’,‘M&M’,‘CIPLA’,‘SHRIRAMFIN’,‘WIPRO’,‘INDUSINDBK’]

single_order = {‘name’:None, ‘date’:None , ‘entry_time’: None, ‘entry_price’: None, ‘buy_sell’: None, ‘qty’: None, ‘sl’: None, ‘exit_time’: None, ‘exit_price’: None, ‘pnl’: None, ‘remark’: None, ‘traded’:None}

orderbook = {}

wb = xw.Book(‘Live Trade Data.xlsx’)

live_Trading = wb.sheets[‘Live_Trading’]

completed_orders_sheet = wb.sheets[‘completed_orders’]

reentry = “yes” #“yes/no”

completed_orders =

bot_token = “7746461948:AAHR7MQSe40UA9jMZuw7-u2XhvBpwwR1ozQ”

receiver_chat_id = “1570007384”

live_Trading.range(“A2:Z100”).value = None

completed_orders_sheet.range(“A2:Z100”).value = None

for name in watchlist:

orderbook[name] = single_order.copy()

while True:

print("starting while Loop \n\n")

current_time = datetime.datetime.now().time()

if current_time < datetime.time(9, 15):

print(f"Wait for market to start", current_time)

time.sleep(1)

continue

live_pnl = tsl.get_live_pnl()

max_loss_hit = live_pnl < (max_risk_for_today*-1)

market_over = current_time > datetime.time(15, 15)

if max_loss_hit or market_over:

order_details = tsl.cancel_all_orders()

print(f"Market over Closing all trades !! Bye Bye See you Tomorrow", current_time)

pdb.set_trace()

break

all_ltp = tsl.get_ltp_data(names = watchlist)

for name in watchlist:

orderbook_df = pd.DataFrame(orderbook).T

live_Trading.range('A1').value = orderbook_df

completed_orders_df = pd.DataFrame(completed_orders)

completed_orders_sheet.range('A1').value = completed_orders_df

current_time = datetime.datetime.now()

print(f"Scanning {name} {current_time}")

try:

chart = tsl.get_historical_data(tradingsymbol = name,exchange = 'NSE',timeframe="5")

chart['rsi'] = talib.RSI(chart['close'], timeperiod=14)

indi = ta.supertrend(chart['high'], chart['low'], chart['close'], 7, 3)

chart = pd.concat([chart, indi], axis=1, join='inner')

sqn_lib.sqn(df=chart, period=21)

chart['market_type'] = chart['sqn'].apply(sqn_lib.market_type)

chart['atr'] = talib.ATR(chart['high'], chart['low'], chart['close'], timeperiod=14)

cc = chart.iloc[-2]

no_of_orders_placed = orderbook_df[orderbook_df['qty'] > 0].shape[0] + completed_orders_df[completed_orders_df['qty'] > 0].shape[0]

# buy entry conditions

bc1 = cc['rsi'] > 60

bc2 = cc['SUPERTd_7_3.0'] == 1

bc3 = cc['market_type'] != "neutral"

bc4 = no_of_orders_placed < 5

bc5 = orderbook[name]['traded'] is None

except Exception as e:

print(e)

continue

if bc1 and bc2 and bc3 and bc4 and bc5:

print("buy ", name, "\t")

margin_avialable = tsl.get_balance()

margin_required = cc['close']/4.5

if margin_avialable < margin_required:

print(f"Less margin, not taking order : margin_avialable is {margin_avialable} and margin_required is {margin_required} for {name}")

continue

# ce_name, pe_name, ce_otm_strike, pe_otm_strike = tsl.OTM_Strike_Selection(Underlying='NIFTY', Expiry=0, OTM_count=2)

# lot_size = tsl.get_lot_size(tradingsymbol = ce_name)

# options_chart = tsl.get_historical_data(tradingsymbol = ce_name,exchange = 'NFO',timeframe="5")

# options_chart['atr'] = talib.ATR(options_chart['high'], options_chart['low'], options_chart['close'], timeperiod=14)

rc_chart = chart.iloc[-1]

orderbook[name]['name'] = name

# orderbook[name]['options_name'] = ce_name

orderbook[name]['date'] = str(current_time.date())

orderbook[name]['entry_time'] = str(current_time.time())[:8]

orderbook[name]['max_holding_time'] = datetime.datetime.now() + datetime.timedelta(hours=2)

orderbook[name]['buy_sell'] = "BUY"

sl_points = rc_chart['atr']*atr_multipler

orderbook[name]['qty'] = int(int((risk_per_trade*0.7)/sl_points))

try:

entry_orderid = tsl.order_placement(tradingsymbol=name ,exchange='NSE', quantity=orderbook[name]['qty'], price=0, trigger_price=0, order_type='MARKET', transaction_type='BUY', trade_type='MIS')

orderbook[name]['entry_orderid'] = entry_orderid

orderbook[name]['entry_price'] = tsl.get_executed_price(orderid=orderbook[name]['entry_orderid'])

orderbook[name]['sl'] = round(orderbook[name]['entry_price'] - sl_points, 1) # 99

orderbook[name]['tsl'] = orderbook[name]['sl']

price = orderbook[name]['sl'] - 0.05

sl_orderid = tsl.order_placement(tradingsymbol=name ,exchange='NSE', quantity=orderbook[name]['qty'], price=0, trigger_price=orderbook[name]['sl'], order_type='STOPMARKET', transaction_type ='SELL', trade_type='MIS')

orderbook[name]['sl_orderid'] = sl_orderid

orderbook[name]['traded'] = "yes"

message = "\n".join(f"'{key}': {repr(value)}" for key, value in orderbook[name].items())

message = f"Entry_done {name} \n\n {message}"

tsl.send_telegram_alert(message=message,receiver_chat_id=receiver_chat_id,bot_token=bot_token)

except Exception as e:

print(e)

pdb.set_trace(header= "error in entry order")

if orderbook[name]['traded'] == "yes":

bought = orderbook[name]['buy_sell'] == "BUY"

if bought:

try:

ltp = all_ltp[name]

sl_hit = tsl.get_order_status(orderid=orderbook[name]['sl_orderid']) == "TRADED"

holding_time_exceeded = datetime.datetime.now() > orderbook[name]['max_holding_time']

current_pnl = round((ltp - orderbook[name]['entry_price'])*orderbook[name]['qty'],1)

except Exception as e:

print(e)

pdb.set_trace(header = "error in sl order cheking")

if sl_hit:

try:

orderbook[name]['exit_time'] = str(current_time.time())[:8]

orderbook[name]['exit_price'] = tsl.get_executed_price(orderid=orderbook[name]['sl_orderid'])

orderbook[name]['pnl'] = round((orderbook[name]['exit_price'] - orderbook[name]['entry_price'])*orderbook[name]['qty'],1)

orderbook[name]['remark'] = "Bought_SL_hit"

message = "\n".join(f"'{key}': {repr(value)}" for key, value in orderbook[name].items())

message = f"SL_HIT {name} \n\n {message}"

tsl.send_telegram_alert(message=message,receiver_chat_id=receiver_chat_id,bot_token=bot_token)

if reentry == "yes":

completed_orders.append(orderbook[name])

orderbook[name] = None

except Exception as e:

print(e)

pdb.set_trace(header = "error in sl_hit")

if holding_time_exceeded and (current_pnl < 0):

try:

tsl.cancel_order(OrderID=orderbook[name]['sl_orderid'])

time.sleep(2)

square_off_buy_order = tsl.order_placement(tradingsymbol=orderbook[name]['name'] ,exchange='NSE', quantity=orderbook[name]['qty'], price=0, trigger_price=0, order_type='MARKET', transaction_type='SELL', trade_type='MIS')

orderbook[name]['exit_time'] = str(current_time.time())[:8]

orderbook[name]['exit_price'] = tsl.get_executed_price(orderid=square_off_buy_order)

orderbook[name]['pnl'] = (orderbook[name]['exit_price'] - orderbook[name]['entry_price'])*orderbook[name]['qty']

orderbook[name]['remark'] = "holding_time_exceeded_and_I_am_still_facing_loss"

message = "\n".join(f"'{key}': {repr(value)}" for key, value in orderbook[name].items())

message = f"holding_time_exceeded_and_I_am_still_facing_loss {name} \n\n {message}"

tsl.send_telegram_alert(message=message,receiver_chat_id=receiver_chat_id,bot_token=bot_token)

if reentry == "yes":

completed_orders.append(orderbook[name])

orderbook[name] = None

winsound.Beep(1500, 10000)

except Exception as e:

print(e)

pdb.set_trace(header = "error in tg_hit") # Testing changes. sadhasd ajsdas dbna sdb abs da sd asd abs d asd

chart_name = orderbook[name]['name']

chart = tsl.get_historical_data(tradingsymbol = chart_name,exchange = 'NSE',timeframe="5")

chart['atr'] = talib.ATR(chart_name['high'], chart_name['low'], chart_name['close'], timeperiod=14)

rc_chart = chart.iloc[-1]

sl_points = rc_chart['atr']*atr_multipler

chart_ltp = tsl.get_ltp_data(names = chart_name)[chart_name]

tsl_level = chart_ltp - sl_points

if tsl_level > orderbook[name]['tsl']:

trigger_price = round(tsl_level, 1)

price = trigger_price - 0.05

tsl.modify_order(order_id=orderbook[name]['sl_orderid'],order_type="STOPLIMIT",quantity=25,price=price,trigger_price=trigger_price)

orderbook[name]['tsl'] = tsl_level