Ambuja Cements reported a net profit of ₹2,302 crore.

But here’s the twist —

only ~30% of that profit came from selling cement.

Recently, Ambuja Cements announced their quarterly results, and the headline was everywhere:

“Profit Surges 364% to ₹2,302 Crore!”

A number so big your uncle probably called asking if he should buy the stock.

But when you dig deeper, something interesting shows up.

What actually happened?

What actually happened?

-

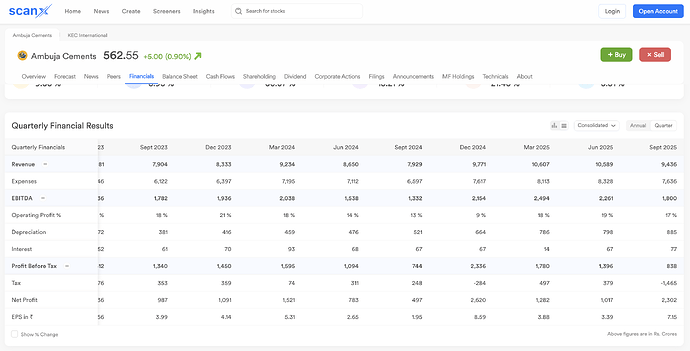

Ambuja’s profit before tax (PBT) was only ₹838 crore.

-

With a normal 20–25% tax rate, the PAT should have been roughly ₹600–650 crore.

-

Instead, they reported ₹2,302 crore PAT.

Why?

Because they added a one-time gain of ₹1,697 crore due to an Income Tax Reversal — basically, old tax disputes being settled in Ambuja’s favor.

Think of it like this:

If you once paid ₹100 as tax assuming you owed it, but after years of dispute the department returns it — that refund becomes part of your profit for that period.

Ambuja just got that refund.

That’s the extra ₹1,697 crore.

So yes, the headline profit surged,

but 70% of that jump wasn’t from selling cement.

The good news: Ambuja’s business IS improving.

Here are the real operating numbers:

-

Revenue up 25% YoY → ₹9,129 crore

-

EBITDA up 58% YoY → ₹1,761 crore

-

Volumes up 20% → 16.6 MT

The core business is getting stronger —

but that’s not what drove the 364% profit jump.

So when you analyze any company’s results, use this 3-layer approach:

-

Headline Profit (what newspapers highlight)

-

Adjusted Profit (remove one-time gains/losses)

-

Operating Metrics (revenue, volume, margins — real business health)

What are you views on this? Is this sustainable for growth - how do you think about it?