Thank you @Dev

I tried this. but not worked. I think there maybe error at some other place.

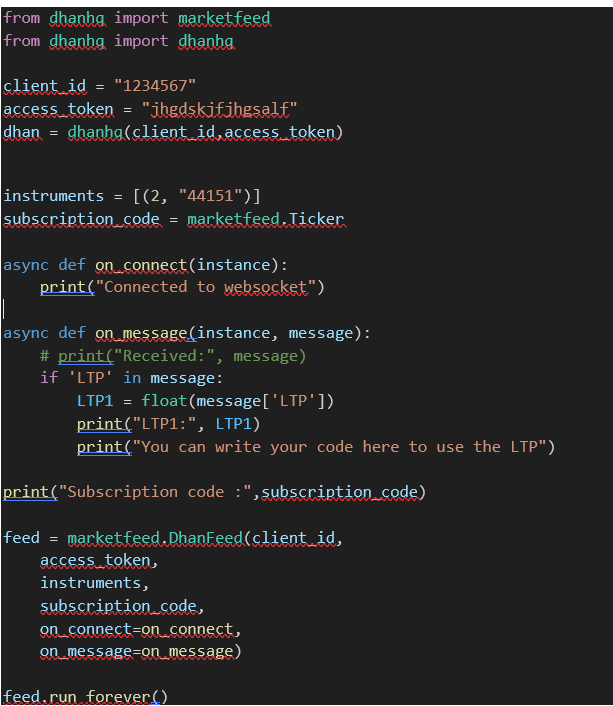

my code are as below:-----

import pandas as pd

import logging

import asyncio

import time

from datetime import datetime, timedelta

from dhanhq import dhanhq, marketfeed

from dhanhq.dhanhq import dhanhq

from dhanhq.marketfeed import DhanFeed

from pathlib import Path

from webbrowser import open as web_open

Constants

client_id = 1208340001-------

access_token = “eyJ0eXAiOiJKV1QiLCJ”

subscription_code = marketfeed.Ticker

HIGH_RANGE = 22040

LOW_RANGE = 22025

PROFIT_BOOKING_THRESHOLD = 100

START_TIME = “09:20:00”

END_TIME = “15:30:00”

Configure logging

logging.basicConfig(level=logging.DEBUG)

Functions

def atm_strike(spot_price):

“”"

Calculate the At-The-Money (ATM) strike price based on the spot price.

Args:

spot_price (float): The current spot price.

Returns:

int: The ATM strike price.

"""

if spot_price % 100 < 25:

return int(spot_price / 100) * 100

elif spot_price % 100 >= 25 or spot_price % 100 < 75:

return int(spot_price / 100) * 100 + 50

else:

return int(spot_price / 100) * 100 + 100

def get_symbol_name(symbol, expiry, strike, strike_type):

“”"

Generate the symbol name for an instrument.

Args:

symbol (str): The symbol name.

expiry (str): The expiry date.

strike (int): The strike price.

strike_type (str): The type of option (CE or PE).

Returns:

str: The generated symbol name.

"""

return f"{symbol}-{expiry}-{strike}-{strike_type}"

def get_instrument_token():

“”"

Retrieve instrument tokens from a CSV file.

Returns:

dict: A dictionary mapping symbols to instrument tokens.

“”"

df = pd.read_csv(‘api-scrip-master.csv’)

token_dict = {}

for _, row in df.iterrows():

trading_symbol = row[‘SEM_TRADING_SYMBOL’]

exm_exch_id = row[‘SEM_EXM_EXCH_ID’]

if trading_symbol not in token_dict:

token_dict[trading_symbol] = {}

token_dict[trading_symbol][exm_exch_id] = row.to_dict()

return token_dict

def main():

# Initialize DhanHQ client

dhan = dhanhq(client_id=client_id, access_token=access_token)

# Get instrument tokens

token_dict = get_instrument_token()

# Define instruments

symbol = 'NIFTY'

expiry = 'May2024'

# Initialize position flags

ce_position = False

pe_position = False

# Initialize profit booking variables

last_ce_ltp = None

last_pe_ltp = None

ce_profit_booked = False

pe_profit_booked = False

while True:

# Get current time

current_time = datetime.now().strftime("%H:%M:%S")

# Check if within trading hours

if START_TIME <= current_time <= END_TIME:

# Get Nifty LTP

nifty_ltp = dhan.intraday_minute_data(

security_id=token_dict,

exchange_segment='NSE_FNO',

instrument_type='OPTIDX'

)

logging.info(f"Nifty LTP: {nifty_ltp}")

# Check if profit booking condition is met for CE

if ce_position and last_ce_ltp is not None and nifty_ltp - last_ce_ltp >= PROFIT_BOOKING_THRESHOLD and not ce_profit_booked:

logging.info("Profit booking for CE triggered")

# Perform profit booking logic for CE here

ce_profit_booked = True

# Check if profit booking condition is met for PE

if pe_position and last_pe_ltp is not None and last_pe_ltp - nifty_ltp >= PROFIT_BOOKING_THRESHOLD and not pe_profit_booked:

logging.info("Profit booking for PE triggered")

# Perform profit booking logic for PE here

pe_profit_booked = True

# Update last CE LTP for next iteration

last_ce_ltp = nifty_ltp if ce_position else last_ce_ltp

# Update last PE LTP for next iteration

last_pe_ltp = nifty_ltp if pe_position else last_pe_ltp

# Check if LTP crosses above high range

if nifty_ltp > HIGH_RANGE:

if not ce_position:

# Enter CE

atm_strike_price = atm_strike(nifty_ltp)

ce_id = token_dict[get_symbol_name(symbol, expiry, atm_strike_price, 'CE')]['NSE']['SEM_SMST_SECURITY_ID']

dhan.place_order(security_id=ce_id, exchange_segment=dhan.NSE, transaction_type=dhan.BUY, quantity=50, order_type=dhan.MARKET, product_type=dhan.INTRA, price=0)

ce_position = True

# Exit PE if entered

if pe_position:

pe_id = token_dict[get_symbol_name(symbol, expiry, atm_strike_price, 'PE')]['NSE']['SEM_SMST_SECURITY_ID']

dhan.place_order(security_id=pe_id, exchange_segment=dhan.NSE, transaction_type=dhan.SELL, quantity=50, order_type=dhan.MARKET, product_type=dhan.INTRA, price=0)

pe_position = False

# Check if LTP crosses below low range

elif nifty_ltp < LOW_RANGE:

if not pe_position:

# Enter PE

atm_strike_price = atm_strike(nifty_ltp)

pe_id = token_dict[get_symbol_name(symbol, expiry, atm_strike_price, 'PE')]['NSE']['SEM_SMST_SECURITY_ID']

dhan.place_order(security_id=pe_id, exchange_segment=dhan.NSE, transaction_type=dhan.BUY, quantity=50, order_type=dhan.MARKET, product_type=dhan.INTRA, price=0)

pe_position = True

# Exit CE if entered

if ce_position:

ce_id = token_dict[get_symbol_name(symbol, expiry, atm_strike_price, 'CE')]['NSE']['SEM_SMST_SECURITY_ID']

dhan.place_order(security_id=ce_id, exchange_segment=dhan.NSE, transaction_type=dhan.SELL, quantity=50, order_type=dhan.MARKET, product_type=dhan.INTRA, price=0)

ce_position = False

# Sleep for a while before checking again

time.sleep(1)

if name == “main”:

main()