Hello market enthusiasts,

Government bonds are secure investment tools with a sovereign guarantee, making them nearly risk-free, generating more returns than FDs. In USA, bond market is bigger than the stock market.

We are now seeing a lot of traction for G-secs and T-bills given that it is accessible easily through various platforms. A lot of veteran stock market investors in India have also started parking their profits in G-secs and Corporate bonds to balance the risk.

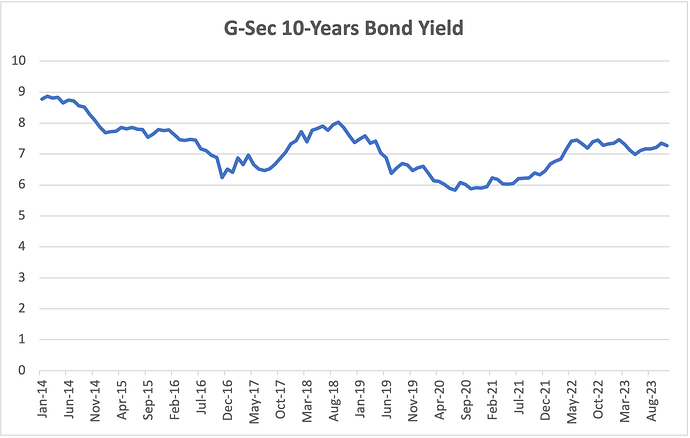

One interesting thing about the Indian markets is the drop rate in g-sec is not that high as shown in the graph below.

India 10 year bond yield historical data:

Post your questions about G-secs and Corporate bonds below and @iamshrimohan will answer it!

@trust_level_0

2 Likes

hello

Recently i started reading about fixed income securities, and the investment instruments which i got are the G-sec and SBGs which are best among the others to get the cash margin benefit for options trading.

as of now i have seen the bonds which are listed on Exchange, most of them gives out an average yield of 7.35%.

since i have no knowledge of prior data about G-sec, Can you explain the terms associated with a bond and how to compare and choose best among all available in the market?

this question is only associated with bonds, as T-bills are not pledgeable as they are of short-term in nature, though they can give better returns.

apart from this How SBGs perform against GOI Loans during long period?

at last Are there any other investment instruments which can be pledged(cash margin) and can give better returns than GOI Loans?

Investing in fixed income securities is done to ensure that you get a steady cashflow. Let us say, you invest in a G-Sec / Bond which is giving you a yield of 7.35% and maturing at 2050. This will ensure that you get an interest rate of 7.35% in the investment till 2050. So now whatsoever be the interest rate in the market, you have fixed or locked your investment at a yield of 7.35% until 2050. So how you select a bond is completely dependent on your horizon and investment goals. You can spread your investments across different maturity dates.

SGB is one of the best investment product so far due to the fact that the proceeds are tax-free. Historically gold has always shown an upward trajectory. Let us say you buy a SGB for Rs. 6,000 and after 8 years the maturity is at Rs. 10,000. The profit of Rs. 4,000 is completely tax-free. Also you get 2.5% interest on the face value. Which translates 20% discount in the gold price over the period of 8 years.

I personally feel SGBs are best instrument for traders to buy and pledge and get the margin benefit. Both G-Sec and SGBs enjoy a margin benefit of 90%. Find the below generic compassion between G-Sec, SGBs, and Liquid ETFs

| Instrument |

G-Sec |

SGB |

Liquid ETF |

| Tentative Return |

7.35% |

2.50% |

5.50% |

| Capital Invested |

1,00,000.00 |

1,00,000.00 |

1,00,000.00 |

| Duration (in Years) |

8.00 |

8.00 |

8.00 |

| Total Interest (Entire Duration) |

58,800.00 |

20,000.00 |

44,000.00 |

| CAGR of Instrument |

- |

10.00 |

- |

| Value of Capital Invested |

1,00,000.00 |

2,14,358.88 |

1,00,000.00 |

| Capital Growth |

- |

1,14,358.88 |

- |

| Tax on Interest (@30%) |

17,640.00 |

6,000.00 |

13,200.00 |

| Tax on Capital Growth |

- |

- |

- |

| Net Gain |

1,41,160.00 |

2,28,358.88 |

1,30,800.00 |

| Net CAGR |

4.40% |

10.87% |

3.41% |

Now you can add your option strategy ROI on the above CAGR to get total ROI earned.

Note that we have reasonably assumed the gold appreciation rate of 10% (4%-5% actual + dollarization).

Disclaimer: Trading and investing in the securities market carries risk. The Content is for entertainment and informational purposes only and you should not construe any such information as investment, financial, or other advice. Data and information is from publicly available sources. Please do your own due diligence or consult a trained financial professional before investing or trading. Don’t take this post as investment advice, it’s purely meant for educational and entertaining purposes only.

3 Likes

thanks for the info as i was not aware about the performance of gold bonds with the benefit of price benefit of gold.

Can you explain bit more about bond when they are bought from secondary market, how to calculate the yield of bond when they are taken from market? for example recently i bought a bond 92GS2030 at a price of INR 115, and one 754GS2036 at a price of INR 101.7.

how to compare them, what are the points which are to be kept in mind?

so that i can make my investments judiciously in future.

1 Like

@ankitch29 The 92GS2030 will pay you a yield of 9.2%. So for every Rs. 100, you will get Rs. 9.2. Now you purchase this bond at Rs. 115. So your actual yield will be 9.2/115 = 8.00%. Similarly you can try for the other bond too.

1 Like

![]()