Are you confused about which sector is performing well in the current economic regime? Do you wonder what works in the markets – whether to focus on news, studying annual reports or following technical indicators? You need not worry anymore, as we have got you covered!

Greetings everyone! We are thrilled to announce the partnership between Dhan and Estee Advisors to enable the entire Dhan community to buy our algo-based Gulaq Portfolios!

Who we are:

Estee Advisors is an algorithmic investment management firm with offices in India & USA, which I started in 2008. Proud to say that we currently employ 125+ quant/technology professionals and manage 500+ crores AUM. Estee is also a SEBI Registered Investment Advisor.

Gulaq is the retail investment advisory brand of Estee Advisors, focused on creating model portfolios using quant-driven strategies to give investors the best risk-adjusted returns.

I personally have 30+ years of work experience in portfolio management, analytics and consulting. I had pursued my B.Tech from IIT Delhi, MBA from Columbia Business School, and CQF from London. I am the recipient of New Jersey’s top 40 under 40, and the Distinguished Alumni Service Award from IIT Delhi. I oversee the Research Team at Estee, and we continually strive to develop profitable investment strategies for our clients.

Our Investment Philosophy:

→ We study 130+ factors algorithmically, and identify the best factors in each market condition, ultimately curating Gulaq portfolios. These factors range from:

- Fundamental factors such as profitability, liquidity, cash flows, ratios, promoter holdings

- Technical factors such as price action, MACD, RSI, SMA, EMA, Momentum indicators

- Macro-economic factors such as Interest rates, GDP growth, inflation, oil prices

→ In other words, we have created a systematic rule-based investment logic based on all above factors. Our multi-factor directional strategy identifies the most promising stocks from a universe of BSE 500 stocks.

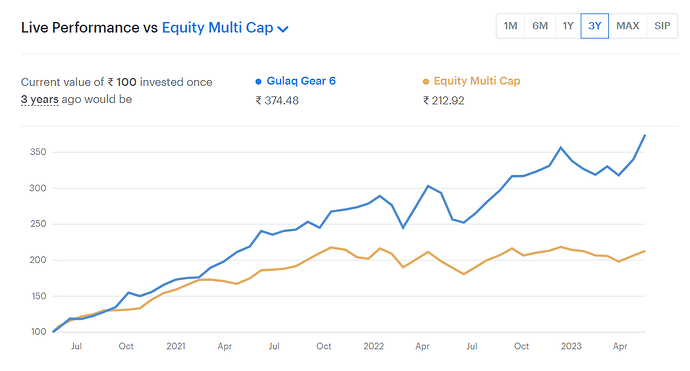

Proof lies in the pudding – and our returns speak for themselves!

Our Flagship portfolio - Gulaq Gear 6 - has recently completed 3 years live track record, and consistently beaten markets by huge margin. The portfolio follows multi-factor investing approach and has 100% equity allocation.

Explore Gulaq Gear 6 smallcase

Past performance doesn’t guarantee future returns

Why Gulaq portfolios:

- Multi-factor investing strategy

- Consistently beating benchmark

- Managing INR 500+ crores AUM currently

- Monthly rebalancing – ensures lower transaction costs & slippage

- Sector Agnostic, i.e., no sector or theme given a preference. Human bias free decision making, based on what our quantitative models tell us.

- Dedicated investor support

We have simple pricing with affordable 3-month and 6-month fixed-fee plans, irrespective of the size of your investment.

We look forward to onboarding you and making a meaningful contribution to your investment decisions! Happy to connect with you all!

Best regards,

Founder & CEO, Estee Advisors