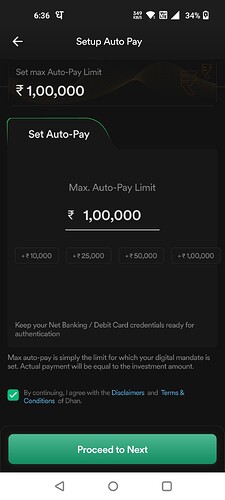

In Mutual Fund when I try to set up auto payment it is asking to set limit more than a lakhs, but my SIP is 5000 thousand. Just want to understand how this set limit option work and is that going to debit the amount which is set on Limit.?

Hi @sudindrak Welcome to the MadeForTrade community.

Note that when you send a Auto-Pay or mandate instruction, you simply are stating that the max debit limit to your account is INR 1 Lac. They actual debit amount will be as per your SIP, which is INR 5000. Hope this clarifies.

If you, say do multiple SIPs and the cumulative payment of these on SIP day is increased to INR 90,000, this same mandate will continue to work without any changes. In case if you end of having 12 SIPs of INR 1,20,000, then on SIP day - your SIPs up to INR 100,000 wil be successfully paid and rest will get rejected.

Thank you for the clarification, In future if i add multiple SIP’s my deduction will get increase it is possible to modify my Auto pay?

@sudindrak After your bank approves the Auto-pay or Mandate, the mandate limit becomes fixed and cannot be altered. Please note, its a per-day limit. If you plan to set up SIPs exceeding 1 lakh (mandate limit), it is advisable to schedule them on different dates

mandate debit frequency is per day. so if the total amount of your sip crosses 1 lac on any particular day you have selected, then you can create a new mandate of a higher amount & cancel the previous mandate.

In zerodha you can have multiple mandates. so for any additional amount to be debited over and above the existing mandate in one single day then you can create a new mandate for the additional amount without modifying the existing mandate.

also at zerodha & indmoney, you can start sip deduction from the date selected. but in dhan & groww, you have to make an immediate payment of the same sip amount to start the sip. after this payment, your sip starts getting deducted as per the date & frequency feeded.