About Bajaj Housing Finance:

They are a non-deposit taking Housing Finance Company, registered with the National Housing Bank since September 24, 2015. They provide tailored financial solutions for purchasing and renovating residential and commercial properties. Recognized as an “Upper Layer” NBFC by the RBI, their products include home loans, loans against property, lease rental discounting, and developer financing. Their primary focus is on individual retail housing loans, with additional offerings for commercial and developer loans, serving both homebuyers and large developers.

About the Industry in which Bajaj Housing Finance operates:

According to the CRISIL MI&A Report (pages 117 and 185 of this Red Herring Prospectus), India’s housing finance sector has low penetration compared to other economies, indicating significant growth potential. The Indian housing finance market experienced a robust CAGR of approximately 13.1% from Fiscal 2019 to 2023, driven by increased disposable incomes, strong demand, and more market entrants. CRISIL MI&A forecasts the housing segment to grow at a CAGR of 13-15% from Fiscal

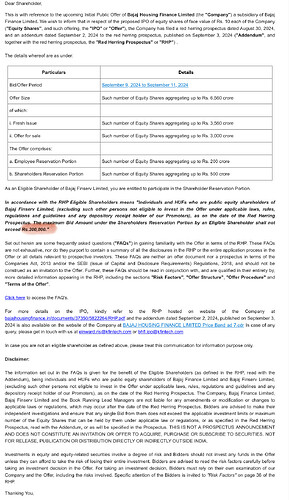

| Important Information and Timelines of the IPO of Bajaj Housing Finance: | |

|---|---|

| Open Date | 9 September 2024 |

| Close Date | 11 September 2024 |

| Total Issue Size – Number of Shares | 937142858 |

| Minimum Bid Price | 66 |

| Maximum Bid Price | 70 |

| Lot Size | 214 |

| Basis of Allotment | 12 September 2024 |

| Initiation of Refunds and Credit of Shares to Demat | 13 September 2024 |

| Listing Date | 16 September 2024 |

| Listing Exchange(s) | NSE and BSE |

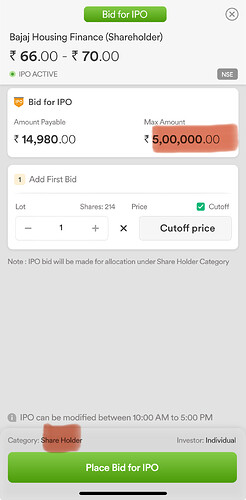

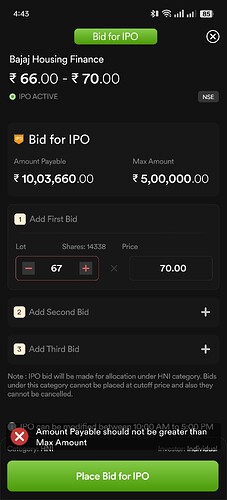

Minimum and Maximum Lot Sizes for the IPO of Bajaj Housing Finance:

| Category | Lots | Shares | Amount (in ₹) |

|---|---|---|---|

| Retail – Minimum | 1 | 214 | 14980 |

| Retail – Maximum | 13 | 2782 | 194740 |

| sHNI – Minimum | 14 | 2996 | 209720 |

| sHNI – Maximum | 66 | 14124 | 988680 |

| bHNI – Minimum | 67 | 14338 | 1003660 |

Objective of the IPO of Bajaj Housing Finance:

Augmenting our capital base to meet future business requirements of our Company towards onward lending

Financials of Bajaj Housing Finance:

| Particulars | As at and for the three months ending June 30, 2024 | As at and for the three months ending June 30, 2023 | As at and for the year ended March 31, 2024 | As at and for the year ended March 31, 2023 | As at and for the year ended March 31, 2022 |

|---|---|---|---|---|---|

| Equity Share Capital | 78,195.86 | 7,121.66 | 7,121.66 | 7,121.64 | 8,833.3 |

| Other Equity | 69,003.34 | 42,528.35 | 55,213.43 | 37,910.31 | 18,580.3 |

| Net Worth | 147,199.10 | 109,649.91 | 122,335.00 | 105,031.96 | 67,413.6 |

| Total Income | 22,087.31 | 17,633.87 | 76,177.15 | 56,654.43 | 37,671.3 |

| Profit for the Year | 4,826.1 | 4,618.0 | 17,312.21 | 12,578.0 | 7,096.2 |

| Earnings per Share (Basic) | 0.6 | 0.7 | 2.6 | 1.9 | 1.5 |

| Earnings per Share (Diluted) | 0.6 | 0.7 | 2.6 | 1.9 | 1.5 |

| Net Asset Value per Equity Share | 18.8 | 16.3 | 18.2 | 15.6 | 13.8 |

| Total Borrowings | 733,470.65 | 585,601.56 | 691,293.25 | 537,453.94 | 414,923.2 |

For more details on the IPO, refer to the DRHP here.

Did you know that you can now Pre-Apply for an IPO on Dhan? You can place your IPO Bid on Dhan and the order will be pushed to the Exchange as soon as the Bidding starts for Bajaj Housing Finance. You will receive a UPI mandate after 10:00 AM on 9 September 2024.

###1. How to apply for the IPO of Bajaj Housing Finance on Dhan?

You can apply for the IPO of Bajaj Housing Finance from either Dhan Mobile App or Web

On Dhan Mobile App you can find the IPO under the Money Section > IPO Tab

On Dhan Web you can find the IPO under Markets Tab > IPOs

###2. In case of successful allotment, when the IPO shares of Bajaj Housing Finance be visible on Dhan?

The CDSL will intimate you regarding the credit of shares into your Demat account by 13 September 2024. However, you will be able to see the shares of Bajaj Housing Finance on Dhan before the market starts on the listing date which is 16 September 2024.