Bank Nifty Crosses 55,000: What’s Fueling the Rally in Banking Stocks?

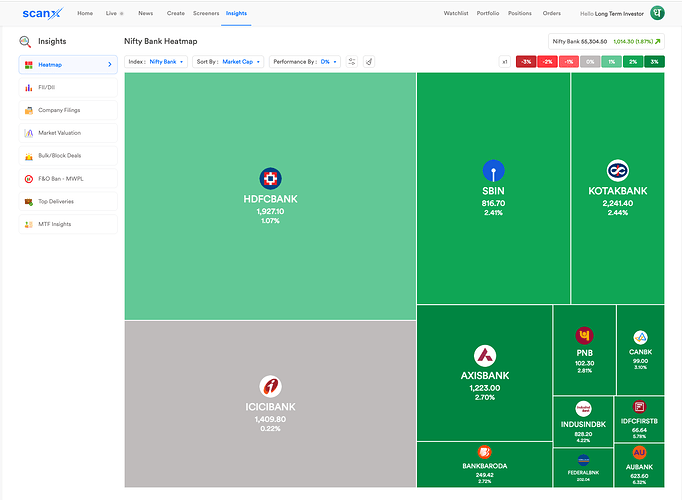

The Bank Nifty has hit a fresh all-time high above the 55,000 mark, rising nearly 8% in just 5 days and 9% over the past month. In 2025 alone, it has delivered an 8% return, and on a 1-year basis, the gains have exceeded 15%.

So, what’s driving this rally?

Strong Q4 Numbers from ICICI & HDFC Bank

Strong Q4 Numbers from ICICI & HDFC Bank

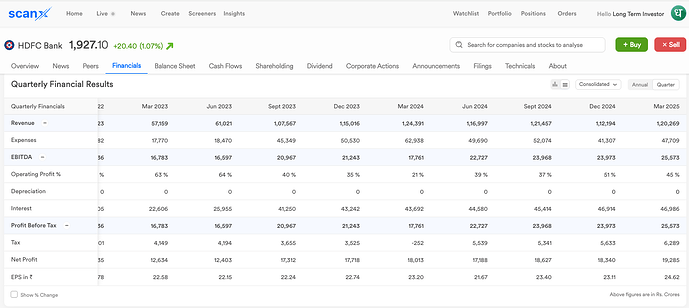

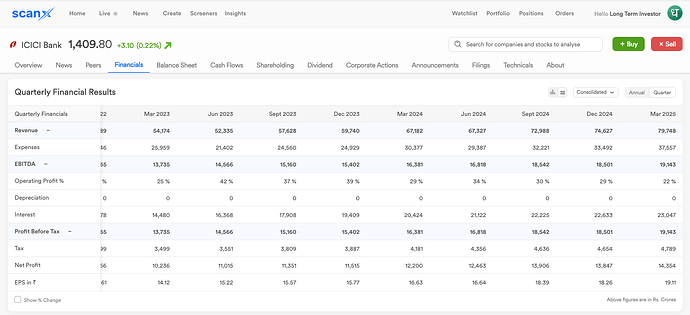

The latest surge is largely powered by better-than-expected Q4 results from HDFC Bank and ICICI Bank.

- Both lenders reported strong profit growth.

- Slippages were lower than expected.

- Deposit and loan growth remained solid.

Here are the key financial results from HDFC & ICICI Bank:

RBI’s Liquidity Boost Helps the Mood

RBI’s Liquidity Boost Helps the Mood

Recent policy measures by the RBI have added more fuel:

- Banking system liquidity is now in surplus.

- Risk weights for MFIs and NBFCs have been reduced.

- Credit growth for FY26 is expected to hit 13%, well above FY25’s 11.5%, as per BNP Paribas.

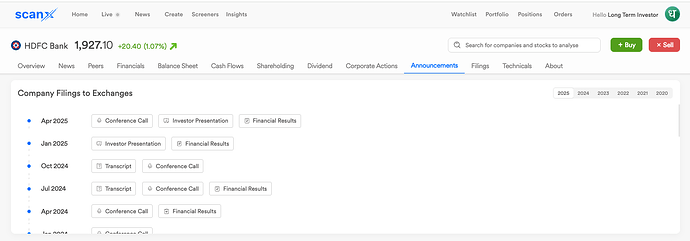

If you’re closely tracking this rally and want to dive deeper, the Q4 earnings reports of ICICI Bank and HDFC Bank are available on ScanX.trade — a quick way to review fundamentals before you trade or invest.

This liquidity wave and cleaner balance sheets give banks the firepower to lend more, especially in retail and SME segments.