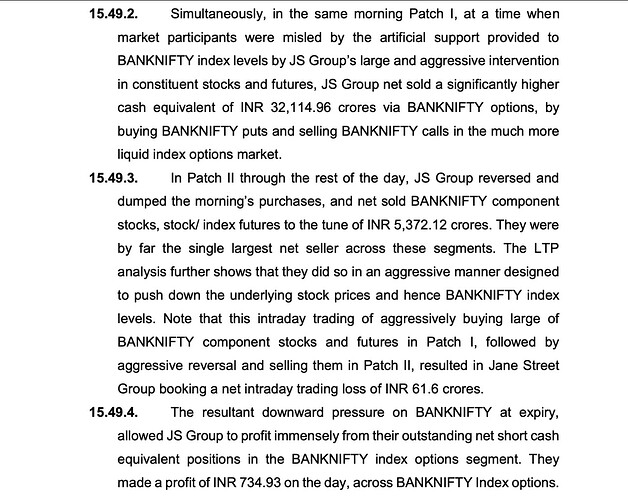

India’s market regulator SEBI has dealt a major blow to US trading firm Jane Street Group, restraining them from accessing Indian securities markets and seizing ₹Rs 4800 Crores in alleged unlawful gains.

Key Details:

- Jane Street generated over $2.3 billion in net revenue from equity derivatives in India last year

- SEBI claims the seized amount represents total unlawful gains made by the fund

- The firm is now prohibited from buying, selling, or dealing in securities directly or indirectly

- Banks have been directed to freeze accounts without SEBI’s permission

Background: SEBI launched this investigation after market participants alleged manipulation by the US firm. This comes as India has become the world’s largest derivatives market by contracts traded, attracting global high-frequency trading firms like Citadel Securities and Optiver.

The retail investor boom has seen options premiums surge 11-fold in the five years to March 2025, making India an attractive market for these international players.

This action raises important questions about market manipulation and regulatory oversight in India’s rapidly growing derivatives market.

Read the full SEBI Interim Order here: SEBI | Interim Order in the matter of Index manipulation by Jane Street Group

Do you think SEBI’s action will impact other international trading firms operating in India?