Pershing Square’s Bill Ackman has upped his game with a revised takeover offer for Howard Hughes Holdings (HHH), signaling his vision to create a “modern-day Berkshire Hathaway.”

Ackman’s latest proposal involves acquiring 10 million newly issued HHH shares at $90 per share, an increase from his previous $85 offer in January. If successful, this would push Pershing Square’s ownership to 48%, cementing his control over the Texas-based real estate giant. Unlike traditional buyouts, this deal won’t require regulatory approvals, a shareholder vote, or financing—meaning it could be completed within weeks.

![]() What’s the Grand Plan?

What’s the Grand Plan?

Ackman envisions Howard Hughes as a diversified holding company, mirroring Warren Buffett’s legendary strategy with Berkshire Hathaway. He aims to leverage Pershing Square’s expertise to acquire controlling stakes in both private and public companies, expanding beyond real estate. HHH will continue to focus on master-planned communities (MPCs), including developments like The Woodlands (Houston) and Summerlin (Las Vegas)—markets Ackman believes will evolve into major urban centers.

![]() Market Reaction & Challenges

Market Reaction & Challenges

Despite the grand vision, HHH stock tumbled 8.9% following the announcement, erasing earlier gains. Some analysts argue the deal doesn’t create significant value for current shareholders, leaving the company publicly traded rather than going private. Ackman’s leadership, however, could bring new opportunities, potentially reshaping HHH’s trajectory.

![]() A Modern-Day Buffett?

A Modern-Day Buffett?

Drawing inspiration from Warren Buffett’s early days, Ackman sees HHH as a powerful long-term asset—except instead of starting with a failing textile mill (like Buffett did with Berkshire), he’s starting with a thriving real estate empire. His move raises a big question: Can Bill Ackman replicate Buffett’s magic and turn Howard Hughes into an investment powerhouse?

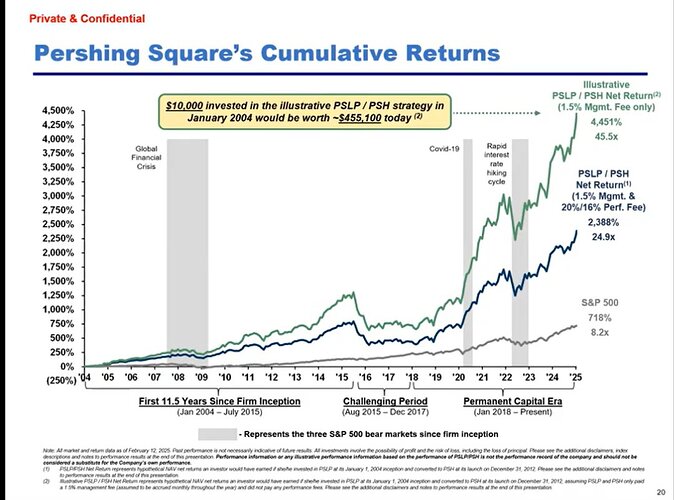

Also here are the returns it has provided over the years:

What do you think— Is this the next Berkshire Hathaway in the making? ![]()

![]()