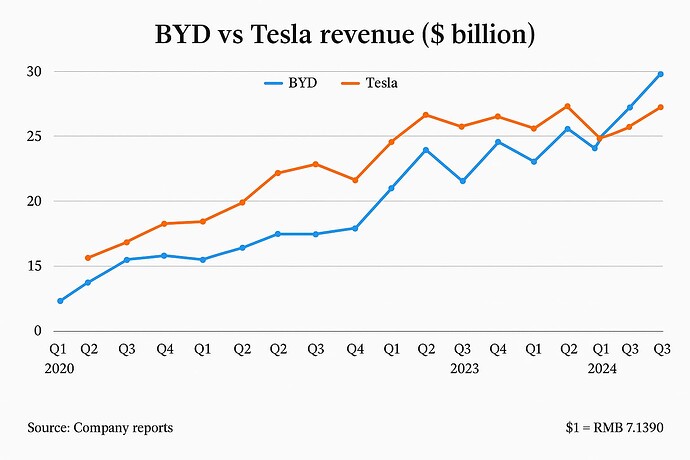

In a significant shift in the electric vehicle (EV) landscape, Chinese automaker BYD reported annual revenues of 777 billion yuan (~INR 8.9 lakh crore / USD 107 billion) for 2024, overtaking Tesla which posted USD 97.7 billion (~INR 8.1 lakh crore). BYD also outpaced Tesla in deliveries, selling 4.27 million vehicles (fully electric + hybrid) compared to Tesla’s 1.79 million battery EVs.

This not only cements BYD’s position as a global leader in clean-energy transportation but signals an ongoing reshaping of the EV industry where innovation, pricing, and scale are critical. The Chinese automaker, buoyed by strong government backing, superior charging tech, and aggressive pricing, has become a formidable force worldwide.

BYD vs Tesla: Technology, Pricing, and Strategy

- Sales & Pricing:

- BYD Qin L (sedan): ~₹1.37L (11,800 yuan) with 545 km range

- Tesla Model 3 (base): ~₹27.3L (235,500 yuan) with 634 km range

- Charging Advantage:

- BYD’s new charging system can deliver 250 miles in 5 minutes

- Tesla Superchargers: 200 miles in 15 minutes

- Autonomous Driving:

- BYD’s “God’s Eye” driver-assistance now free for all new models

- Tesla’s FSD costs $99/month or $8,000 one-time in the US and isn’t yet approved in China

- Global Strategy:

- BYD is making rapid inroads in Southeast Asia, Europe, and Australia

- Tesla is losing share in China and struggling in Europe

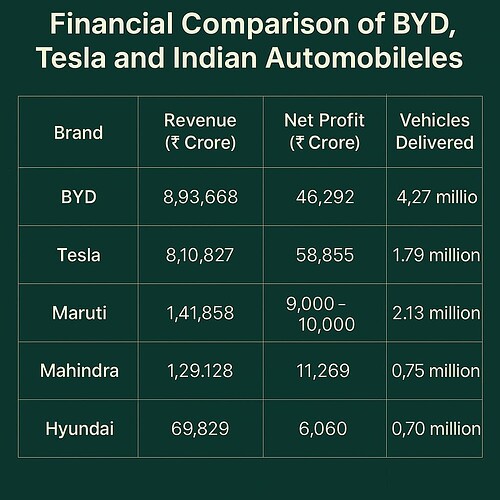

Indian Automobile Giants: Current Snapshot (FY 2023-24)

| Company | Revenue (INR Cr) | Net Profit (INR Cr) | Vehicles Sold | Focus |

|---|---|---|---|---|

| Maruti Suzuki | 1,41,858 | ~9,000 | 2.13 million | Small cars, hybrids, ICE |

| Hyundai India | 6,98,290 | 60,600 | ~700,000 | SUVs, ICE, emerging EVs |

| Tata Motors | 3,49,000 | 2,700+ | ~1.0 million | EVs, SUVs, passenger & fleet EVs |

| Mahindra & Mahindra | 1,01,219 | 10,718 | 8.25 lakh | SUVs, EVs, Tractors, Rural mobility |

| BYD | 8,93,668 | 46,292 | 4.27 million | EVs, Batteries, Urban Transport |

| Tesla | 8,10,827 | 58,855 | 1.79 million | Premium EVs, Energy Storage, FSD |

Maruti leads in small ICE cars, Hyundai in design-led SUVs, and Tata in affordable EVs. But the landscape is rapidly evolving.

If BYD (and Tesla) Enter India Aggressively…

- EV War at ₹10L-15L Segment: BYD Dolphin, Seagull could undercut Tata Nexon EV and Punch EV in pricing & tech.

- SUV Disruption: BYD Atto 3 and upcoming Tesla compact SUV could challenge Hyundai Creta EV and MG ZS EV.

- Tech Leap: Advanced ADAS, battery safety (Blade tech), faster charging could push Indian OEMs to accelerate R&D.

- Pressure on ICE & Hybrid: Maruti’s stronghold in ICE & hybrid may weaken if EVs reach price parity faster.

- Infra Boost: BYD’s presence can lead to faster charging infra and localization, possibly battery cell manufacturing.

Conclusion: A New Era is Coming

If BYD doubles down on India with its price-performance edge and Tesla clears regulatory hurdles, the Indian market could witness a second wave of disruption after Reliance Jio’s entry in telecom. Affordability, reliability, and smart tech will win the next decade of auto wars in India. Indian automakers must pivot fast or risk being left behind.

This is not just a competition between companies. It’s a clash of visions for the future of mobility in one of the world’s fastest-growing car markets.

What are your thoughts on the automotive industry in the coming years