I’ve been looking into HUF (Hindu Undivided Family) accounts for investments, and I’d like some clarity on the charges that come with it. Specifically, I want to know about:

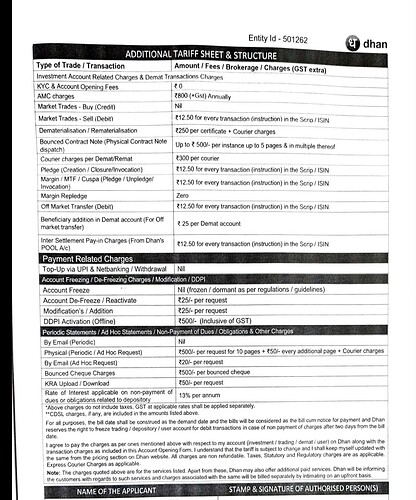

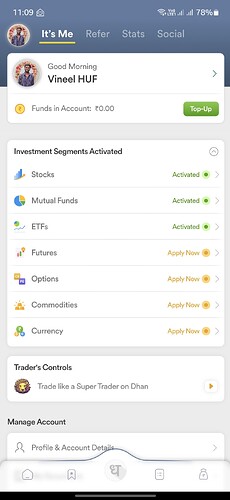

1. Annual Maintenance Charges (AMC):

- Are the AMC charges for HUF accounts the same as those for individual accounts?

- What is the typical range for AMC? Is it charged yearly, and do all brokers have the same AMC structure for HUF accounts?

2. Brokerage Charges:

- How are brokerage charges structured for HUF accounts? Is it a percentage of the trade value, or are there flat fees?

- Are there different brokerage rates for delivery vs intraday trades?

- Do discount brokers offer lower brokerage for HUF accounts, and if so, how much lower?

3. Other Extra Charges:

- Besides AMC and brokerage, are there any other hidden charges like transaction fees, GST, stamp duty, or DP (Depository Participant) charges?

- How are these extra costs calculated, and are they charged on every transaction or annually?

4. Cost-Saving Tips:

- What can I do to minimize these charges? Should I look for specific brokers with lower fees or trade in a certain way to avoid excessive costs?

Would appreciate any insights or personal experiences with managing costs in an HUF account!