@Dhan_Cares @kuldeep

Please let me know how commodity options are settled at Dhan. I did read your settlement process here but it is not fully clear to me.

-

Will a short OTM option on expiry be cash settled or will you convert it to a short futures with sell price being the option strike value ?

-

Will a short ITM option on expiry be cash settled or will you convert it to a short future with sell price being the option strike value ?

-

Will you auto square off before or on expiry day an open long or short OTM or ITM option ?

3 Likes

Hi @t7support

-

There is no obligation for the OTM option to expiry (end of the day) since its value is zero.

-

The Short ITM option on expiry will convert into a Future position and it will be Long/Short based on your option (call/put).

-

On Expiry day, all carry forward positions of the Current month Option are closed if the margin is not available as per the required margin of devolvement.

You can read more about this under physical settlement here: Risk Management Policy | Dhan

Thanks @Divyesh.

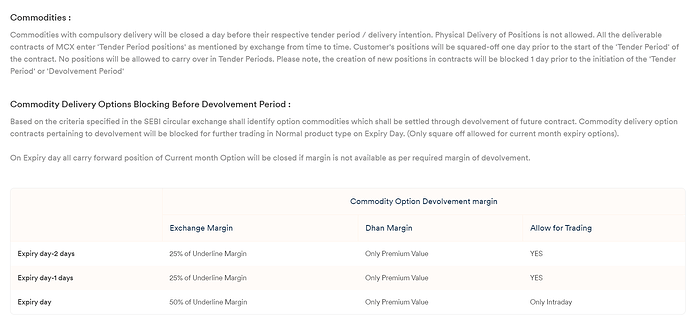

I am holding a SILVERM 19 APR 85000 CALL which is currently OTM. I got a message today from Dhan that I need to maintain an additional margin. It is not clear from your documentation whether the additional margin is for ITM alone or for OTM also (to cover for the risk in case it becomes ITM intraday or at EOD)

Also seeing the post here it seems Dhan margin is “only premium value” and not % of underlying as stipulated by exchange. What is the catch ?

1 Like

Hi @t7support

Yes, the margin is required irrespective of option type (ITM or OTM) to cover the risk of devolvement on expiry day.

Secondly, the “Only Premium Value” refers to the margin that gets blocked for initiating the position and the devolvement margin to be as per the Future contract.

1 Like

Ok Thanks @Divyesh for the explanation.

@t7support

You are welcome, always here to help

1 Like

@Divyesh

Sor for example if I am long a call otm option whose premium is x on T-2( where T is expiry day), then I will need to put in x as margin for dhan, but what is this “25% of underline margin”? And what kind of margin are we asking here for both dhan and MCX : is it 50% cash-margin + 50% non-cash-margin or it is hard cash?

Also let’s assume on expiry my otm option converts to itm, this means I will get a long futures position. What if I am already short future ( with a different strike price ofcourse), the future here is the same as the one which is underlying for call option. Will it change the required margin for me or not?

Another thing I wanna ask is: these options are highly illiquid, how would dhan calculate the premium required for margin here?

P.S:

Consider one more scenario: Let’s say I am long bull call spread and both the calls have been chosen as the one that will go for devolvement into futures. Does that mean I will receive no long future contract position at either of the strike price because I am long one and short one and so they will cancel out and I will receive some cash instead

I found the link of which you pasted the screenshot: Is Underline margin “future contract margin”?

@Pranita @Divyesh Please respond