For over a decade, China led the world in oil demand growth. Now, India is expected to take that lead over the next ten years, according to Moody’s Ratings. This shift will greatly affect how crude oil is traded globally. Let’s know how:

India’s Growing Oil Demand

India’s strong economy, large population, and ongoing development are driving its increased energy needs.

- Economic Growth: India’s economy is growing rapidly, with GDP expected to expand by 6.3% in 2025 and 6.5% in 2026, making it a top G-20 performer. This growth, along with more people, urbanization, and industrialization, means more demand for fuel and energy.

- Key Drivers: Government efforts to build infrastructure, like new roads, and improve energy access also boost oil use. India’s long-term vision to become a developed nation by 2047 means continued economic expansion and higher energy use.

- Fuel Types: Diesel is expected to be the biggest source of oil demand growth, making up almost half of India’s increase and over one-sixth of global growth by 2030. This is due to industrial growth, farming, and road transport. Jet fuel demand is also rising. While electric vehicle (EV) adoption is increasing, traditional vehicles will still dominate for a while.

- Refining Expansion: Indian oil companies are investing heavily to expand their refining capacity. India plans to add about 1 million barrels per day (mb/d) of new refinery capacity over the next seven years, more than any country except China. This aims to increase capacity by a fifth, from 256.8 million tonnes per annum (mmtpa) in 2024 to 309.5 mmtpa by 2030.

- Import Reliance: India is already the world’s second-largest crude oil importer, bringing in 4.6 mb/d in 2023, a figure expected to rise to 5.8 mb/d by 2030. Over 85% of India’s crude oil and about 50% of its natural gas needs are imported. Most of its crude imports (around 71%) come from OPEC nations. India is diversifying its suppliers, now sourcing from 39 countries, up from 27. Russia has become a top supplier, accounting for 36% of imports in March. India is also trying to boost its own oil production through new laws to attract foreign investment in shale oil and gas.

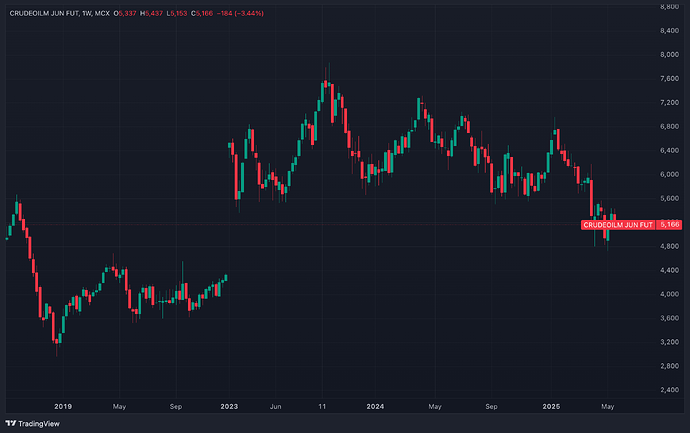

Last 5 years of Crude Oil:

China’s Changing Energy Needs

While India’s demand grows, China’s oil consumption is slowing down due to economic changes and a shift to cleaner energy.

- Slowing Demand: Moody’s expects China’s crude oil use to peak in the next 3-5 years, with only small annual growth until 2030. This is because its economy is growing slower and shifting away from heavy manufacturing towards services and technology.

- EV Impact: A major reason for this slowdown is the rapid adoption of New Energy Vehicles (NEVs). EVs made up 50% of new car sales in China in 2024, significantly reducing fuel use . China’s extensive high-speed rail network also helps reduce oil demand for transport . Sinopec, a major Chinese refiner, believes gasoline consumption peaked in 2023 .

- Peak Consumption: Multiple sources, including Moody’s, predict China’s crude oil consumption will peak within the next 3-5 years. This means China is moving towards a less oil-intensive economy.

How This Affects Crude Oil Trading

The different paths of India and China will lead to big changes in global oil supply and demand, affecting prices and trading strategies.

- Global Rebalancing: India is set to be the largest source of global oil demand growth until 2030, with its demand projected to increase by almost 1.2 mb/d, making up over one-third of global gains. In contrast, China’s growth will be much slower. OPEC expects global oil demand to rise by 1.3 mb/d in both 2025 and 2026, mainly due to India.

- Potential Oversupply: Despite India’s strong demand, global oil supply is expected to grow faster than demand, leading to more oil in storage in 2025 and 2026. This could put downward pressure on oil prices.

- Price Volatility: Crude oil prices have been volatile, with Brent futures recently falling by about $10/bbl. Experts predict lower Brent prices in the near term, around $64/bbl in 2025 and $60/bbl in 2026. Prices are affected by supply and demand, OPEC+ decisions, global economic growth, U.S. shale production, and currency changes. A stronger U.S. dollar makes oil more expensive for countries like India, potentially lowering demand .

- OPEC+ and U.S. Shale: OPEC+ has announced production increases, but its effectiveness is challenged by some members not following quotas and by rising oil production from non-OPEC countries, especially U.S. shale. However, U.S. oil production is expected to peak around 2027 and then decline, which could reduce its role as a “swing producer”.

| Source | Country | Projection (2025) | Projection (2026) | Long-Term Outlook | Key Drivers/Context |

|---|---|---|---|---|---|

| Moody’s | India | 3-5% annual growth | 3-5% annual growth | Leading driver over next decade | Robust economic growth, industrialization, infrastructure, rising middle class |

| China | Peak in 3-5 years | Marginal growth | Peak at ~800 mmtpa by 2030 | Slower economic growth, accelerating EV penetration, refining capacity cap | |

| OPEC | India | 5.74 mb/d (+3.39%) | 5.99 mb/d (+4.28%) | Potential to double by 2045 (11.7 mb/d) | Robust economy, transport, manufacturing, petrochemicals, road expansion |

| China | 16.90 mb/d (+1.5%) | 17.12 mb/d (+1.25%) | Slower growth, energy transition | ||

| Global | 1.3 mb/d growth | 1.3 mb/d growth | Driven by India’s increasing fuel needs | ||

| IEA | India | 0.3 mb/d growth | 0.3 mb/d growth | 6.6 mb/d by 2030 (+1.2 mb/d from 2023) | Urbanization, industrialization, mobility, clean cooking, diesel growth |

| Global | 1.1 mb/d growth | 0.76 mb/d growth | Driven by China, India, other emerging economies; OECD declines | ||

| EIA | India | +330 kb/d | Poised to account for 25% of global growth in 2025 | Rising transportation fuels, home cooking fuels | |

| Global | <1 mb/d growth | <1 mb/d growth | Slowdown in economic growth, particularly in Asia | ||

| OPEC (WOO) | India | 5.3 mb/d (2023) to 13.3 mb/d by 2050 (+8 mb/d) | Road transport, freight, industrial production, population, urbanization |

Conclusion: A New Global Energy Order

The global oil market is at a turning point. India is becoming the main driver of oil demand growth, replacing China, which is slowing down its oil consumption and moving towards cleaner energy. This means:

- India’s demand will keep growing, especially for diesel, driven by its economy and infrastructure.

- India will expand its refining capacity but will also rely more on oil imports, leading to complex energy diplomacy.

- China’s oil demand will peak soon due to slower growth and widespread EV adoption.

- For crude oil trading, this means a dynamic market with potential oversupply and continued price volatility.

- Traders must use flexible strategies and strong risk management, keeping an eye on both market fundamentals and global events.

The era of China leading oil demand is ending, and India is now in the spotlight, shaping the future of global energy.