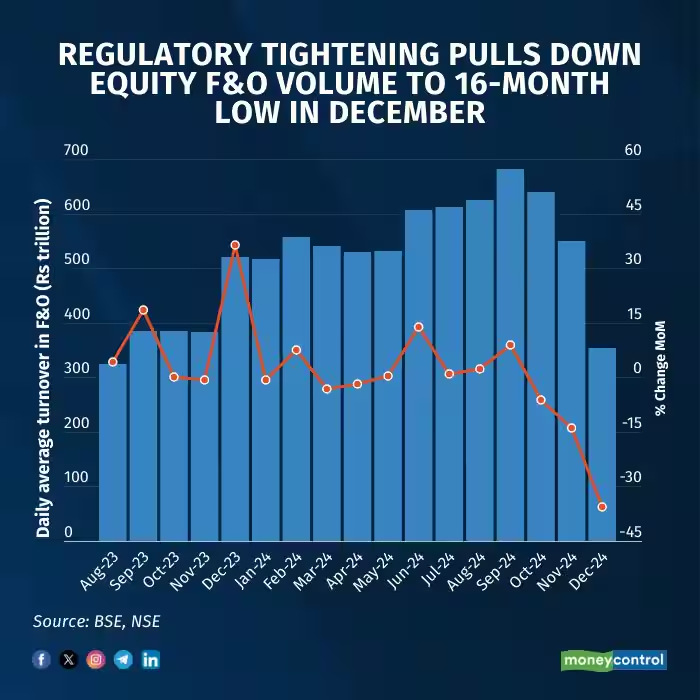

The Indian derivatives market witnessed a sharp 37% month-on-month decline in trading volumes this December, following a series of regulatory measures implemented by SEBI (Securities and Exchange Board of India)**. These changes aim to reduce excessive speculation and enhance risk management in the derivatives segment.

According to reports, the average daily turnover (ADTV) in the derivatives market for December stands at ₹280 trillion, marking its lowest level since June 2023. This represents a significant drop from the ₹442 trillion recorded in November.

Key Factors Behind the Decline

- New Trading Norms: SEBI has introduced new measures, such as:

- Higher Expiry Margin Levies (ELM): This makes trading more capital-intensive, discouraging speculative participation.

- Weekly Expiry Rules: The number of weekly expiries per exchange has been reduced to just one, further limiting excessive speculation.

- Contract Size Adjustments: Starting January 1, 2024, the contract sizes for weekly derivatives (Nifty, Bank Nifty, and Fin Nifty) will be revised, potentially reducing retail participation.

- Reduction in Weekly Contracts: Nifty 50 weekly contracts, which earlier had expiries on every Thursday, will now have a 35-40% lower notional turnover due to these changes. Similarly, weekly contracts for Nifty Bank and Bankex have been discontinued, reducing overall market activity.

- Market Volatility & Institutional Strategy:

- The recent correction in benchmark indices like Sensex and Nifty has added to investor caution.

- Institutional investors, who play a crucial role in derivatives trading, are now adjusting their risk management strategies in response to SEBI’s policy changes.

The Broader Impact on the Market

- Declining Individual Trader Participation: SEBI’s stringent F&O measures have resulted in a 90% reduction in individual traders’ contributions to derivative volumes.

- Increased Institutional Presence: With stricter trading requirements, institutional players are expected to dominate the market.

- F&O Revenue Impact: Exchanges and brokerage firms that rely heavily on derivatives revenue will experience reduced income streams.

Looking Ahead: What’s Next for the Derivatives Market?

With new margin requirements and regulatory controls, it is evident that SEBI’s primary goal is to curb excessive speculation. However, the question remains—how will this reshape India’s derivatives market in 2024?