Hello, investors!

February was a bit of a rollercoaster ride for the Mutual Fund world. While the overall market took a breather, investors stayed strong and kept the faith — continuing to pour money into funds, especially through SIPs. Let’s break down what happened ![]()

![]() Industry Highlights.

Industry Highlights.

-

Total Assets Under Management (AUM) Stood at ₹64.53 lakh crore, up 18.32% year-on-year

-

That said, there was a 4.04% dip from January, mainly due to market corrections — Nifty 50 and Sensex both fell over 5%, pulling down equity valuations.

Continued Growth in Folio Numbers: ₹40,063 crore of net inflows came in during the month

Folios (investor accounts) grew to 23.22 crore, with nearly 31 lakh new folios added in just one month. That’s some serious participation!

Source: AMFI, CRISIL MI&A Research

![]() Types of Mutual Funds and Their Performance

Types of Mutual Funds and Their Performance

![]() Key Highlights and Unique Observations:

Key Highlights and Unique Observations:

-

Equity Funds: Equity funds continued their winning streak with ₹29,303 crore in net inflows — that’s 48 months in a row!. Sectoral and thematic funds were the star performers, pulling in over ₹5,700 crore.

-

Debt Funds: : The total AUM hit an all-time high (₹17.08 lakh crore), but the category saw net outflows of ₹6,526 crore. Interestingly, liquid funds saw ₹4,977 crore coming in — showing a clear preference for short-term safety.

-

Hybrid Funds: These got ₹6,804 crore in inflows, mostly via arbitrage funds. Total AUM grew nearly 20% year-on-year — a good sign that investors still love a balanced approach.

-

Passive Funds: Continued to shine with ₹10,249 crore in net inflows. Gold ETFs had their second-best month ever with ₹1,980 crore — gold seems to be the go-to during market stress.

![]() SIP (Systematic Investment Plan) Insights

SIP (Systematic Investment Plan) Insights

Investors contributed ₹25,999 crore through SIPs in February, a 35.51% increase compared to the same month last year

The number of contributing SIP accounts stood at 8.26 crore, highlighting the growing adoption of disciplined investment approaches among retail investors.

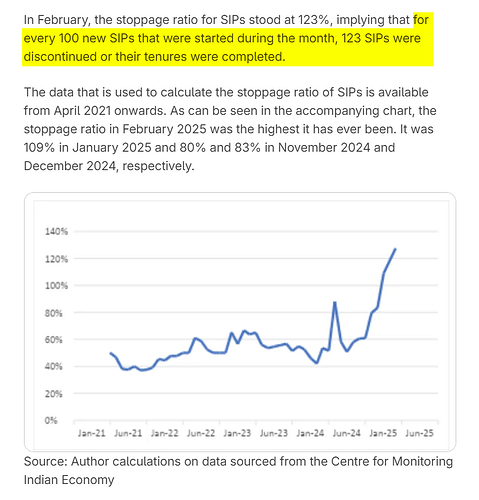

However, the SIP stoppage ratio hit a record 123% — meaning more SIPs were stopped than started during the month.

![]() New Schemes Launched in Feb’25

New Schemes Launched in Feb’25

- 29 New Fund Offers (NFOs) launched

- Total collections: ₹4,029 crore

- Most were index funds and sectoral strategies — showing growing demand for targeted and low-cost investing

| Category | Scheme Name | Fund House |

|---|---|---|

| Income/Debt Oriented | Bank of India Money Market Fund | Bank of India Mutual Fund |

| Growth/Equity Oriented | Bajaj Finserv Multi Cap Fund | Bajaj Finserv Mutual Fund |

| Sectoral/Thematic Funds | Baroda BNP Paribas Energy Opportunities Fund | Baroda BNP Paribas Mutual Fund |

| Edelweiss Consumption Fund | Edelweiss Mutual Fund | |

| HSBC Financial Services Fund | HSBC Mutual Fund | |

| Invesco India Business Cycle Fund | Invesco India Mutual Fund | |

| ITI Bharat Consumption Fund | ITI Mutual Fund | |

| Motilal Oswal Innovation Opportunities Fund | Motilal Oswal Mutual Fund | |

| Nippon India Active Momentum Fund | Nippon India Mutual Fund | |

| Hybrid Schemes | LIC MF Multi Asset Allocation Fund | LIC Mutual Fund |

| Other – Index Funds | Angel One Nifty Total Market Index Fund | Angel One Mutual Fund |

| Axis Nifty500 Momentum 50 Index Fund | Axis Mutual Fund | |

| Bandhan Nifty Next 50 Index Fund | Bandhan Mutual Fund | |

| Edelweiss CRISIL-IBX AAA Bond NBFC-HFC - Jun 2027 Index Fund | Edelweiss Mutual Fund | |

| Groww Nifty India Railways PSU Index Fund | Groww Mutual Fund | |

| HDFC Nifty100 Quality 30 Index Fund | HDFC Mutual Fund | |

| Kotak BSE Sensex Index Fund | Kotak Mutual Fund | |

| Kotak Crisil-IBX AAA Bond Financial Services Index – Dec 2026 | Kotak Mutual Fund | |

| SBI Nifty Bank Index Fund | SBI Mutual Fund | |

| SBI Nifty IT Index Fund | SBI Mutual Fund | |

| UTI Nifty Midsmallcap 400 Momentum Quality 100 Index Fund | UTI Mutual Fund | |

| UTI Nifty India Manufacturing Index Fund | UTI Mutual Fund |

Happy Investing,

Saurav Parui.