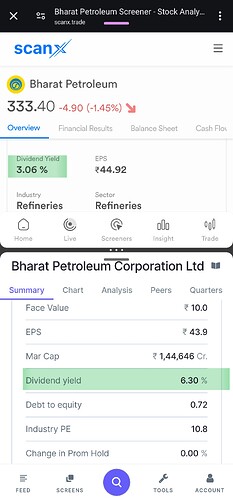

I recently noticed a significant discrepancy in the financial metrics for Bharat Petroleum between the Dhan ScanX platform and Screener.com. Specifically, the Return on Equity (ROE), Return on Capital Employed (ROCE) and Dividend Yield values differ greatly: Also attaching the screenshots below

Dhan ScanX: ROE - 3.98%, ROCE - 4.97%, Dividend Yeild - 3.06%

Screener.com: ROE - 32.1%, ROCE - 41.9%, Dividend Yeild - 6.3%

Given that these metrics are crucial for investment decisions, I am concerned about which platform provides the accurate data. The figures on Screener.com seem more consistent with other sources I have checked.

Could you please review the data on Dhan ScanX and confirm its accuracy? If there is an error, an update or correction would be greatly appreciated to ensure we are making informed decisions based on reliable information.