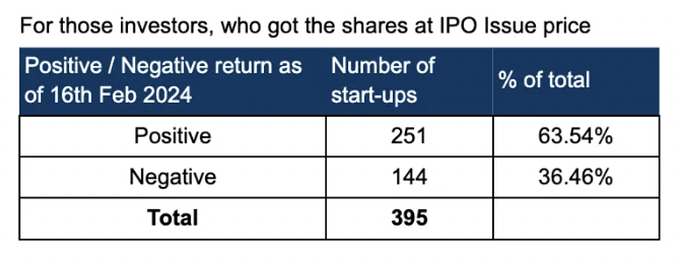

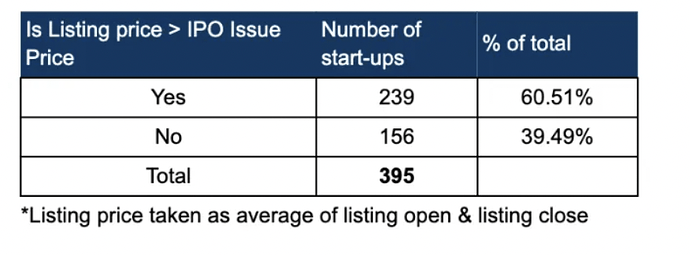

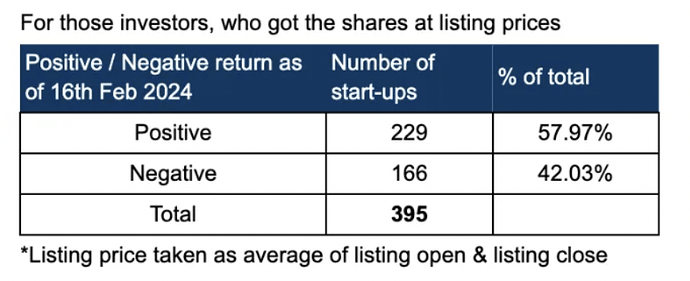

There were 395 IPOs in India from 2010 to Feb 2024. We saw Zomato, Paytm, Nykaa listing on the exchanges and a lot more startups are now coming up their IPOs - Ola, PhonePe, Swiggy etc.

But should retail investors take this risk? Is it worth it?

Sharing some numbers on IPO performance over the years, do share your thoughts:

Data source: Moneycontrol & The Painted Stork on substack.

4 Likes

Thank you @shraddha, appreciate what Dhan does and it’s passion to make the product great along with this highly credible madefortrade community.

I could write paragraphs on this - restricting myself to the gist! I do not trust IPOs. Private Equities are manipulated badly and IPO companies are generally in debt and raising more debt. Invest in companies that have great MOAT, ROE, ROCE and transparency. In the earlier markets, share price was mostly fixed around face value, unlike capitalists who tend to extremely bloat valuations to make money (VCs, Inv. Banks who underwrite, etc.). Stay away for your good, or if you are good in winning tosses, make your call

1 Like