Paytm recently faced a significant setback as the RBI took stringent measures, stopping the onboarding of new customers to Paytm Payments Bank and abruptly halting its operations.

As per a report by CNBC,

Reserve Bank of India had found 31 crore out of 35 crore Paytm Wallets inoperative in its inspection, cases where a single PAN card was linked to thousands of accounts, absence of KYC for lakhs of accounts and violation of KYC-anti money laundering rules, instances of false compliance reports being submitted by the bank, PPBL’s financial and non-financial business co-mingled with its promoter group companies in violation of licensing conditions, and many other red flags, which pushed the regulator to put stringent curbs on the bank, bringing its operations to a standstill.

RBI barred the company from no deposits, no credit transactions, no wallet top ups, no bill payments, nothing — after February 29.

As per the report, Paytm Payments Bank has a history of non compliant issues starting from its first year of operations. One severe problem raised was that the RBI found that in thousands of cases the same PAN was linked to more than 100 customers and in some cases for more than 1,000 customers. The total value of transactions in some accounts ran into crores of rupees, much beyond regulatory limits in minimum KYC pre-paid instruments raising money laundering concerns.

In lakhs of cases, for instance, the accounts and wallets were found to have been frozen by various law enforcement authorities across the country, as such accounts were used for committing digital frauds.

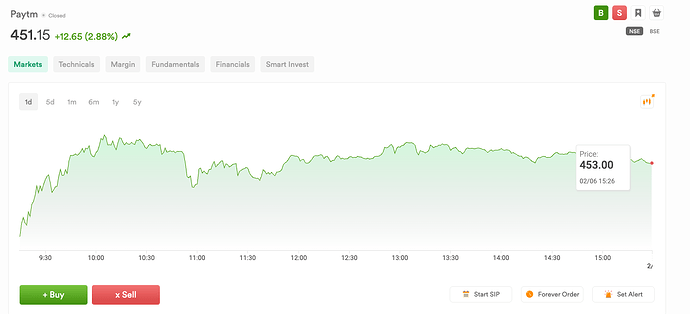

In response to the RBI’s actions, Paytm’s shares rebounded after a meeting between Paytm’s team and the RBI.

What are your thoughts on the RBI’s strict action? Do you believe it was justified to halt all transactions, or do you think a more measured approach would have been better?

Share your perspectives below!