How much rebate income as % of total revenues does Dhan get? @PravinJ

Dhan is very small, in our case it is approx 8%. The right way to look at it from industry perspective is - we charge only brokerage and nothing else like account opening fees, or AMCs or many other things that other platforms charge. If our revenue mix was similar to others - in that case this should be 4-5%.

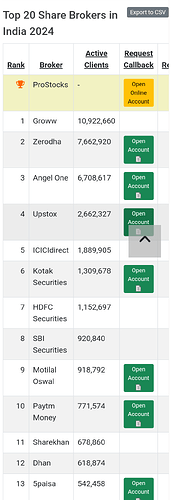

all thing is good but Dhan is not a Small broker because Dhan recently comes before 5paisa from 13 to 12

Thanks @ArjunaGupta, thanks for your words. Dhan has just ~1% of the industry while the big players have 15% to 25% of the industry… long way ahead of us.

Angelone has revised their brokerage charges. They will start charging Rs.20 or 0.1% + GST for equity/cash delivery , whichever is lower per executed order. This will be in effect from 1st October onwards.

I think as the transaction charges have been levied by NSE and BSE both, brokers are going to pass it down to customers only. Ashish Nanda from Kotak Securities tweeted hinting that they might increase the brokerage as well.

Does dhan plan on doing the same @PravinJ ? ![]()

Given the value Dhan provides, I have always been of the opinion, that Dhan should charge ₹25-₹30 per executed order, regardless of FO, CNC or MIS.

Quality = Premium Pricing (Zerodha, Dhan)

Me-Too Product = Normal Pricing (AngelOne, Upstox)

KS has everything free for “under 30” and Intraday FREE for all. I guess only the FREE part will go.

I still think some of Dhan Features arent fully baked in. Their API/python lib certainly isnt. If you talk about keenness to adopt “gamification” and “Bling-features” - that I agree.

PS: The % of “interested parties” with “conflict of interest” is high on this forum compared to Z’s tqna. Makes it unclear who is bias-free in the true sense. In the interest of transparency I think “interested parties” should have a “status badge” or a “sig” to prevent this forum from becoming a ‘CJ’.

Perhaps the suspension of “referral program” may have improved this situation.

Just a disclosure, I am bias free. I am not associated with Dhan. Just a happy customer.

I have been in the markets since 2012 (school days), and I have used every other brokerage since then.

I prefer Dhan because before 3 years (before Dhan), nobody was really interested in giving a good trading experience. Now, features are being copied left and right, by brokers like, AnOne, Zedh and many more.

Your Python might have issues, but I am not commenting on your algo stuff because it is not within my circle of competence. As a discretionary trader, I find Dhan highly VFM and tech-saavy and meets all my needs. @VijayNair

@thisisbanerjee I thought you did admit to receiving commissions in one of your earlier posts. Anyways, whatever I stated in my previous post holds, I mean that in general, whether or not you received commissions. Disclosure (status badge or sig) is a nice thing to do, it adds the right amount of salt to the servings ![]()

@VijayNair No, I have never said that I receive commissions from Dhan or anybody as a matter of fact, BECAUSE I DON’T.

Okay @thisisbanerjee

For the record, I dont have anything against APs (maybe a lil against random unscrupulous referrers), some of them are very good am sure, especially the one under whom I joined. My point is mainly about disclosures.

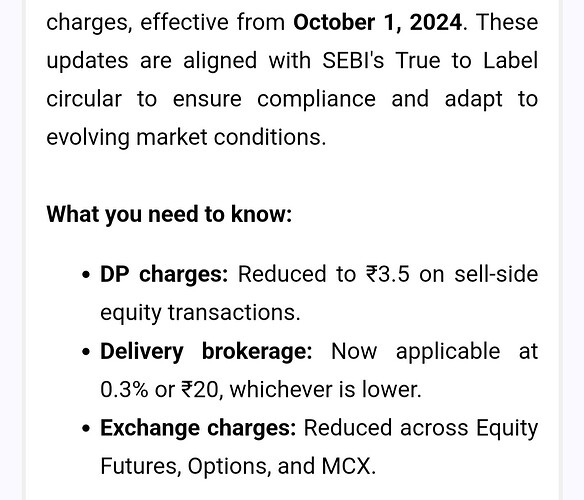

Fyers also changed brokerage charges:

Reduced dp charges. Now only 3.5 rs

But introduce delivery brokerage charges by 0.3% or 20 whichever lower.

Are you going to increase brokerage charges in delivery & intraday ? Today few brokers already revised brokerage charges. @PravinJ @iamshrimohan @Naman

Zerodha switched back

Equity is now free again

Phonepe free till Dec 31st .

Might extend further too never know to attract customers

Blinkx ( JM.financial)

200.rs subscription ( EQ continues to be free)

New age guys with subscription model are very competitive but not sure if anybody has tried out.

Broking is currently a super competitive space. The broker that can hold a good number of active traders will survive and be profitable.

We reviewed the changes made by our peers, they are all quite big industry players when compared to us and have the pricing power which we do not have. All changes to pricing plans that got announced are can be termed as adjustments, but not major or significant changes. It would have been significant if F&O brokerage would have changed from INR 20 to say INR 25 or 30.

Yes, there are smaller players who are free - would they have ability to keep it free when there are zero exchanges rebates now is yet to be discovered.

We do not want to tinker or adjust for sake of changing the plans. The changes suggested by SEBI will play out the next few months and may be there will be some additional changes in the pricing. I would think that most players would truly realise the impact by end of March 2025, and get back to the drawing boards again to rethink on their decisions.

We will be reviewing these industry updates collectively among us and come back if there are adjustments to be made. If not, we wait for some significant changes to happen.

Where is the subsciption cost mentioned? Can find the subscription plan details but couldn’t find the cost of subscription.

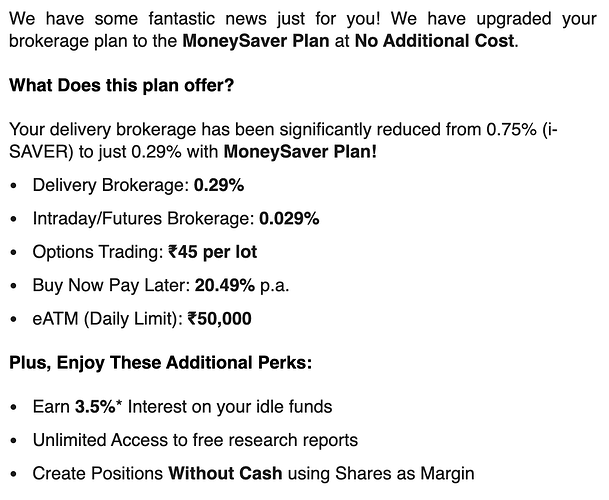

Crazy, I have few old demat accounts - and one of them sent this to me today morning: my new brokerage plan.

While change in regulations and landscape is forcing many platforms to change its pricing, I wonder if we could really have pricing like this ever becoming benchmark for the industry in coming days.