Should be ICICI direct

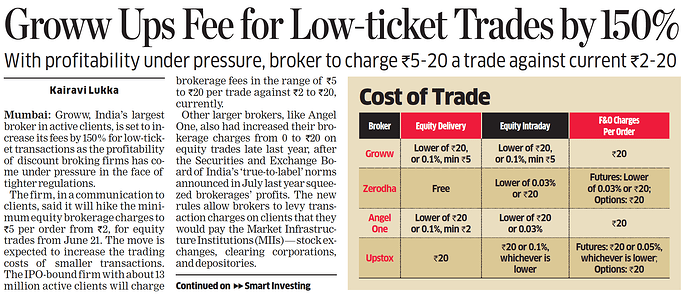

Just saw this news about Groww hiking its brokerage fees for low-ticket trades minimum charge now ₹5 instead of ₹2. Angel One and others had already done it earlier. Looks like many brokers are reworking their pricing to stay profitable with all the regulatory pressure. Earlier as well I had asked in here when angel changed their pricing.

Does Dhan also plan to revise its brokerage structure now then? Would be great to understand your view @PravinJ on this, especially since tighter regulations seem to have started applying on almost on all brokers.

Tagging team members as well @Naman @Pranita @Sameet @RahulDeshpande

Nope @RohanTrader We have no immediate plans to look at our pricing structure, there are no internal conversations in that direction.

This is a older post now, in case it was missed - we recently revised down on our MTF prices, more on that is here - https://private-poc.madefortrade.in/t/big-update-mtf-pay-later-investing-on-dhan-now-for-as-low-as-12-49-p-a/43721

Hi

Apart from their brokerage, SEBI regulation is for all broker right ,but how ICICI Direct

1.Allowing sold stock amount to get credited in 30mins?

2.Allowing 100% collateral for overnight positions?(But interest charged)

3.Mostly they have unique feature we can add margin to exact MTF position to reduce interest how is this possible(this is most usefull features if dhan implements,this reduce risk for broker as well as user).