They Are Providing Tick By Tick Data On Charts, Can We Expect Something Like That From Dhan As Well.

Hi @Duck

We had evaluated Tick By Tick Data on Dhan long while back, however dropped it for multiple reasons.

a. The additional benefit it brings in for charting data is very marginal compared to what is already available in the Snapshot data. For example, the snapshot data has about 3-5 snaps a second, which results on a data snap of one per 200 ms. Anything less than 200 ms is indistinguishable to human eyes.

b. This data is available only for NSE, not for BSE or MCX. That aside, even NSE shows data of snapshot on its own website v/s showing tick by tick data. As a result, if any user claims for data inaccuracy, it is going to be extremely difficult for the user or even us to reconcile or compare the same as it is not publicly available on NSE. PS: It is already difficult.

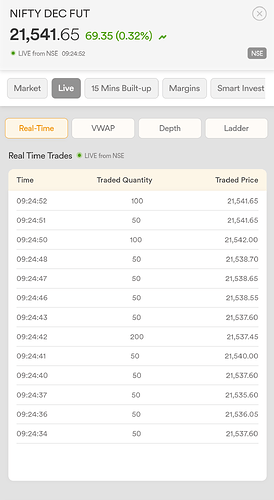

c. Tick by Tick data, at the best adds more data points on the High / Low of the OHLC candles and that too only when it is not captured in the snapshot data. On Dhan, we do show you Real-Time Transactions on Live section of the scrip, you will see most trades for price span on OHLC are captured well on the snap-shot data.

d. Additional ticks on charts means more attention on price movement. I recently mentioned that ~7 to 8% of our users are on second charts to capture early breakouts. That said, the most standard time-frames are 1,5,15 minutes and swing traders are on 1 hr, 1 day and the India specific timeframes we provide for 25, 75, 125 min time frames. Larger timeframes are preferred over seconds one.

At Dhan, we give a lot of attention to charts. Users on Dhan spend insanely higher time on our charts for the experience it brings along with the data and many features and capabilities we have introduced over a period of time.

While we haven’t ruled out Tick-by-Tick data from our things to do, I just wanted to mention that the incremental benefit that is brings is very very marginal. So yes, sometime in future we may consider adding this.

@PravinJ I’m Not 100% Sure But I Think That It Will Eliminate Opening Hour (Say 9:15) Candle Errors Or Sudden Big Movements In Market Hours If I’m Not Wrong… However Thank You For Providing A Beautiful Product As Well As Reliable Tech To The Trading Community…

@Duck At NSE trades happen at nano second intervals. By the time the data comes via the internet to you it’s already few 100 milli seconds delayed. So u lose any speed advantage relative to the collocated HFTs at exchange.

Also I think brokers get only snapshot data and not tick by tick. @PravinJ pls correct me if am wrong. There is no way the interval between successive liquid nifty futures trades is 1-3 sec and that too at rounded timestamps in seconds.

Hi @t7support There is an option to get tick-by-tick data by brokers, one has to set up additional infrastructure to access that. However getting that data is one thing, and putting that over the internet connection and showing it fast is another task altogether.

Honestly, it is a good problem to solve and we would love to do it ourselves. But as I mentioned, the reason we dropped in was that the additional benefit was super duper marginal. Another example I can share is 20-depth data, at Dhan we do not provide it but in our user interactions many traders mentioned that they don’t find it reliable enough - so becomes good to have, but it creates additional data point. At times we have seen inconsistencies in this data because of yes, internet speeds and network; eventually the platforms also state using 5-depth over 20-depth.

Btw, 100 ms is very fast and measurable. Dhan now processes > 98% of transactions in less than 100 ms and a major chunk of it is under 50 ms. It usually takes 3-8 ms to send exchange order packet… so we are talking about orders getting executed end to end in under 40-50 ms. In past 12 months, we have reduced over execution time by 1/3rd.. we started at avg response of 150-180 ms and now under 50 ms.

Speed matters for execution of trades. For charts, we can live with snapshot. Most traders miss the point that LTP is last trade price, it is historic (by nano/milli seconds) by the time you see it on the screen ![]()

Exactly. No speed advantage. Only advantage I see is that it leads to correct bar construction in chart without missing ticks as can happen with snapshot data.

Opening this thread for more discussions.

TBT good for those who want extreme accurate data points on Candle.

Shows more no. Of trades happening.

20Market depth combined with TBT is good in my opinion but the question is how a retailer can take its advantage over current 5 depth + Snapshot data ?

Personally I don’t find any major benifit for retailers having TBT but yeah having precise data points are good too. so if we get it its good If don’t then its okay.

Thanks @PravinJ For Keeping This Thread Alive…

Most welcome @Duck. After your post, we discussed this among ourselves again.

Realised that to make TBT Charts alone won’t make the experience better… if TBT has to implemented, then it has to also get implemented across the platform - including watchlists, orderbook, positions and scrip pages. Else traders may find it frustrating to see price mismatch in different sections of the app or web.

@GalaticX - I’m paranoid too. I’m using someone else’s (family member) account for charting. And another member’s account for execution. And both accounts use different IPs using different internet connections. I wanna stay profitable as well as hidden ![]()

![]()

Hi,

I’m new member to dhan.

I observed candle formation for WEEKLY nifty has tick data missing but monthly contract show correct data compared to other broker chart.

Tick by tick is not necessary but for scalping in one minute time frame candle formation should be fairly accurate other wise it shows gap between two candle which is confusing for a scalper.

Please note I’ve observed only one expiry on dhan platform ![]() .

.

But great job by Dhan team for rolling out features in such short time.![]()

Great UI.

Need to check UX in upcoming days .

Thanks ![]() .

.

Hi @PravinJ - Please provide TBT chart data. For the Fair Value Gap to work we need Tick-by-tick data. Snapshot data provide inaccurate or wrong fair value gaps. Also, there is nothing more universal than providing correct chart data. This might be expensive but a one-time setup, I guess!