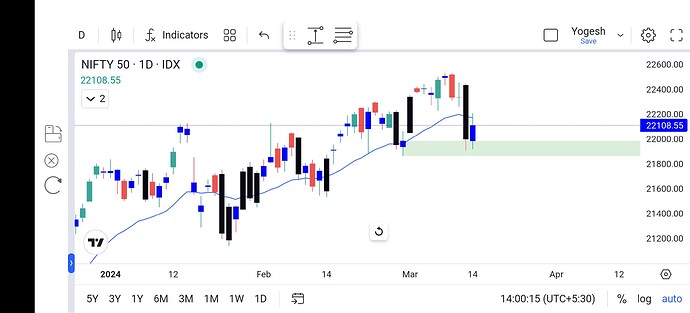

Over the past three weeks, 82% of stocks within the small-cap index experienced declines. The Nifty Smallcap 100 index saw a significant drop of 5.3%, while the Nifty Midcap 100 also fell notably by 4.4%, marking their most substantial single-day decline in nearly two years.

Here is a quick read - https://www.business-standard.com/markets/news/small-midcap-stocks-sink-further-to-log-their-biggest-fall-in-two-years-124031300939_1.html

What are your views on this?

@trust_level_0

2 Likes

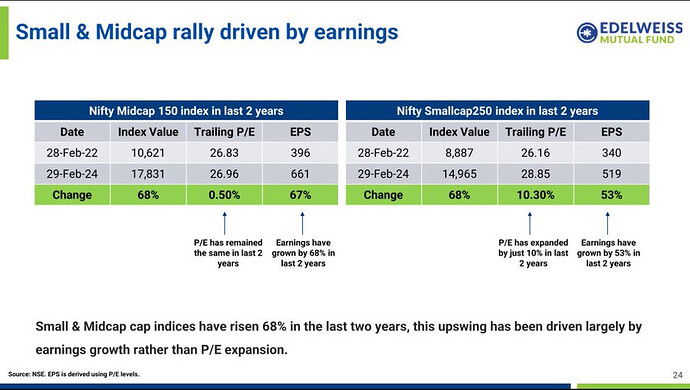

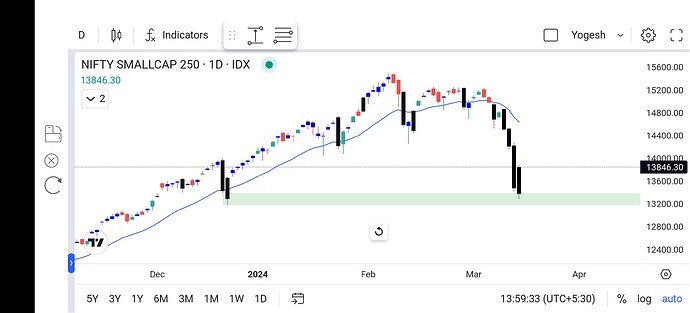

Everything wheather outside the market or inside the stock market, prices are derived from Demand and supply here also institution are selling but today nifty and smallcap taken support from Demand area, please refer the chart attached if these levels break again a big fall expected

In recent days Banknifty was falled from Supply area screenshot attached if fallen again banknifty next demand zone 46150

So in general market is controlled by institutions and today smallcap and Nifty taken support from daily demand area and reacted well, if these levels break then a good fall expected.

Thanks,

Yogesh

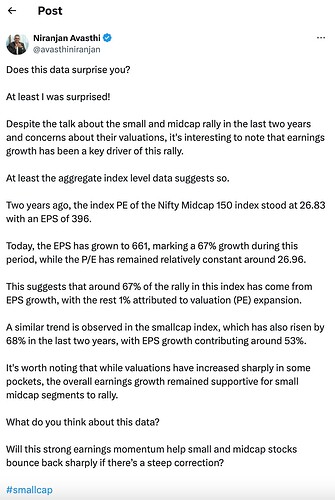

I believe the primary reason for concern stems from apprehensions about overvaluations and AMC’s measures to curb inflows into the Small Cap sector. Small Cap stocks are particularly susceptible to market avalanches, often bearing the brunt of their impact. This segment had excessively high valuations, with signs of frothiness apparent in the sector.

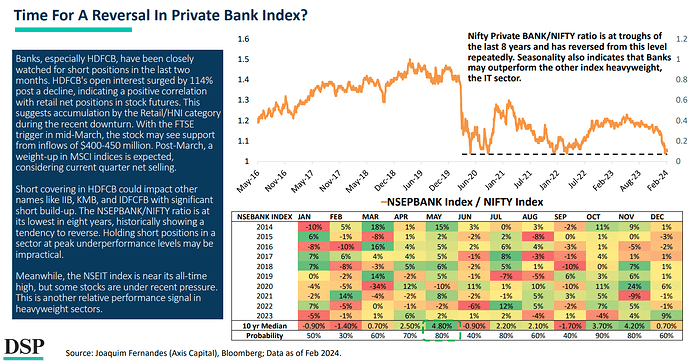

For next sector, I think the Private Banks would be torch bearer. A recent study by DSPIM reveals this too.

2 Likes

@Anirudha will be the best person to share his insights on the bank sector  What do you think about @iamshrimohan’s view?

What do you think about @iamshrimohan’s view?

1 Like

Great, post, I am expecting to see a rally upwards in good midcap stocks after the end of the Financial year.

Completely agree with the above data. The differentiating point of the smallcap rally of 2023 Vs. smallcap rally of 2017-18 is the earnings growth rate.

The possible correction could only be if the future earnings of small & mid-caps look bleak, which is not the case either. So this correction could only be for a very short period.

Very right yogesh ! DATA / NUMBERS / NEWS is one side which can be very easily manipulated but candles price action cannot be manipulated. Once recorded on chart NARENDRA MODI JI can’t even change the candle. I am too expecting fall because stocks demand zone is far away as well as other sectors.

1 Like

@RahulDeshpande - please remove me from this trust rating. I stopped visiting this forum due to this tagging.