Are investors so keenly focused on outperforming market returns that they forget the steady and reliable growth index funds offer?

By focusing on performance and suitability for the Indian investor, can index funds outperform hedge funds over time?

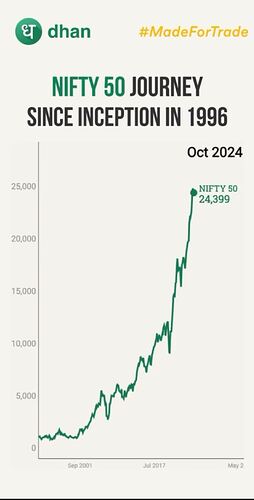

Index funds are constructed to replicate the performance of a selected market index, like Nifty 50 or Sensex.

These provide:

- Simplicity

- Lower cost

- Long-term consistency

Index funds have managed to deliver 12% returns consistently for the last decade in India and are one of the top choices for long-term wealth creation. Hedge funds, although they promise aggressive returns, rarely beat the market after fee adjustment.

Let’s discuss: What is your take on index funds versus hedge funds for Indian investors?

- Have you ever invested in either? If so, what were the results?

- Do you believe low costs and steady returns outweigh the potential high rewards of hedge funds?

Share your thoughts.