Dhan Trading Platform has continually evolved to provide traders with cutting-edge tools and features, empowering us to make well-informed decisions in the dynamic financial markets. One such feature that significantly enhances the trading experience is the integration of Market Depth during order placement.

Level II data, provides traders with real-time insight into the order book, displaying a list of buy and sell orders at various price levels. This will help to fill our order at better price and reduce slippage due to liquidity. Option trader is really good platform and add market depth at order window makes us get order fill at better price(for reference try order execution at sensibull). Few points in otm option selling makes huge % difference.

@Siddharth_24 I guess you mean to say Level III. Level 1 provides the best bid and best ask price, Level 2 offers up to five best bid and ask prices and Level 3 market depth offers a view of the twenty bids and asks. Will surely get this on discussion in the next internal product meet-up.

To add up, in my past, at a Prop. Trading Desk we had a Co-Location setup enabling access to the entire order book (not just 20). But we rarely used the DOM for options trading. I managed the Strangle and Short Box desk and found a 5-level Depth of Market (DOM) to be adequate. I would love to connect with you to know more how can this help in options trading.

It was extensively employed for equity buying and selling though.

- We used to estimate average buy and sell price in the current market to inform our block deal decisions.

- While acquiring/offloading institutions or large holdings. Now the approach has largely shifted towards VWAP and TWAP. Consequently, the reliance on DOM significantly diminished.

1 Like

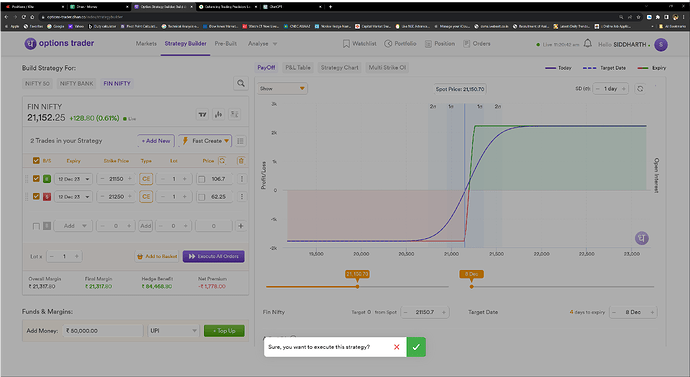

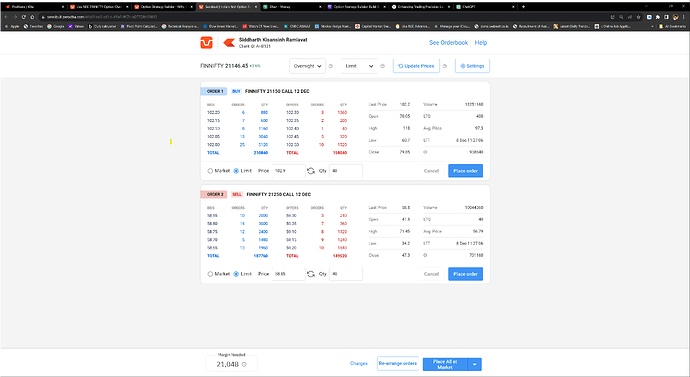

I appreciate your response but I think my point is missed here. So here I am attached with two screen shots for better understanding my point. I am sharing bull CE spread sample for the same. I am talking about the execution window…

- Option trader basket order execution

- Sensibull order execution window

Uploaded image in second reply as I was allowed to attach one media only…