Expired options data plays a crucial role in options research and strategy development. It is commonly used to study expiry behaviour, analyze option price decay, observe OI shifts near expiry, and build reliable backtesting datasets.

With Dhan_TradeHull, expired options data can now be fetched programmatically and stored in a structured format, making large-scale analysis simple and repeatable.

Downloading Expired ATM Options Data in Bulk

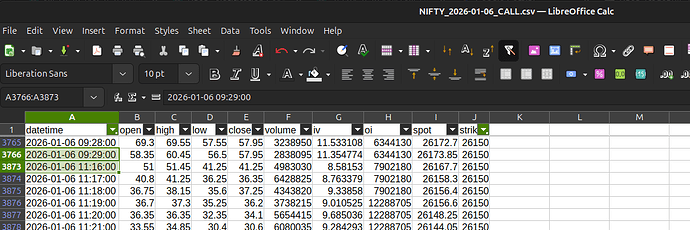

The example below demonstrates how expired ATM CALL option data can be fetched for multiple symbols and multiple monthly expiries.

For each expiry:

• The last 30 days of data before expiry is fetched

• Data is stored symbol-wise and expiry-wise

• Files are saved automatically as CSV

from Dhan_Tradehull import Tradehull

import datetime

import os

client_id = "YOUR_CLIENT_ID"

access_token = "YOUR_ACCESS_TOKEN"

tsl = Tradehull(client_id, access_token)

watchlist = ["NIFTY", "BANKNIFTY", "TCS", "INFY", "RELIANCE"]

expiries = ["2024-01-25", "2024-02-29", "2024-03-28"]

for name in watchlist:

for expiry in expiries:

try:

from_date = (

datetime.datetime.strptime(expiry, "%Y-%m-%d")

- datetime.timedelta(days=30)

).strftime("%Y-%m-%d")

data = tsl.get_expired_option_data(

tradingsymbol=name,

exchange="NSE",

interval=1,

expiry_flag="MONTH",

expiry_code=1,

strike="ATM",

option_type="CALL",

from_date=from_date,

to_date=expiry

)

path = f"Options data/{name}/ATM"

os.makedirs(path, exist_ok=True)

file_name = f"{name}_{expiry}.csv"

data.to_csv(f"{path}/{file_name}", index=False)

print(f"{name} {expiry} : Download completed")

except Exception as e:

print(f"{name} {expiry} : Error {e}")

continue

Folder Structure Generated

The script automatically creates a clean and organized structure:

Options data/

└── RELIANCE/

└── ATM/

├── RELIANCE_2024-01-25.csv

├── RELIANCE_2024-02-29.csv

└── RELIANCE_2024-03-28.csv

This makes it easy to load data later for analysis or backtesting.