-

Can you provide information about the charges associated with Liquidbees or LiquidCase ETFs, specifically regarding buying and selling them?

-

Are the charges for buying and selling these ETFs similar to those for regular stocks?

-

What are the charges involved in trading these ETFs, including:

a. Securities Transaction Tax (STT)

b. Goods and Services Tax (GST)

c. Brokerage fees

d. Depository Participant (DP) charges

e.Other charges.

Hi @AshaTapre ,

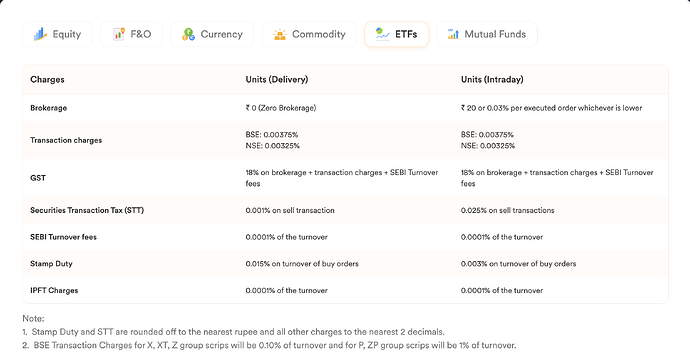

Please find the detailed price breakdown of ETFs in the image below.

For further pricing details, please visit: Pricing & Brokerage Charges | Dhan

Thanks,

Mahima

Product @ Dhan

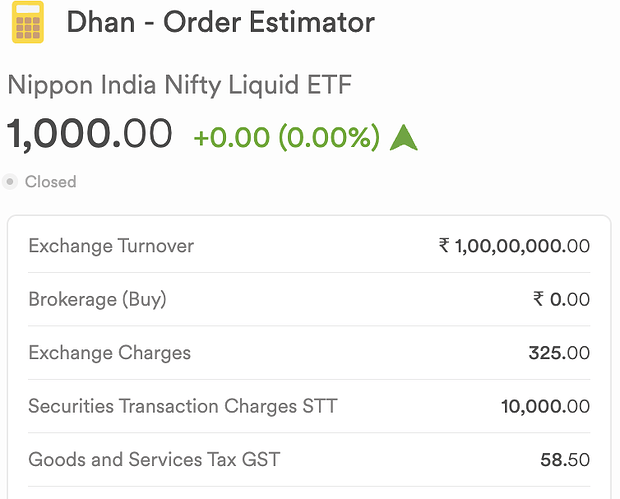

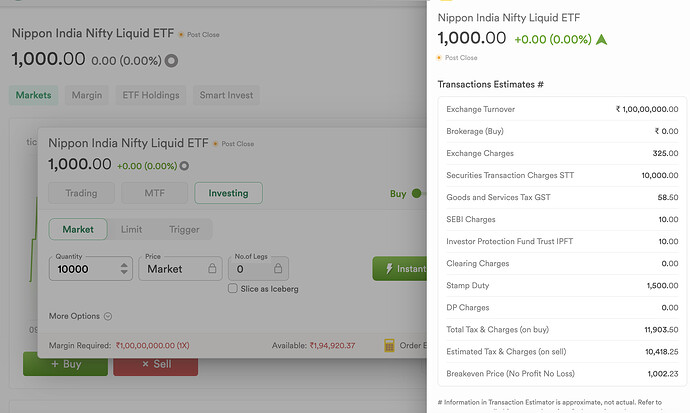

@MahimaShah @PravinJ wanted to park my liquid funds in either zerodha liquid fund or liquid bees …so that i can use that for margin purpose in trading.However i saw the STT Charges as attached? is it true? as far as i know there shouldn’t be any stt on etfs? also in above screenshot it sasy 0.001% on sell? Bcz you do not have demat form mutual fund i can not pledge the debt fund which is more beneficial in such cases? what is the solution? what do you suggest? else i wl have to move my entire stocks + liquid funds in zerodha to get this benefit?i.e cash putting into liquid mutual funds and then take the margin benefit of the same…

@dino STT is not applicable on the Liquid ETFs. The transaction estimator is generic but rest assured, we will get this optimized.

so does tht mean buy side 10000 rs and sell side 10000 rs both will not be applicable? or just buy side wont be applicable? @iamshrimohan

@iamshrimohan @PravinJ any update on the above?

so does tht mean buy side 10000 rs and sell side 10000 rs both will not be applicable? or just buy side wont be applicable

@dino Yes, for liquid ETFs, STT is not applicable on either side.

Hi @iamshrimohan I see STT on brokerage calculator for liquid still.Can this be updated at earliest.

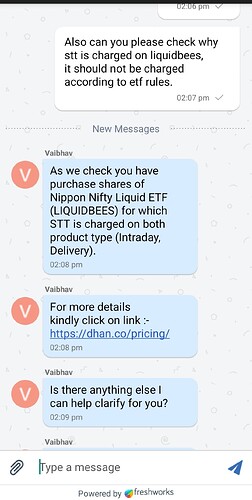

Hey, can someone confirm if STT is charged on liquidbees on dhan? The support mentioned that it’s charged

edit : someone else from support now says it’s not charged and to check the contract note.

Please note that Securities Transaction Tax (STT) does not apply to GOLD ETFs, LIQUID and Gilt ETFs, and certain International ETFs. you may read more here