Dear Dhan Team,

I am currently using Dhan for daily SIP investments and positional trading, and I truly appreciate the platform’s features. However, I would like to have the flexibility to choose a specific execution time for my daily SIP orders.

For example, if I set 3:15 PM as the execution time, my SIP should be processed at that exact time every trading day. This would help traders like me execute SIPs at a preferred market condition.

Is this feature currently available, or can it be considered for future updates? I believe this would be beneficial for many traders in the community.

Looking forward to insights from the Dhan team and fellow traders!

Best,

Fenil Vaghasiya

1 Like

Hi @Fenil_Vaghasiya Welcome to the Made For Trade community.

Just curious - how would anyone know that at 3:15 PM there will be a better price available than other time, or than at current 10:00 AM when SIPs are executed.

Hi @Fenil_Vaghasiya This idea can be best boxed into a bias - Recency Bias.

It might be possible that you have entered the market in recent months and the relentless selling for the last 6 months has given you an incomplete picture.

Open - High prices

Close - Low prices

It doesn’t work everytime though. At 3:15 PM, the price could be anywhere. Let’s say the stock hits 10% UC by 3:15 PM so you are actually getting a bad price of the day.

However, backtesting says irrespective of the time of the day or even day of the week, you don’t generate any significant alpha over the market and instead you are likely to incur extra brokerage or transaction costs.

If I were you, I would pick a day of the week and do the SIP on that day or even see weekly charts and take an entry on the daily charts, once a week.

Hope that helps in your investment journey.

1 Like

Dear PravinJ,

Thank you for your response. I understand your curiosity about selecting a specific time for SIP execution. Let me explain my perspective with data-driven reasoning.

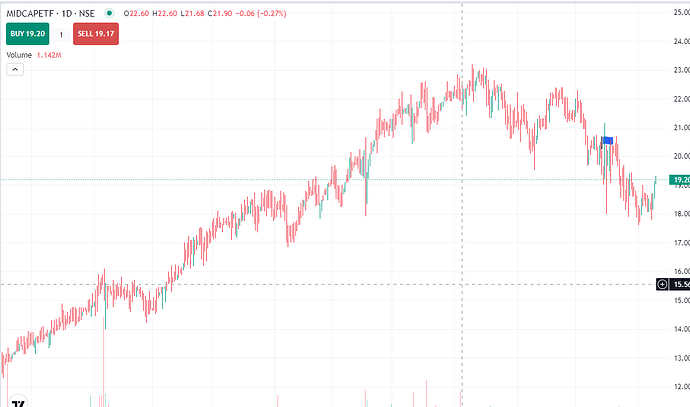

If you observe the daily chart of MIDCAPETF (attached), you will notice that most candles are red, even in a bull run. This indicates that, on most trading days, the closing price is lower than the opening price.

What does this imply?

- If most ETFs tend to close lower than they open, then executing SIPs at closing hours (3:15 PM) instead of 10:00 AM could provide a better average buying price over time.

- This isn’t about predicting a specific day’s movement but rather leveraging historical price behavior for alpha generation.

- Anyone can check the daily chart of different ETFs and notice a similar pattern.

Thus, having a feature to customize SIP execution time can be beneficial for traders who follow such data-backed strategies.

Would love to hear your thoughts on this. Looking forward to insights from the Dhan team and community members!

Best,

Fenil Vaghasiya

2 Likes

For SIP in ETF, Go for Fyers Smart SIP feature. Where you can select Price Range and Timing both

Hi @Fenil_Vaghasiya @Nilkanthraval

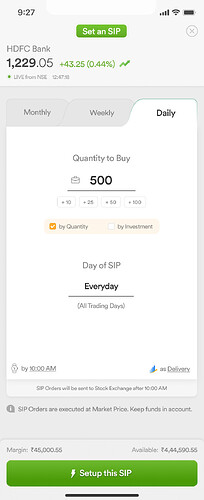

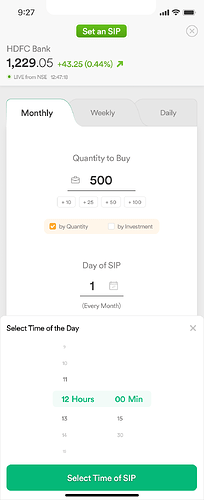

We’re happy to share that we’ve started working on giving users the flexibility to choose their custom time for daily SIPs.

It should be available to everyone soon.

Here’s the glimpse of how it will look like

Disclaimer: The stocks mentioned are exemplary and not recommendatory.