“I require cash to meet M2M obligations. Hence there is a huge opportunity cost for my idle funds.” This is the feedback we received from a lot of Super Traders.

Hence, we have created a seamless pledging experience for traders after identifying their challenges. Here are 6 unique benefits of pledging on Dhan:

-

Instant Pledge: Get Margin benefit within 15 minutes with our instant pledge feature

-

Option Buying on Pledge: Enjoy the convenience of buying options using pledged margin. By keeping your cash invested in securities, you can pledge your holdings to avail margin and trade seamlessly.

-

Easy Sell: In case when your holdings are pledged and you wish to sell it to meet M2M obligations, you can sell your holdings without being worried about unpledging them before selling

-

Only on Dhan, as a trader you can view the expected Pledge Benefit on the entire portfolio in Real-time

-

Your pledge stocks always stay in your Portfolio Holdings. Unlike many platforms, we do not reduce pledge stocks from your portfolio - they appear at all times in your portfolio so that you know the real value of your portfolio holdings at all times

-

Exactly the same for unpledge, many platforms you have to unpledge stocks and then later they appear in the portfolio after a day or two. Not on Dhan, your stocks are always in your portfolio

-

You can instantly pledge your entire portfolio, no need to select each one and then pledge them individually

Do let us know your thoughts on this in the comments!

5 Likes

Hello @shraddha Can you explain the point no. 2 in detail?

Hello @shraddha I have already watched this video before your reply. It only explains where margin can be used ( including for option buying ). But doesn’t explain what option buying via pledging actually is and how does it work?

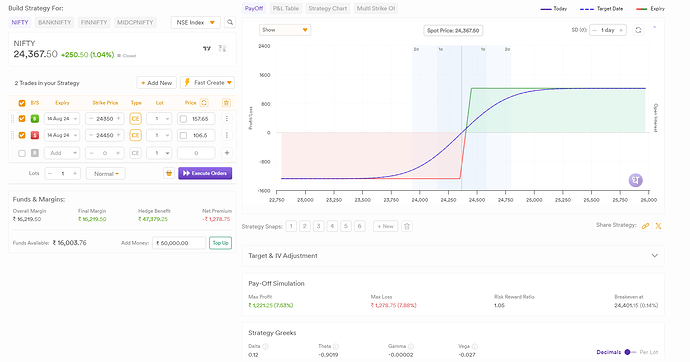

Let’s cnsider the example of bull call spread. It says that I need to provide margin of 16129.5 Rs. ( of which 50% is cash-component margin and 50% is non cash component margin). Do I also need to provide hard cash of 1278.75

rupees here which is the premium of call spread

I usually trade nifty options in zerodha and commodity futures in 5Paisa. I am planning to use MTF and trade commodity options in future as well. And I am planning to do all of this from one single platform i.e. dhan to net out different MTM cash pay-in and pay-out arising out of trades on different asset classes

Hello @shraddha Please respond.

P.S: I think I partially got it. Is this applicable for stock options? Because in stock options physical delivery is compulsory and closer to expiry higher margins is required. So premium will always be paid in real cash but closer to expiries margin requirements will also be there for stock options. Please confirm this

Hey @explrorer ,

You are right about having to maintain 50:50 margins while taking the above trade in your example. However, you will not need to provide hard cash of the premium of Rs 1278.75 as that is included in the overall margin of Rs 16,129.

Additionally, this is applicable to stock options as well. For better understanding you can go through the ‘Physical settlement of F&O and Commodity’ section of this link.

Please let us know incase of any other doubts!

Thanks,

Pranita

Product @ Dhan

However, you will not need to provide hard cash of the premium of Rs 1278.75 as that is included in the overall margin of Rs 16,129.

That seems too good to be true or I am misunderstanding things. The overall margin i.e. Rs 16,129 will come from collateral margin( in 50:50 ratio as usual) then and I won’t need to provide any actual cash at all. Then this means I can buy any option without needing any cash just by using my margin. Right?

Hey @explrorer ,

Of the total margin of Rs 16129, 50% needs to be in cash or else you will be charged interest on the deficit cash amount.

Thanks,

Pranita

Product @ Dhan