I would like to highlight a very illogical process at Dhan for changing IFSC details of a bank account.

The bank details can be added online through UPI payment of ₹1. Since I had changed my branch recently, the IFSC also got changed. Now many of you wont know that in the upi app, the bank account already linked will have the old branch & ifsc detail incorporated unless after changing the branch, you remove and add the same bank account again on the upi app (phonepe, gpay, etc).

Because of the above reason, my old branch & ifsc got updated while opening an account on Dhan.

Now Dhan’s customer care team wants me to send a hardcopy form & cancelled cheque just to update my Ifsc. I would like to mention this process unnecessary & illogical & let me mention the reasons why -

-

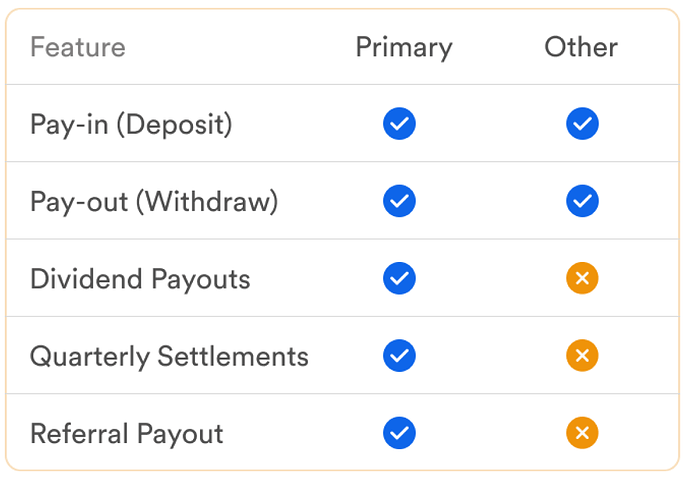

Please note that at Dhan, If you want to change the bank account itself (not just ifsc), you can simply add a new bank account online itself, make it primary & delete the old bank record very easily. This is entirely online

-

At zerodha & many other brokers, there is a dedicated online process to update bank record (where you can update primary bank account details - be it account number or ifsc).

-

At Indmoney, there is no dedicated process to update primary bank details online but there is a mechanism where you can add a secondary bank account with new ifsc (yes you can use same primary bank account number but different ifsc & add it as seondary bank account). After adding the old account number with new ifsc as secondary bank detail, you can make this as primary and delete the earlier record with incorrect ifsc easily. Entire process online.

But at Dhan, neither there is a process to update primary bank account directly, nor you can add a secondary bank record with same primary bank account number but different ifsc like Indmoney.

Why this paperwork process to change ifsc at Dhan is illogical because Dhan already has the online process mechanism of adding a secondary bank and making it primary. But just bcz of same account number restriction, it is not allowing us to do so. If dhan developers are not comfortable in allowing same account number (with different ifsc) to be added as secondary bank detail, then pls launch a dedicated process like zerodha to change primary bank detail.

It is also illogical because a person who has 2 bank accounts can simply add his another bank account, remove the old bank account with incorrect ifsc, add the old bank account again with correct ifsc & make it primary.

But people with just 1 bank account have to go through paperwork. Isnt this illogical ?

Also, when all mechanism is there but an eye for detail is missing which’s not just causing trouble for one section of users but also for dhan in terms of effort & cost for say courier charges for user, manpower utilisation at Dhan office, etc.