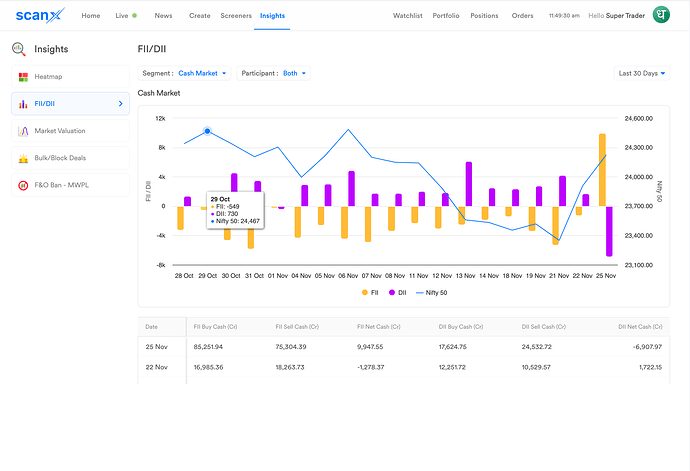

FIIs (Foreign Institutional Investors) have shown significant fluctuations in their cash market activity over the period analyzed.

DIIs (Domestic Institutional Investors) have largely acted as a stabilizing force, often stepping up purchases when FIIs have been net sellers.

The most notable observation is the sharp increase in FII net inflows on 25th November, where the net cash inflow amounted to ₹9,947.55 crore. This contrasts with earlier periods of net outflows, such as 22nd November (-₹1,278.37 crore).

DIIs, on the other hand, switched to being net sellers on 25th November, contributing to a negative net cash flow of ₹6,907.97 crore.

Why do you think FIIs have shown a sudden increase in inflow on 25th November?