Drawing from recent data on the global bond market, particularly concerning Japan and the US, I’m observing some noteworthy shifts.

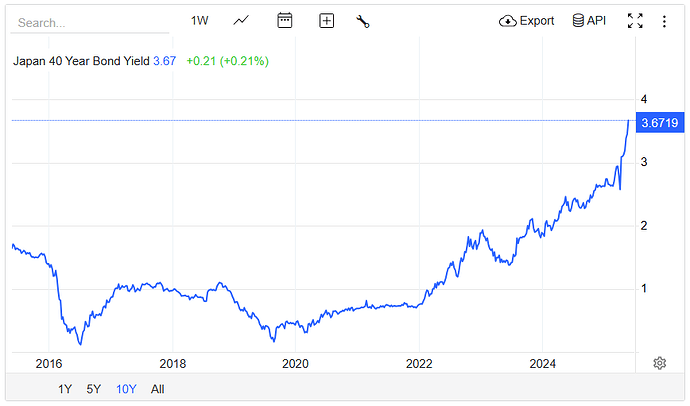

The long-held belief among global investors that Japanese government bonds represent a relatively safe haven is currently being questioned, underscored by unsettling yield spikes.

Should this situation continue to deteriorate, investors are likely to seek refuge in hard assets such as gold. This market instability could have far-reaching consequences, potentially impacting currencies across the globe.

Despite this rather somber outlook, history suggests that periods of significant market pessimism often present opportune moments to invest in equities, reflecting the enduring nature of the global economy.

The World really never ends.

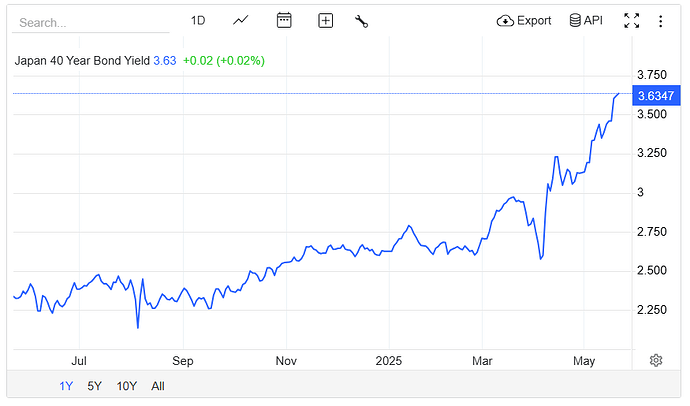

Japan

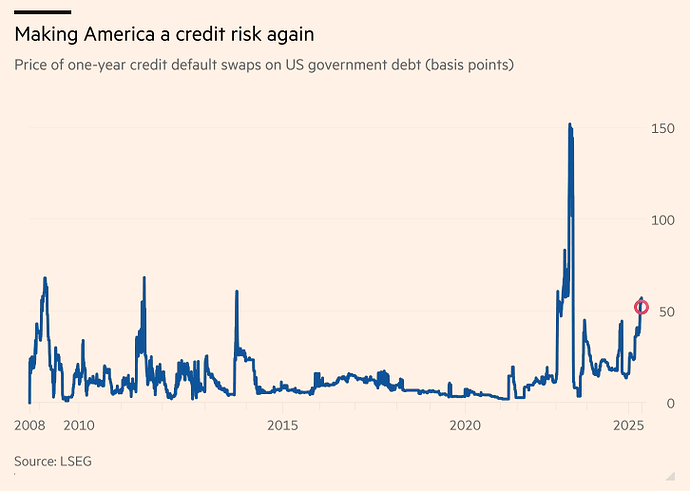

US

@RahulDeshpande

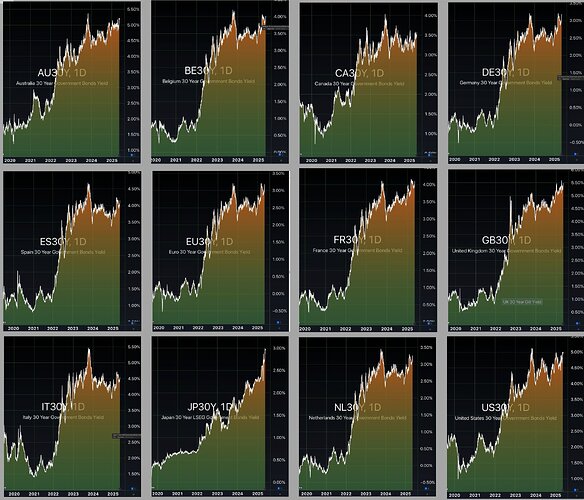

Discomfort evident in all major economies from Europe to Asia.

What happened suddenly that all bonds are spiking globally?

Amidst global market spikes, Indian bonds are holding stable. This relative strength against G20 peers positions India well to attract substantial capital inflows potentially anytime.

India is likely to emerge as a a very big wealth creator.

JUST IN: Japan’s 40-year bond yield soars to 3.6%, an all-time high

1 Like

Just In: Japan’s 40-year bond yield hits 3.63, an all-time high.

This isn’t just about Japan. It’s a signal that the global debt machine is starting to tear at its longest seams.

The World was fuelled by debt all this while, but that is about to change. How soon? I don’t know, but IT WILL.

Read along here  What's fueling Japanese, US bond yields? Is this rise a worry for you? EXPLAINED | Stock Market News

What's fueling Japanese, US bond yields? Is this rise a worry for you? EXPLAINED | Stock Market News

1 Like

New day. New high. Japan’s fiscals is clearly under duress.

3.67%  40-year bond yeild.

40-year bond yeild.

Japan’s intense work culture, often considered the most demanding globally, offers a stark warning about the societal impact of extreme labor practices.

Employees are expected to arrive an hour before official start times, a custom seen as both polite and practical for desk organization.

Beyond work, social norms also dictate behavior, as it’s considered impolite to approach someone of the opposite gender with romantic intentions.

This rigorous work environment, coupled with declining birth rates and ‘sanskaar’, not only threatens Japan’s economic stability but also raises concerns about its very survival as a civilization.

Dhan folks got ideas by my community post

3 Likes

![]()

![]()